Venture capital funding into crypto jumped by 52.5% month-on-month in March, with crypto projects getting $1.16 billion, mostly in infrastructure and decentralized finance projects.

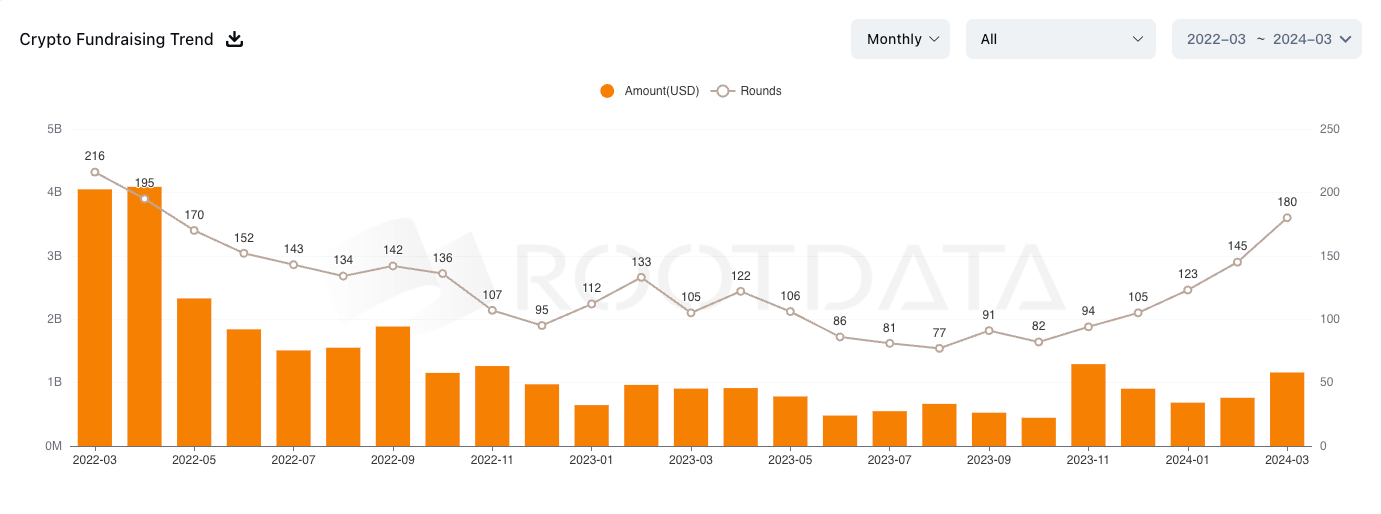

RootData figures show 180 publicly-announced investments managed to sec investment in the last month — the highest monthly figure since April 2022.

One-fifth of deals saw fundraises of between $1 million to $3 million, while just over 15% raised between $5 million to $10 million. The majority of the funded projects were based in the United States, but they still only made up less than 10% of the total deal count.

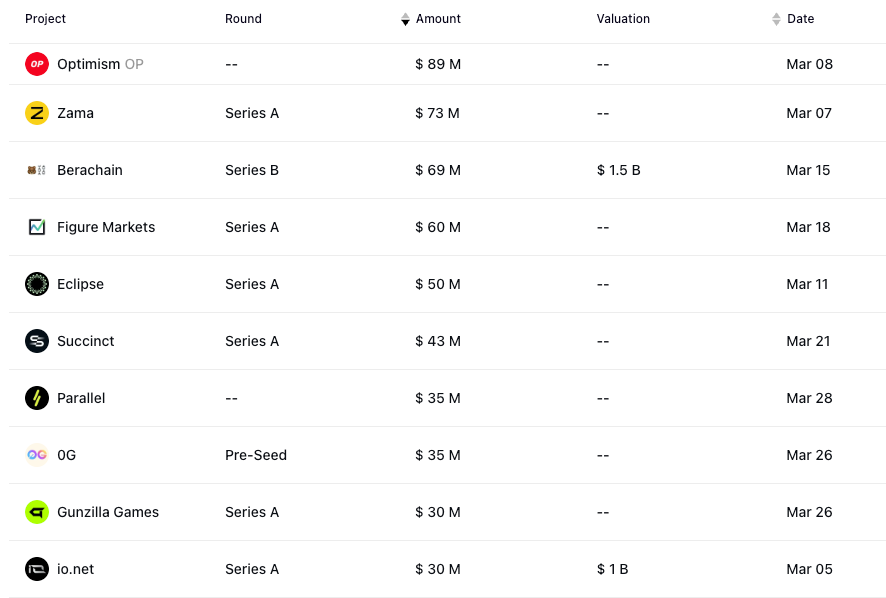

Ethereum layer-2 blockchain Optimism got the month’s largest raise when it sold $89 million worth of its tokens in a private deal. Cryptography startup Zama was runner-up with its $73 million Series A.

March’s top 10 largest deals by amount raised. Source: RootData

The monthly deal number was up 25% from February and over 70% from the prior year period, while the total amount raised was also up 28% compared to March 2023.

VC firms recently hinted at their crypto-focused interests for the year ahead. Andreessen Horowitz (a16z) on April 1 earmarked $30 million for a fund focused on Web3 gaming.

Crypto-related VC funding by month since March 2022 with USD amount raised (orange) and number of deals (gray line). Source: RootData

Last week, a16z co-founder Marc Andreessen and Galaxy Digital were top contributors to VC firm 1kx’s $75 million fund targeting crypto-based consumer apps and Hack VC in February raised $150 million to fund early-stage crypto and artificial intelligence startups.

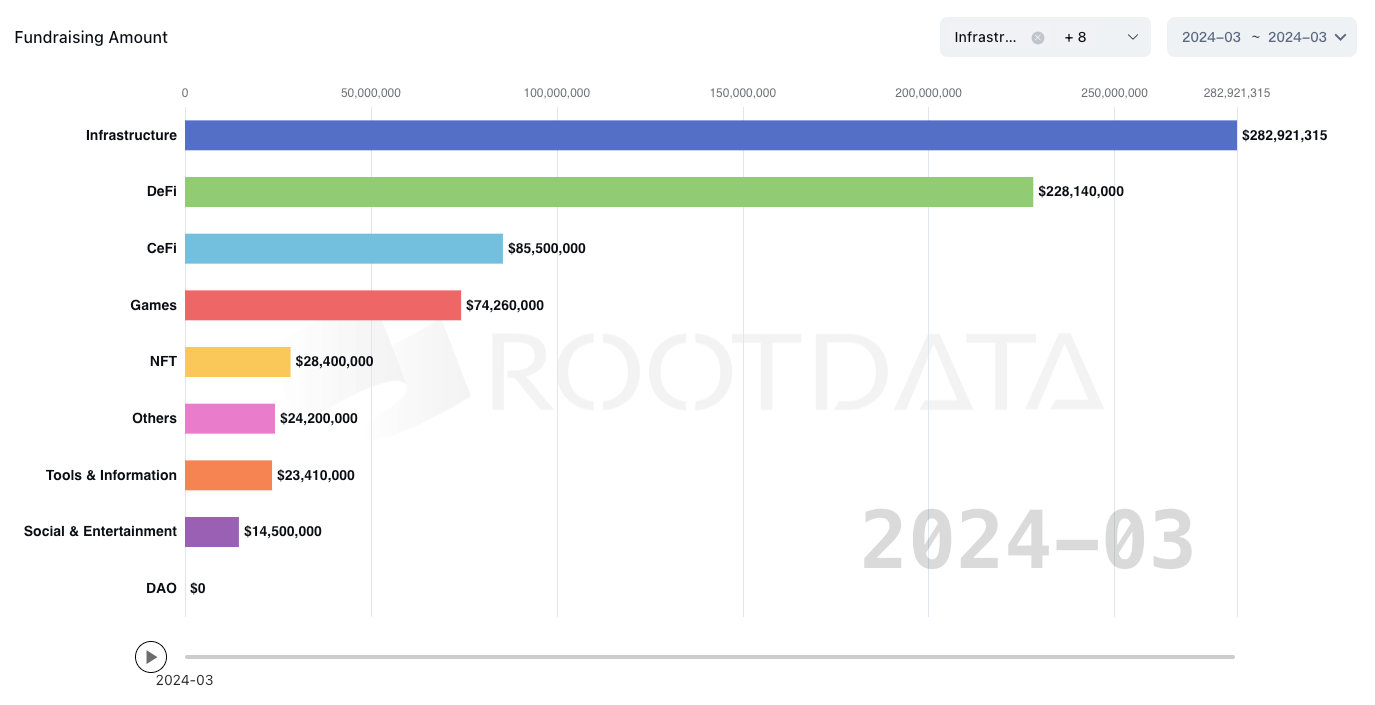

Infrastructure projects were the most well-funded firms in March, making up for nearly $283 million — around a quarter of the total $1.16 billion VC funding.

Decentralized finance (DeFi) projects followed with $228.1 million in funding, making up nearly 20% of the total, with centralized finance (CeFi) projects — such as exchanges — seeing the third-most funding at $85.5 million.

No funding was raised in the DAO category.

Fundraising amount per sector for March 2024. Source: RootData

Last month’s funding is the first time since November that VC funding has broken over $1 billion for the month.

It comes after a dampened 2023 for crypto raises after FTX collapsed in late 2022 and took the crypto markets with it.

VC funding has made monthly gains year-to-date as enthusiasm for crypto has made a comeback in tandem with the markets, which PitchBook attributed to the launch of spot Bitcoin (BTC $66,836) exchange-traded funds (ETFs) in the U.S.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers.

Recommended Content

Editors’ Picks

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC, ETH and XRP eyes for a rally

Bitcoin’s price finds support around its key level, while Ethereum’s price is approaching its key resistance level; a firm close above it would signal a bullish trend. Ripple price trades within a symmetrical triangle on Friday, a breakout from which could signal a rally ahead.

Could XRP surge to new highs in January 2025? First two days of trading suggest an upside bias

Ripple's XRP is up 7% on Thursday, extending its rally that began during the New Year's Day celebration. If long-term holders continue their recent accumulation, XRP could overcome the $2.9 resistance level and aim for a new all-time high.

Bitcoin Price Prediction: BTC tops $97K as Microstrategy, Coinbase kick-off 2025 in green

Bitcoin price crossed $97,750 on Thursday, rising 7% since MicroStrategy’s latest BTC $200 million purchase on Monday December 29. On-chain data shows user activity on the Bitcoin network is still trending 30% below last month's peak.

Meme coin market cap grew 500% in 2024, can they replicate same performance in 2025?

In a report on Thursday, DWF Labs revealed that the meme coin market cap skyrocketed over 500% in 2024 following a change in how investors perceive their value, especially among the younger generation.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.