Crypto.com price at risk after BlockFi's SEC settlement

- Crypto.com price continues to test the range lows near the $0.37 value area.

- Interest and staking rewards may be at risk for some cryptocurrency platforms and services.

- A bearish continuation pattern may trigger and push CRO to new 2022 lows.

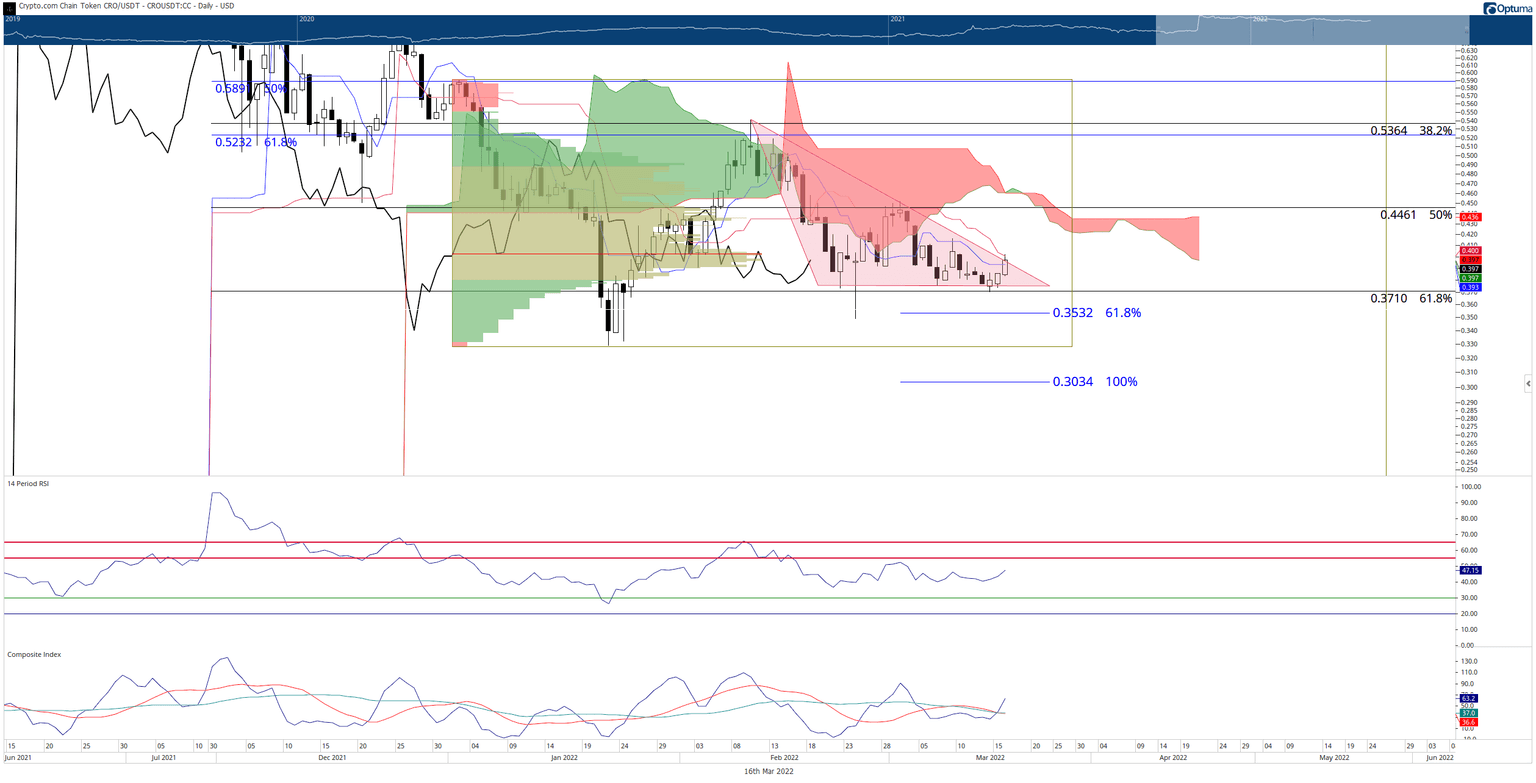

Crypto.com price action has been a source of frustration and disappointment for bulls. CRO has consistently made new lower highs but has maintained the same lows. This behavior created one of the most powerful bearish patterns in technical analysis – the descending triangle. Adding to the frustration is some uncertainty regarding platforms like Crypto.com and the SEC – especially given last month's BlockFi settlement.

Crypto.com price set for new lows unless bulls step in to support CRO

Crypto.com price is currently making attempts to break above some critical Ichimoku resistance levels, levels that have proven impossible for bulls to crack for over a month. Another failed attempt on the daily chart – especially with the intraday gains – could trigger a massive sell-off.

Interest-bearing projects, companies, or tokens in the DeFi space may risk US regulators scrutiny. Recently, BlockFi agreed to a massive $100 million settlement with the SEC (combination of Federal and State) for not complying with the Securities Act of 1933 and the Investment Company Act of 1940.

A clear warning for other companies was given by the Director of the SEC's Division of Enforcement in the SEC's press release by saying, "Crypto lending platforms offering securities like BlockFi's BIAs should take immediate notice of today's resolution and come into compliance with the federal securities laws."

As a result, the lending platform NEXO abruptly terminated all new interest payments for US customers, but other services, like Crypto.com, continue to provide interest and staking rewards.

Crypto.com price, however, does not operate the same business model that NEXO or BlockFi do. NEXO and BlockFi issue loans and Crypto.com does not. So CRO may be safe for now, but that is all speculative. There is an unknown threat as to whether the SEC may go after cryptocurrencies that provide a passive income in the form of staking rewards or interest, which Crypto.com would most definitely have exposure to.

CRO/USDT Daily Ichimoku Kinko Hyo Chart

From a price action perspective, the short-term outlook is bearish for Crypto.com price. Failure to hold the $0.31 support zone may trigger a return to the 2022 lows but could very easily push right through the Volume Profile to the next high volume node at $0.24.

However, if Crypto.com price can close above the Kijun-Sen on the daily chart at $0.40, it would be a rare breakout above a descending triangle. The result could be extremely bullish, as failed triangles often lead to spectacular bullish movement. The target zone on a bullish breakout above the descending triangle is the $0.50 price level.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.