Crypto.com price pitches camp here after shelving plans to $1.00

- Crypto.com price slumps below a key ascending trend line after facing a challenging resistance at $0.1560

- CRO’s whales booked early profits during the move to $0.1560, hindering recovery to $1.0000.

- The 50-day SMA is the immediate support preventing Crypto.com price from sliding to $0.1421 and $0.1360, respectively.

Another bear market correction erased most of the gains witnessed on Monday, and tokens like Crypto.com were not spared the axe. Over the last 24 hours, CRO has lost 3.5% of its value to exchange hands at $0.1462. From a fundamental and technical perspective, buyers must go back on the drawing board and eke out a plot for the much-awaited recovery to $1.0000.

Crypto.com price bears the brunt as whales book early profits

Whales are likely the main force driving Crypto.com price to the ground. Based on the Supply Distribution metric below, the number of addresses holding between 1 million and 10 million CRO tokens plunged to 1,064 from a 30-day high of 1,127.

Initially, the above change may seem subtle, but the volume move by these investors is colossal - hence the huge impact on Crypto.com price. If whales continue their selling spree, investors should acclimatize to CRO exploring more downhill levels.

Crypto.com Supply Distribution

Crypto.com also deals with a significant decrease in the number of newly-created addresses. Santiment’s Network Growth metric shows only 285 new addresses were created on Monday, down from 543 addresses on July 19. It is worth mentioning that a consistent decline in this metric implies that mainstream adoption is falling, which denies CRO the momentum to sustain upside movement.

Network Growth

Crypto.com price bear market reversal not yet over

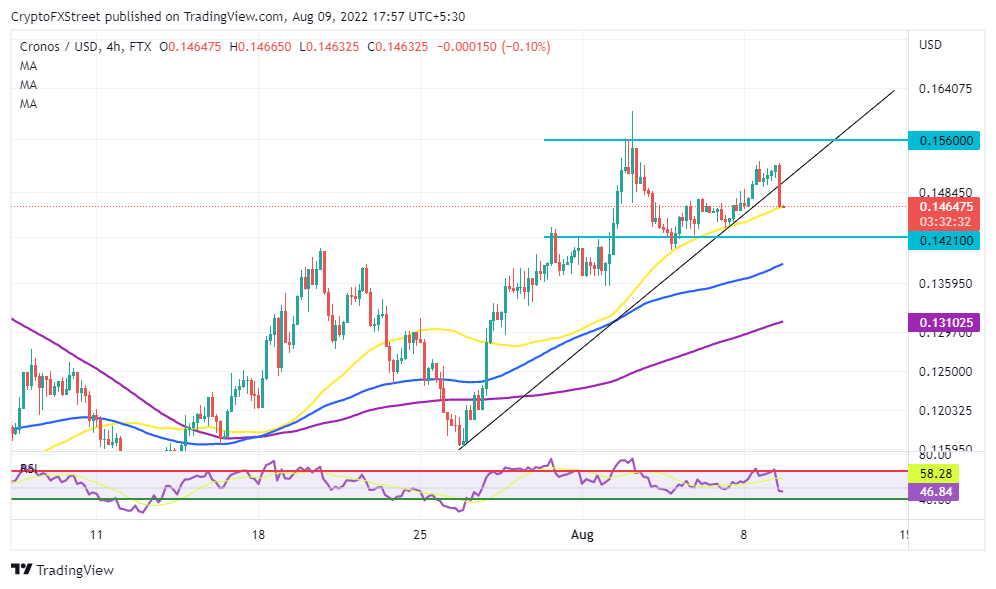

Crypto.com price appeared to have hit its ultimate floor level when it bounced off support at $0.1109 in June and July. The buyer congestion in the area propelled CRO to highs around $0.1560, affirming a potential move to $1.0000. However, progress has been hampered by fundamental and micro factors, occasioning losses below the ascending trend line as observed in the chart below.

CRO/USD four-hour chart

The Relative Strength Index (RSI) in the same four-hour timeframe reveals a bearish divergence from the price. If the 50-day Simple Moving Average (SMA) crumbles, selling pressure may surge, pushing Crypto.com price to seek support at $0.1421 and $0.1360, respectively. For CRO to be safer, buyers should escape the range resistance (from $0.1421 to $0.1560) and make headway to $1.0000.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

%20%5B15.27.40%2C%2009%20Aug%2C%202022%5D-637956496489038139.png&w=1536&q=95)

%20%5B15.27.48%2C%2009%20Aug%2C%202022%5D-637956496424371483.png&w=1536&q=95)