Crypto.com price awaits further decline as bearish pattern projects 18% drop

- Crypto.com price may not prevent a further drop in price as a pessimistic chart pattern has emerged.

- CRO is awaiting an 18% descent toward $0.35, indicated by the bearish governing technical pattern.

- Additional selling pressure may push Crypto.com toward the swing low at $0.32.

Crypto.com price has recently dropped below a critical level of support, projecting further decline for the token. CRO has formed a bearish chart suggesting that the exchange token could fall further toward $0.35.

Crypto.com bears target $0.35 next

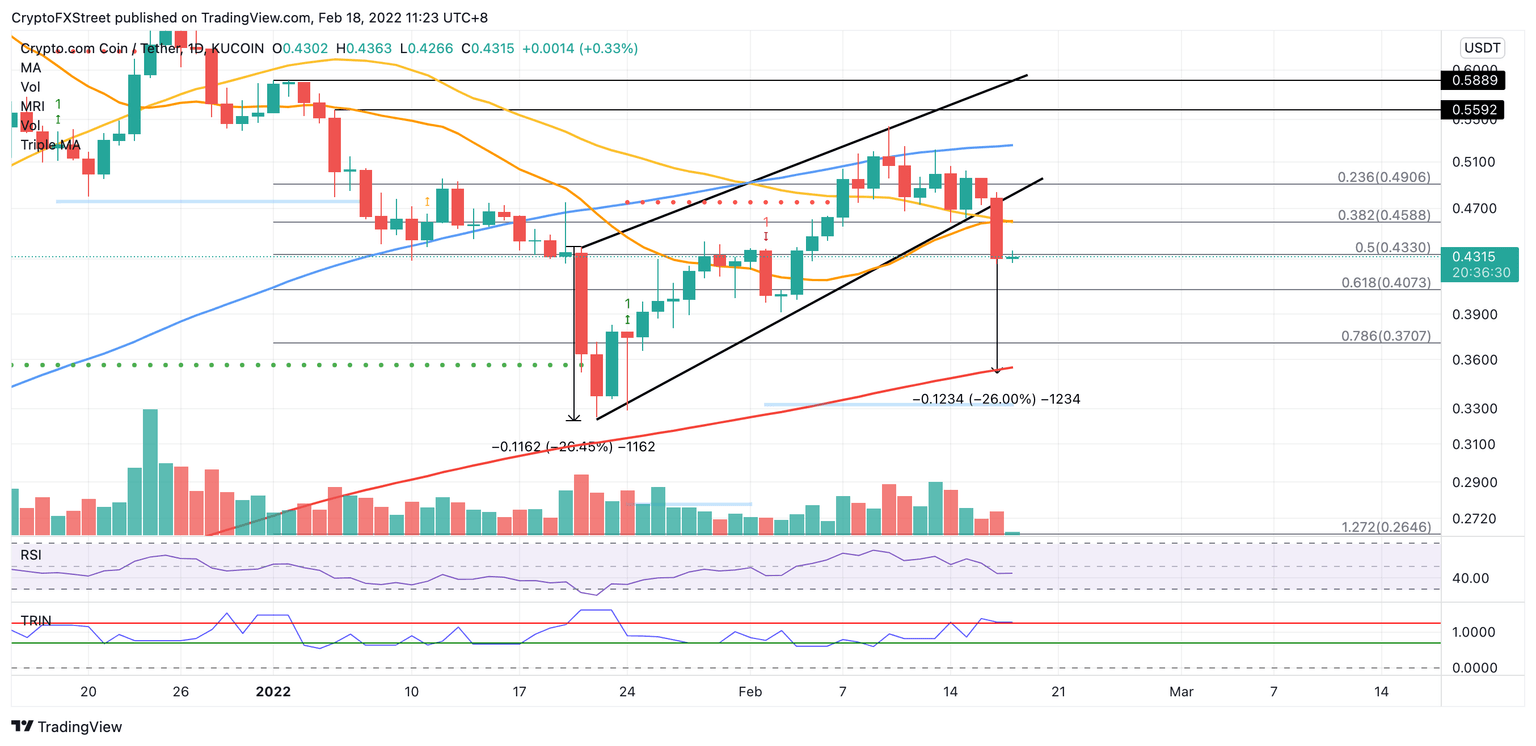

Crypto.com price has sliced below the lower boundary of the rising wedge pattern at $0.47 on the daily chart, projecting a 26% descent toward $0.35.

Crypto.com price also fell below a critical line of defense below the downside trend line of the governing technical pattern at $0.45, where the 38.2% Fibonacci retracement level and 21-day Simple Moving Average (SMA) and 50-day SMA intersect.

The next area of support will emerge at 50% Fibonacci retracement level at $0.43, then at the 61.8% Fibonacci retracement level at $0.40.

Additional selling pressure may push CRO down toward the 78.6% Fibonacci retracement level at $0.37 before Crypto.com price reaches the pessimistic target, coinciding with the 200-day SMA at $0.35.

An additional increase in bearish sentiment may witness Crypto.com price descend toward the swing low recorded on January 22 at $0.32.

CRO/USDT daily chart

However, if buying pressure increases, the first area of resistance is the pullback at $0.45

A spike in buy orders may incentivize the bulls to aim higher, reaching the lower boundary of the governing technical pattern at $0.47, coinciding with the 23.6% Fibonacci retracement level.

Bigger aspirations may target the 100-day SMA at $0.52, then toward the January 5 high at $0.55.

Author

Sarah Tran

Independent Analyst

Sarah has closely followed the growth of blockchain technology and its adoption since 2016.