Crypto.com Price Prediction: CRO aims for new all-time highs thanks to high-grade partnerships

- Crypto.com price has spiked by 23% in the past 24 hours.

- Visa announced a new global partnership with Crypto.com boosting its price.

- Crypto.com will issue the Visa Card in Australia to tap into more markets.

The main coin behind Crypto.com, CRO had a significant 23% breakout in the past 24 hours thanks to a partnership announcement with Visa, which aims to take advantage of the cryptocurrency market.

Crypto.com and Visa will open the doors to crypto for even more people

The Hong Kong-based payment platform, Crypto.com announced a partnership with Visa and will roll out a new service for fiat lending against other cryptocurrencies as collateral through the Crypto.com Visa card. Cuy Sheffield, head of Crypto at Visa added:

Visa's credentials add a lot more utility for crypto assets and enable an easier way to spend them, the demand that we're seeing from consumers to be able to access crypto.

Additionally, Crypto.com also plans to launch a new product for cardholders to allow them to spend fiat against other cryptocurrency holdings with an interest rate set at 9.9%.

Crypto.com price poised for even more upside as it becomes scarcer

Although the partnership with Visa is great news for CRO holders, there is perhaps an even better metric in favor of the digital asset. The number of CRO tokens inside exchanges has seen a steep decline since the beginning of February from 8.5% of its circulating supply on exchanges to only 5.81% currently.

CRO Supply on Exchanges

Additionally, despite the digital asset's performance in the past week and being close to new all-time highs, the MVRV(30d) remains low, which means there is a lot more upside potential for CRO and weak resistance.

CRO MVRV(30d) chart

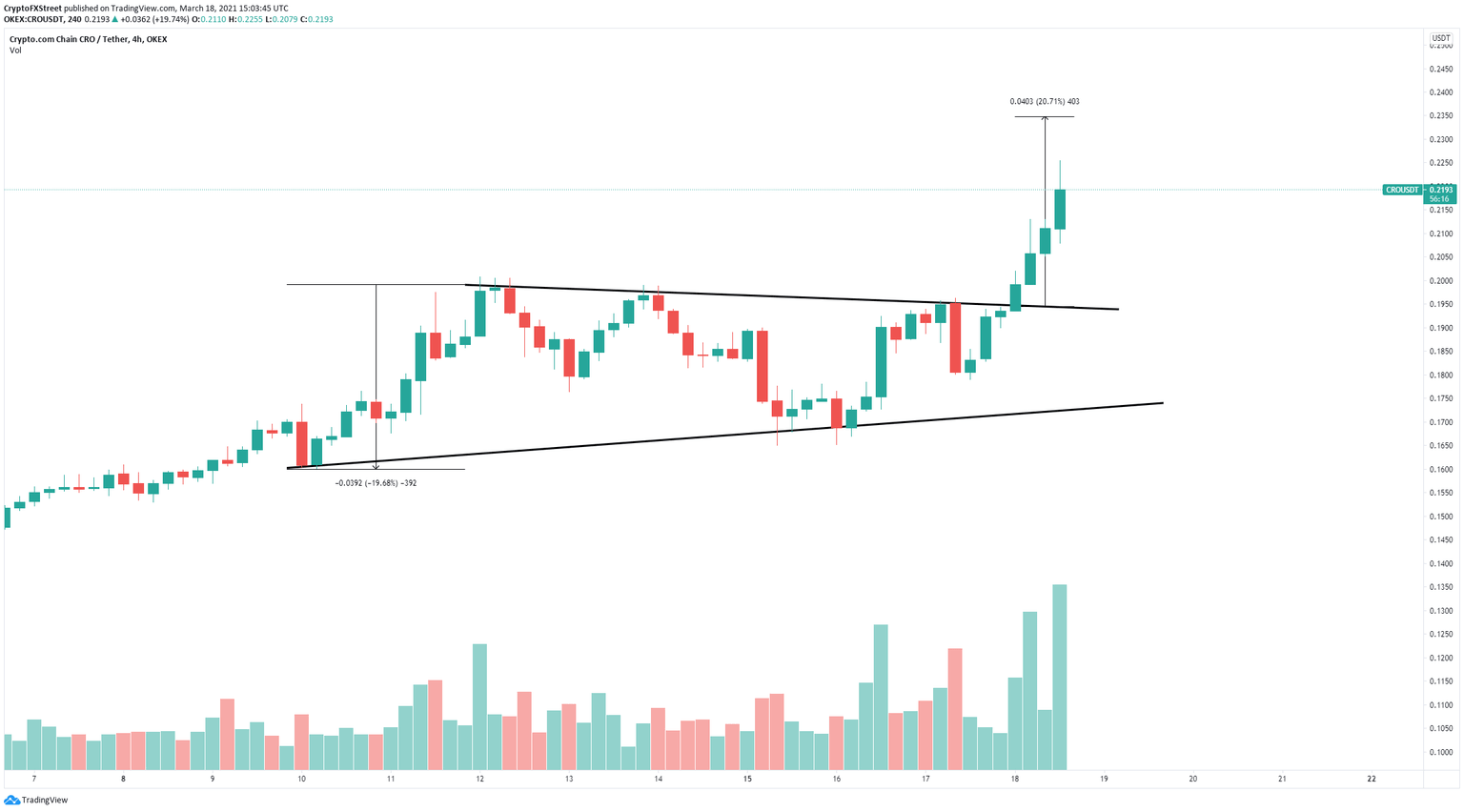

On the 4-hour chart, CRO had a breakout from a symmetrical triangle pattern with a price target of $0.234 not yet reached. Above this point, there is basically no resistance until the all-time high of $0.271, which can be quickly reached again.

CRO/USD 4-hour chart

However, there is a chance that CRO will see a pullback down to the previous resistance trendline to re-test it. This is often the case after a significant breakout. This price target is located at the psychological level of $0.20.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

%2520%5B15.56.57%2C%252018%2520Mar%2C%25202021%5D-637516768918128712.png&w=1536&q=95)

%2520%5B16.01.19%2C%252018%2520Mar%2C%25202021%5D-637516768938753924.png&w=1536&q=95)