Crypto.com to form bear trap before CRO breaks out to $0.50

- Crypto.com price reacts to bearish continuation setup in its oscillators.

- First Ichimoku resistance level has resulted in rejection, pushing CRO lower.

- Bulls must break $0.44 to give Crypto.com a clear upside move ahead.

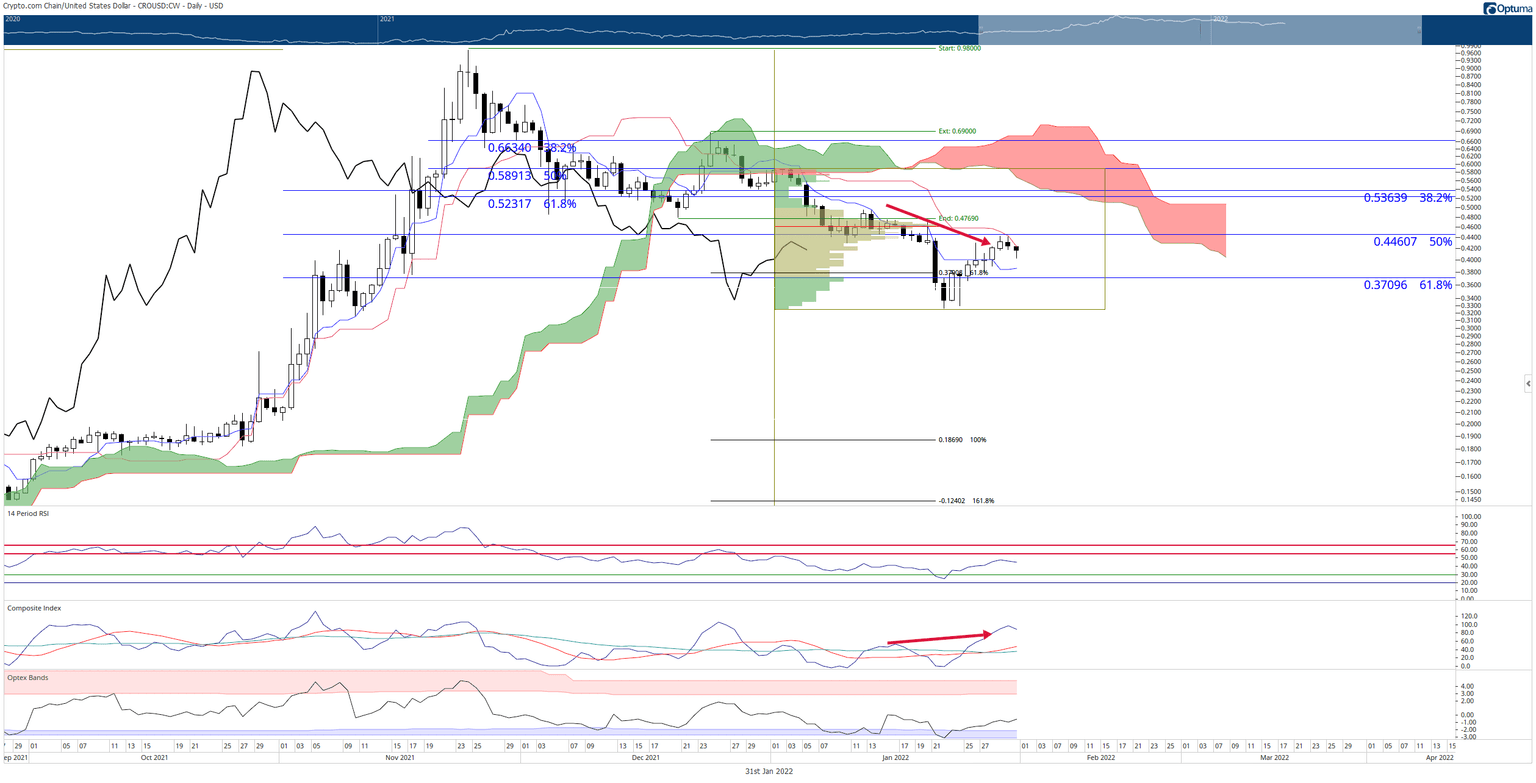

Crypto.com price has made a strong recovery over the past ten trading days. From the January 22 low of $0.33 to the January 29 swing high of $0.44, CRO has bounced nearly 36% higher. Crypto.com is still 28% above its most recent major swing low despite the selling pressure on Sunday and today's continued weakness.

Crypto.com price readies for push beyond $0.44 and a return to $0.50

Crypto.com price faced the most robust near-term resistance on its daily chart over the weekend. The 50% Fibonacci retracement and Kijun-Sen sit right at the $0.44 value area, creating a challenging price level for bulls to move and close above. Rejection could probably trigger continued selling pressure.

The hidden bearish divergence previously identified on January 27 shows signs of impacting the current rejection at $0.44. However, the daily candlestick is developing into a bullish reversal pattern – the hammer. After closing above the Tenkan-Sen for four consecutive days, the Tenkan-Sen is now near-term support.

If the Tenkan-Sen holds as support, then the likelihood of a bear trap and short-squeeze for Crypto.com price is increasingly likely – especially if bulls close above the Kijun-Sen. But downside risks do remain.

CRO/USD Daily Ichimoku Kinko Hyo Chart

Crypto.com price will be under intense selling pressure if a daily close below the Tenkan-Sen ($$0.39). In that scenario, CRO will likely see a solid push to retest 2022 lows at $0.32.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.