Crypto.com price tightens, hinting at a 20% upswing

- Crypto.com price shows a tight consolidation with higher lows, suggesting a build-up of bullish momentum.

- Investors can expect a 20% rally from the current position to $0.0785 in the coming week.

- A daily candlestick close below $0.0612 will invalidate the bullish outlook for CRO.

Crypto.com price action over the last two weeks has not been kind to investors. The ongoing tight consolidation will likely end on a good note but will require support from Bitcoin, which is also getting squeezed.

Crypto.com price edges closer to a breakout

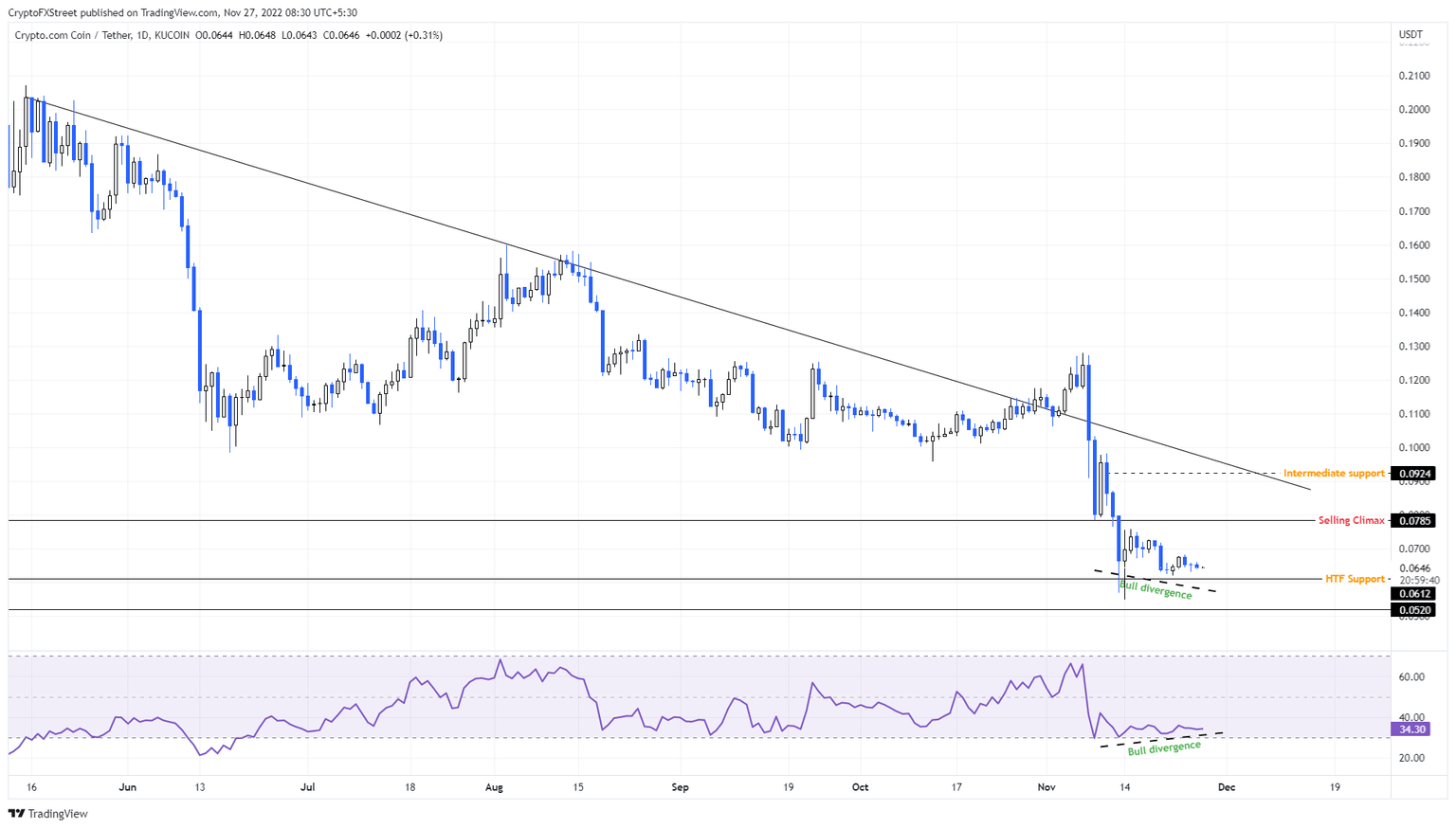

Crypto.com price downtrend since May 15 is apparent, and the lower highs formed in this period can be connected using a trend line. Over the last two weeks, CRO has produced a string of lower lows and lower highs, indicating a tight consolidation.

Interestingly, the Relative Strength Index (RSI), a popular momentum indicator, has produced higher lows, indicating a slow build-up of bullish momentum. This non-conformity in Crypto.com price hints that a trend reversal is likely.

Since CRO is bouncing off the $0.0612 support level, the bullish outlook is more likely to play out. In such a case, market participants can expect Crypto.com price to rally 20% and tag the $0.0785 hurdle.

Although a further extension of the uptrend is unlikely, investors should consider the possibility that CRO retests the confluence of the declining trend line and the intermediate resistance at $0.0923. This move would bring the total gain for investors from 20% to 43%.

CRO/USDT 1-day chart

Regardless of the optimism, investors should note that a breakdown of the critical support level at $0.0612 will invalidate the bullish thesis for Crypto.com price. This move would produce a lower low and signal a downtrend continuation.

Such a development for Crypto.com price could see it tank 15% and retest the $0.0520 support level.

Here's how Bitcoin's moves could affect Crypto.com price

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.