Crypto.com Coin set for a bullish breakout as geopolitical tension eases

- Crypto.com Coin delivers a bullish candle on de-escalation by Russia.

- CRO bulls can push price action higher with almost 13% intraday.

- Expect a continuation if more headlines feed the de-escalation rhetoric, holding 32% of gains.

Crypto.com Coin (CRO) is seeing a solid bullish uptick after what was again a very choppy trading session yesterday with markets all over the place. The main theme front and centre remains the geopolitical situation with Russia and the Ukraine, although this is set to de-escalate on reports Russia is pulling back some troops after military drills this morning. This favourable tailwind adds to the positive vibe currently present in the markets and could spark a relief rally towards $0.62 in just a matter of days.

CRO bulls can start dreaming about 32% gains in a relief rally

Crypto.com Coin looked heavy yesterday as the Nasdaq and several other indices were on the backfoot in a very choppy trading session marked by headlines on the situation between Ukraine and Russia. Tensions seem to have died down a bit this morning, with a relief rally on the back of news Russian troops have been ordered to return to base camps, after several extensive military exercises near the Ukrainian border. The recovery has set indices in the green across the board, causing haven outflow and cryptocurrencies to see gains.

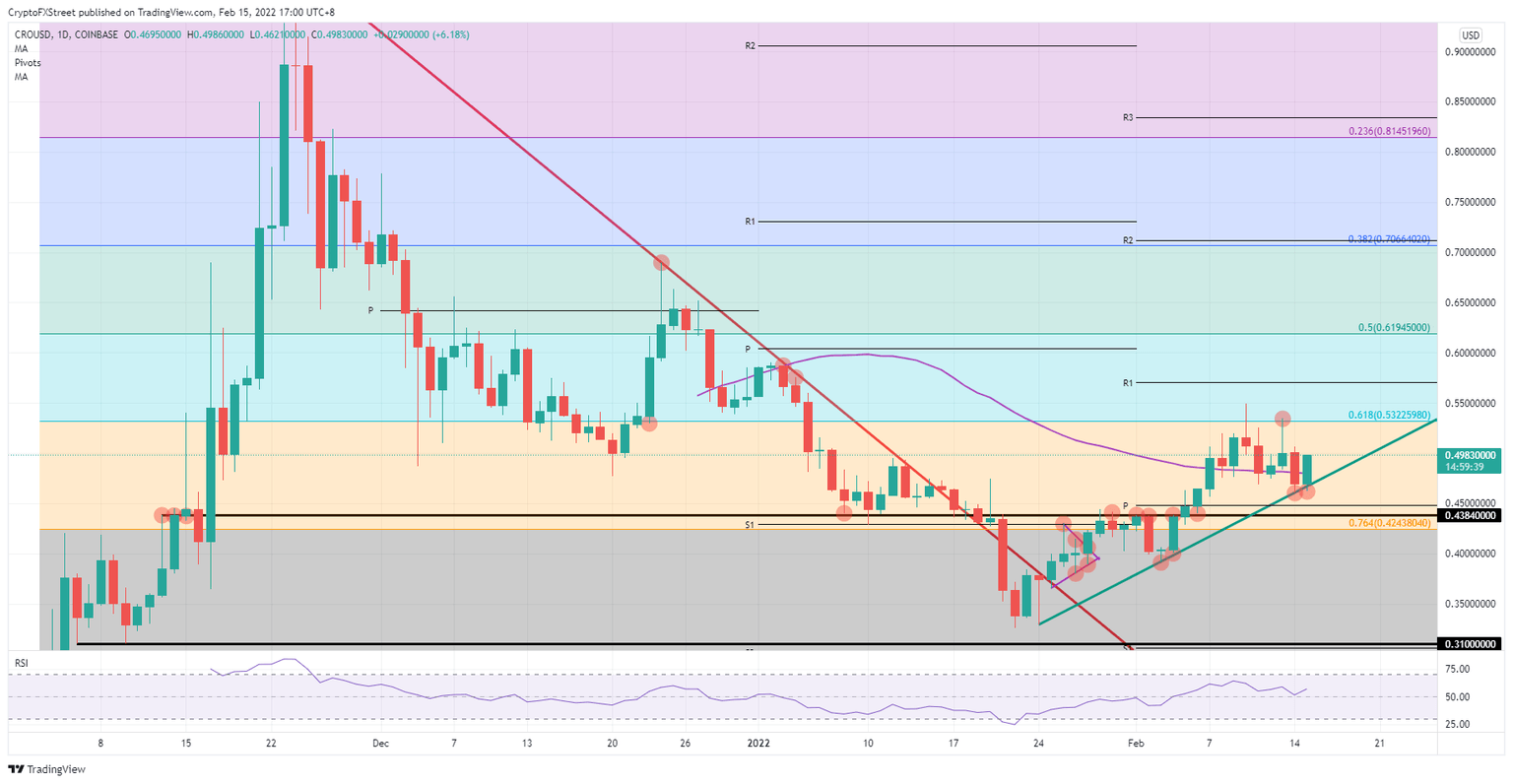

Expect this relief rally to add up to a possible 13% gain intraday as bulls use the green ascending trend line as a launchpad. This trend line has now been confirmed and shown its importance with three solid tests. The break above the 55-day Simple Moving Average (SMA) at $0.48 is an excellent indicator of the upside momentum and good to have marked up as a level for any later support from profit-taking. But the overall rally could tick $0.53 or the 61.8% Fibonacci level later in the trading session, once it is expected German chancellor Scholz will bring some positive remarks to the table after his bilateral meeting with Putin in Russia later today. The relief rally could even continue throughout the week on more deescalating news, topping $0.62, with 32% of gains on the counter.

CRO/USD daily chart

In the case that some negative headlines emerge because there are indeed tactical movements that could bring back the tensions and escalate the situation, expect a retest and break of the green ascending trend line with a return to $0.45 at the monthly pivot level. Should signs arise even of a possible war, expect a sharp breakthrough of $0.42, or the 76.4% Fibonacci level, in a sharp nosedive towards $0.31 and the S1 monthly support just a few cents below as a safety cushion to refrain from a full-price collapse. That move will have amounted to a 34% decline in price action.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.