Crypto.com coin sees traders pull out of CRO as global market turmoil hits Defcon 1

- Crypto.com coin sees traders flee this morning during ASIA PAC and European sessions as markets are rattled.

- CRO price dips and erases gains from Wednesday as a series of events puts traders on edge.

- Expect more downturns in the run-up to Friday's US job numbers.

Crypto.com coin (CRO) price action is in the crosshairs as a few geopolitical elements trigger traders to pull out of risk assets. For a few days already, the PBOC has been trying to break the dollar's strength with stronger fixings of its currency but has so far seen its efforts fully crushed because of announced lockdowns in a large part in Shanghai. Meanwhile, Russia committed it would buy a substantial amount of yuan and other friendly currencies, triggering another run of ruble strength against most major currency pairs.

CRO price not insensitive to forex correlation

Crypto.com coin price action is on the back foot today and currently breaking to Wednesday’s lows after the initial gains got erased on the back of two external geopolitical events. As you can read above, another round of lockdowns on major blocks in the million-people city of Shanghai is triggering fears of more supply chain issues and production disruptions. Next, Russia is teasing and taunting the US and Europe by buying large portions of forex from China and other 'friendly' nations like India to trigger a devaluation for the already battered euro, spilling over into a negative risk sentiment that sees a small sell-off in cryptocurrencies.

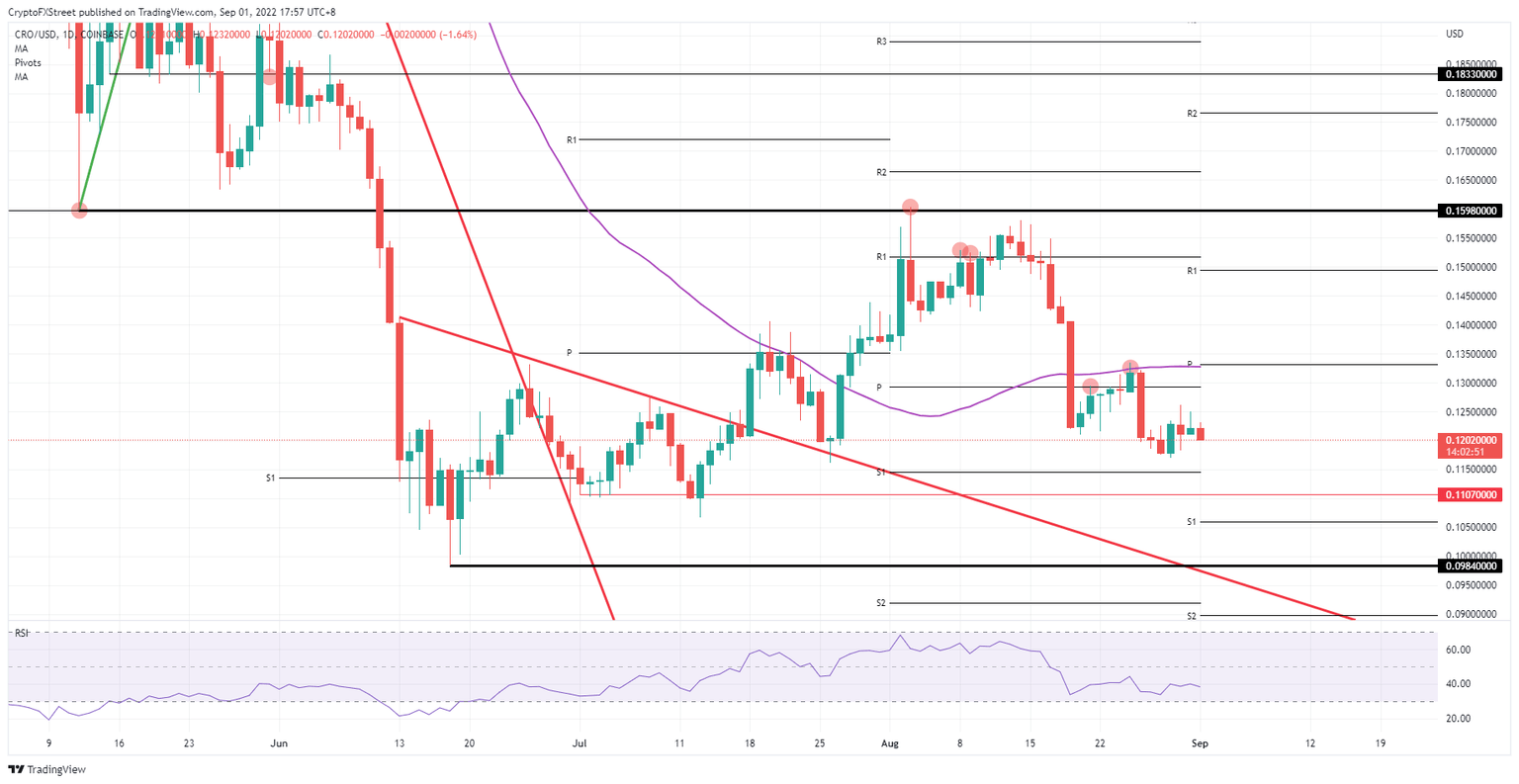

CRO Price thus could fall further towards the low of this week at $0.1170, with a possible slim 4% loss. Overall this could be a telling sign of things to come with the US job report on the docket tomorrow, possibly triggering an exponential loss that could go as far as a 20% downturn, with CRO price slipping below $0.1000. That devaluation could come from a still solid and positive job report, making it harder for markets to hang on to the idea that the Fed will soon start to lose its monetary conditions, thus not opening up more cash to invest in cryptocurrencies.

CRO/USD Daily chart

Of course, for now, the losses look contained, and as seen this week, the US equity session has often reversed the losses incurred during the European trading session. That could be the same case today with a very light US calendar on the economic front, opening up some room for bulls to push equities and risk assets higher. CRO price could be seen paring back losses and trying to hit $0.1330, which is the new monthly pivot for September and coincides with the 55-day Simple Moving Average (SMA).

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.