Crypto.com price in trouble as technicals point to a 12% correction

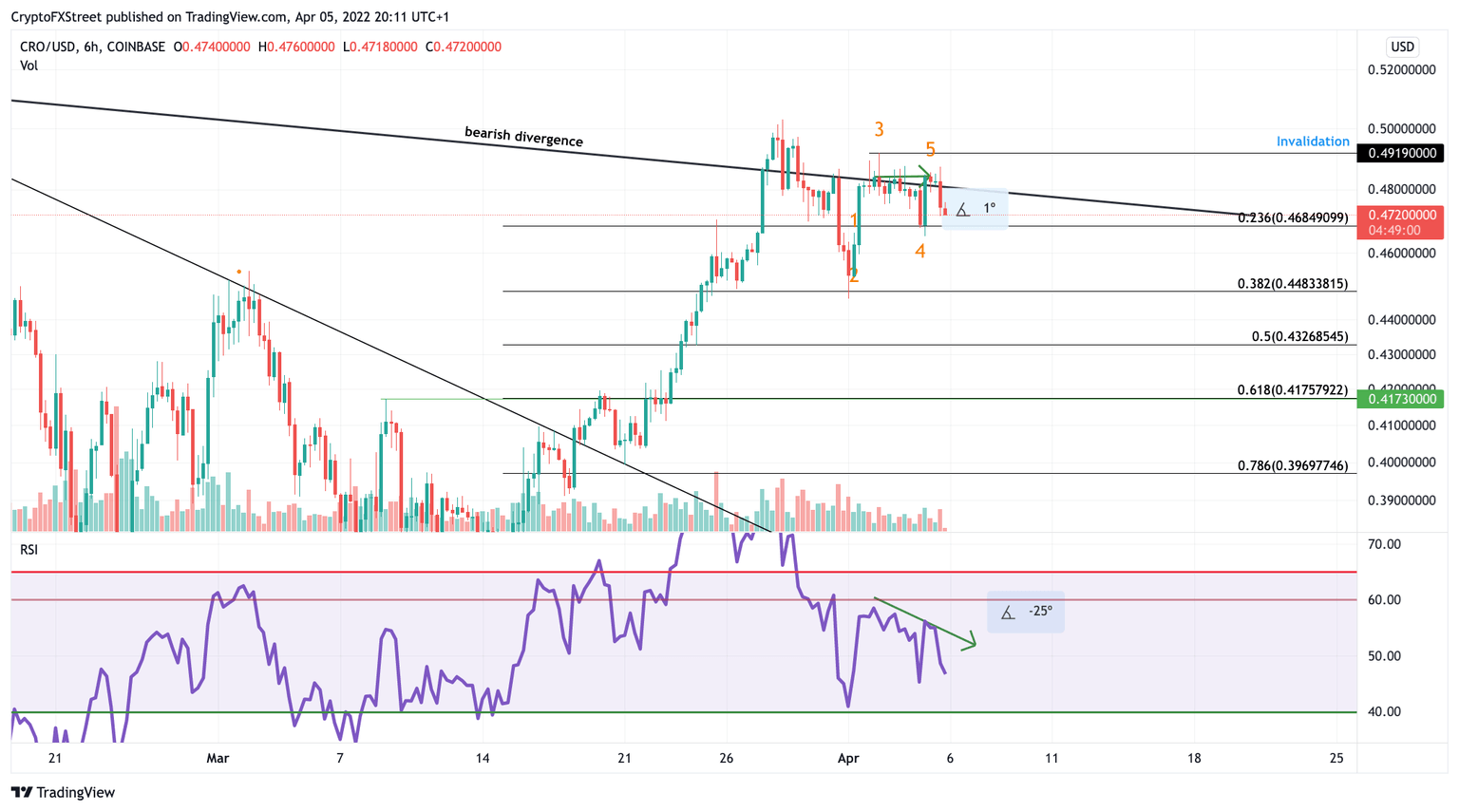

- Crypto.com price may have printed a 5th wave impulse.

- CRO price has a substantial RSI divergence.

- Invalidation for the bearish thesis will be a close above $0.492.

Crypto.com price is offering significant sell signals. Traders should proceed with caution.

Crypto.com price is setting up for a sharp move down

Crypto.com price has been displaying multiple bearish signals in recent days. Some analysts at FXStreet began closing their positions on CRO price amidst last week’s bearish divergence. This week, Crypto.com price adds more confluence that the impulsive rally might be over. There is evidence of a 5th wave rally ending at $0.484 on the 6-hour chart. The impulsive rally has a higher settling price than the consolidation prior, but there is substantial divergence on the Relative Strength Index.

Crypto.com price could be due for a significant correction into the 50% and 61.8% Fibonacci levels at $0.43 and $0.41 if the Elliot Wave analysis is correct. It is worth noting that very sharp declines usually follow 5th wave failures. Thus, investors may get caught sleeping at the wheel. The best scenario for CRO optimists will be to trail stop losses under the swing low at $0.44 to secure some profit from last month’s successful buy setups. Traders late to the party should stay away, as every investor comes to realize, “some gains are better than no gains, and no gains are better than some losses.”

CRO/USD 6-Hour Chart

Invalidation of the bearish thesis on Crypto.com price will be a closing candle above $0.4919. If this scenario occurs, the bulls should have enough strength to take out liquidity in the $0.51 and $0.53 levels resulting in a 12% increase from the current Crypto.com price.

Author

FXStreet Team

FXStreet