Crypto.com price gains ground with more upside yet to come

- Crypto.com coins have breached above the 55-day SMA level at $0.48.

- CRO surfs on the tailwinds that emerged after positive news out of Russia.

- Expect to see a further uptick throughout the trading day as more bulls join the rally.

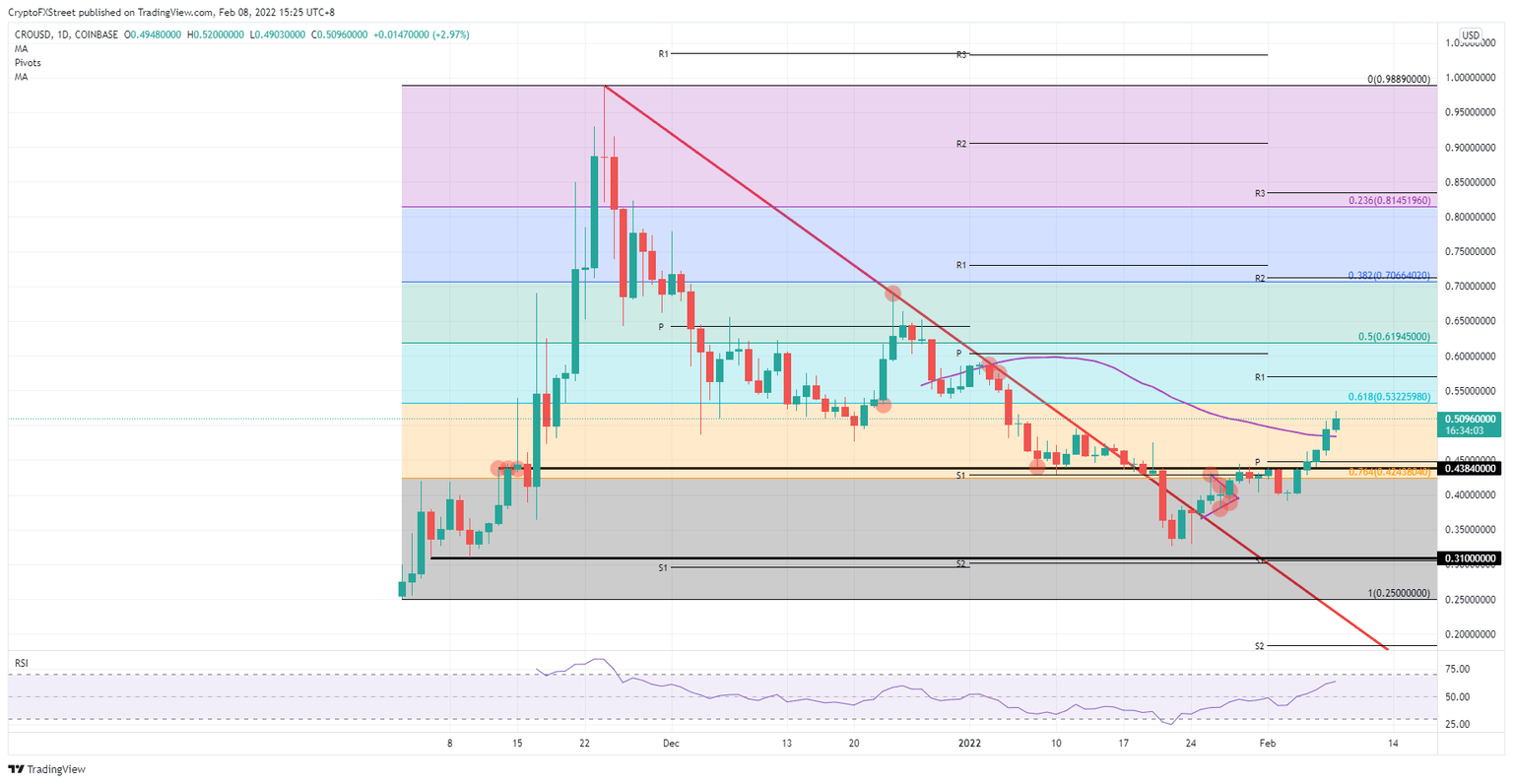

Crypto.com (CRO) coin's price action is further building on the solid rally that has been formed since last week, with the departure point around $0.40. In the meantime, the monthly pivot, the 76.4% Fibonacci level, and since yesterday the 55-day Simple Moving Average (SMA) have all been overturned from resistance into support. With this move, $0.53 looks set as the price target for today, with $0.62 as the ultimate target for this week offering a 25% gain.

Who can say no to 25% gains?

Crypto.com coins are steady as she goes, as the market woes have had no impact these past few days on the trend of CRO price action. With more and more upside to come, several key elements are being formed into support as bulls march on. For this week, the price target looks set at $0.62, around the 50% Fibonacci level, bringing investors back to levels not seen since December 28.

CRO price action today is currently surfing on some positive news from the meeting between Macron and Putin and some old Trump tariffs on steel imports that have been erased by a new trade truce between the US and Japan. Expect this momentum to keep going during the European session and heading into the US session, offering some low-bearing fruit around $0.53, with the 61.8% Fibonacci level as the first target to the upside. That would mean that today, an easy profit of around 8% could be hard to refuse.

CRO/USD daily chart

These tailwinds came out early today, and some counter comments could quickly be posted to break the current fragile positive sentiment. That would see CRO price action being pushed back toward the opening price around $0.49, which would see bears possibly test the 55-day SMA at $0.48. Pressure could start to mount, and if markets would roll over and erase positive numbers for the day, expect a dip further toward $0.45 with the monthly pivot and the 76.4% Fibonacci level at $0.42 in the way of double support.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.