Crypto.com gives up 7% gain post Fed, CRO at a make-or-break point

- Crypto.com price faced significant selling pressure after Fed policy notes and Chairman Powell's presser concluded.

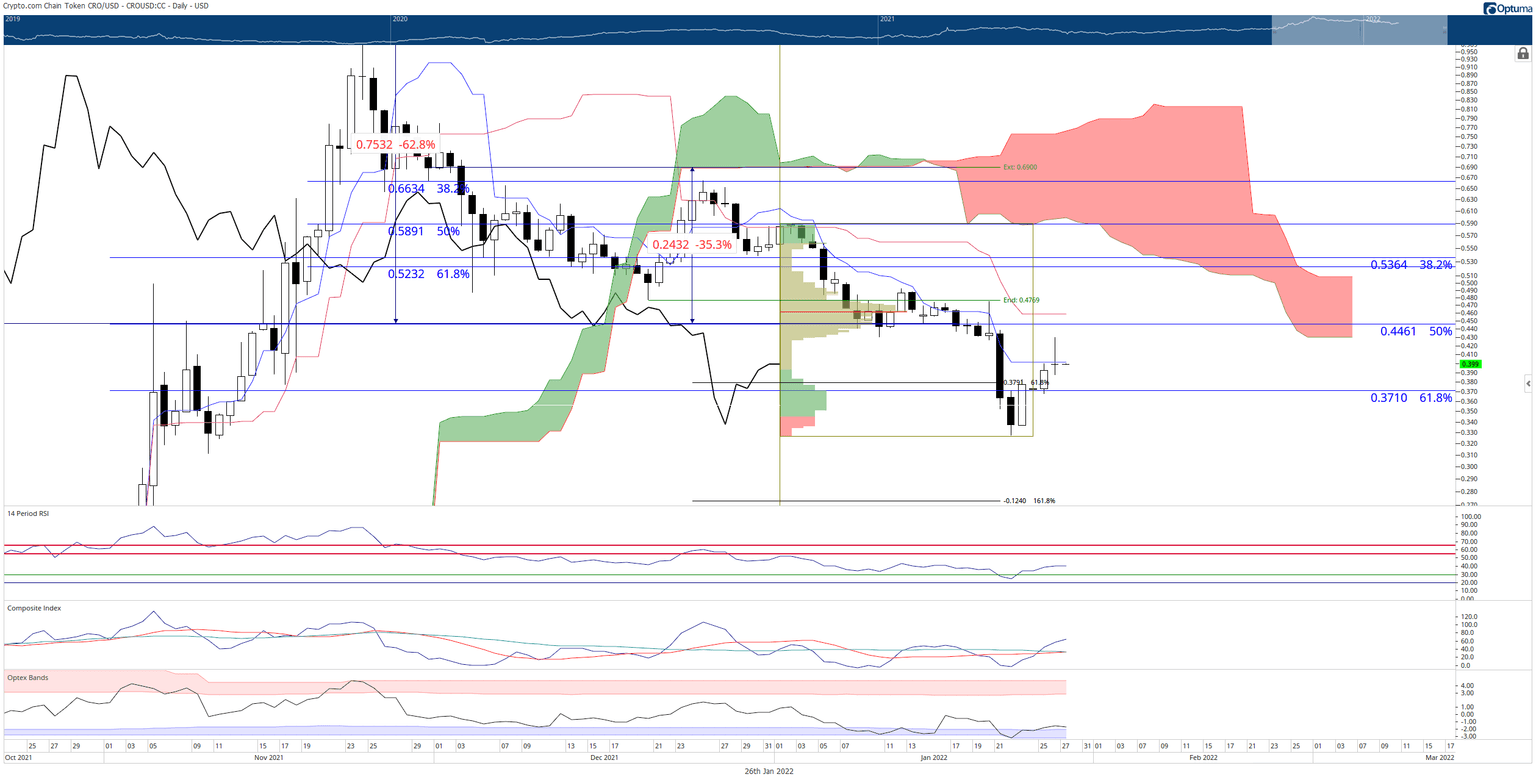

- Rejection occurred at an Ichimoku level that could trigger a resumption of the prior bearish price action.

- Upside potential exists but may be hampered due to strong resistance zones ahead.

Crypto.com price was handed a massive rejection move during the Wednesday trade session – as did the broader cryptocurrency market. As a result, the interpretation of Wednesday's candlestick leans heavily on the bearish side of the trade, but a continuation move south is not a foregone conclusion.

Crypto.com price may dip to retest recent support before resuming an uptrend

Crypto.com price may be positioned for a retracement to the 61.8% Fibonacci retracement at $0.37. However, the daily oscillators give mixed signals on how likely that drop may be. The Relative Strength Index is in neutral territory and of no help in determining a bias. The Optex Bands oscillator, on the other hand, is just turning up and moving out of extreme oversold conditions – signaling a likely bull move coming up.

Conversely, the Composite Index has a higher high while the candlestick chart has a lower high – a condition known as hidden bearish divergence, a warning sign that the current corrective move higher is likely to terminate and the trend will continue south. If CRO bulls can push a close above $0.47, that would invalidate the hidden bearish divergence.

CRO/USDT Daily Ichimoku Kinko Hyo Chart

While a return to $0.37 for CRO price is the more likely move, a close above the Tenkan-Sen at or above $0.40 would give any short-sellers pause and could entice bulls who are on the sidelines to participate. Upside potential is limited to the $0.50 value area.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.