- Bitcoin and large-cap altcoins are yet to establish a clear direction despite upcoming halving hype.

- Santiment data shows AI & Big Data, Liquid Staking, and DeFi are among the most profitable categories in the crypto market.

- Santiment analysis shows that traders see recent Bitcoin correction as a buying opportunity.

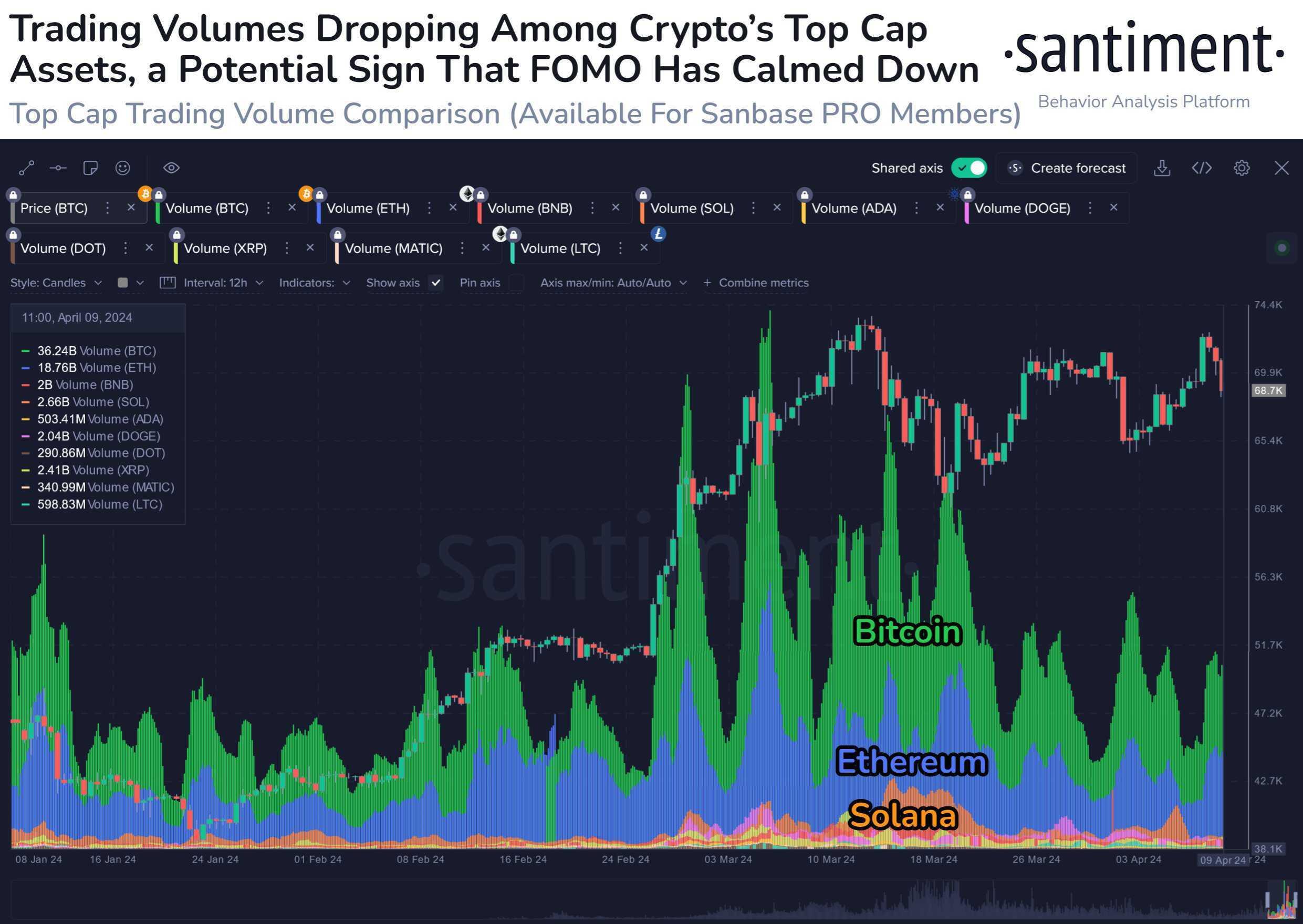

The general crypto market has witnessed a steady decline in trading volume since March 6 according to data from Santiment. While Bitcoin and many large altcoins struggle to establish a clear direction, community members see the recent market correction as a buying opportunity.

Also read: Vitalik Buterin excludes L2 chains that do not use Ethereum for data availability at web3 carnival

Crypto trading volume plummets

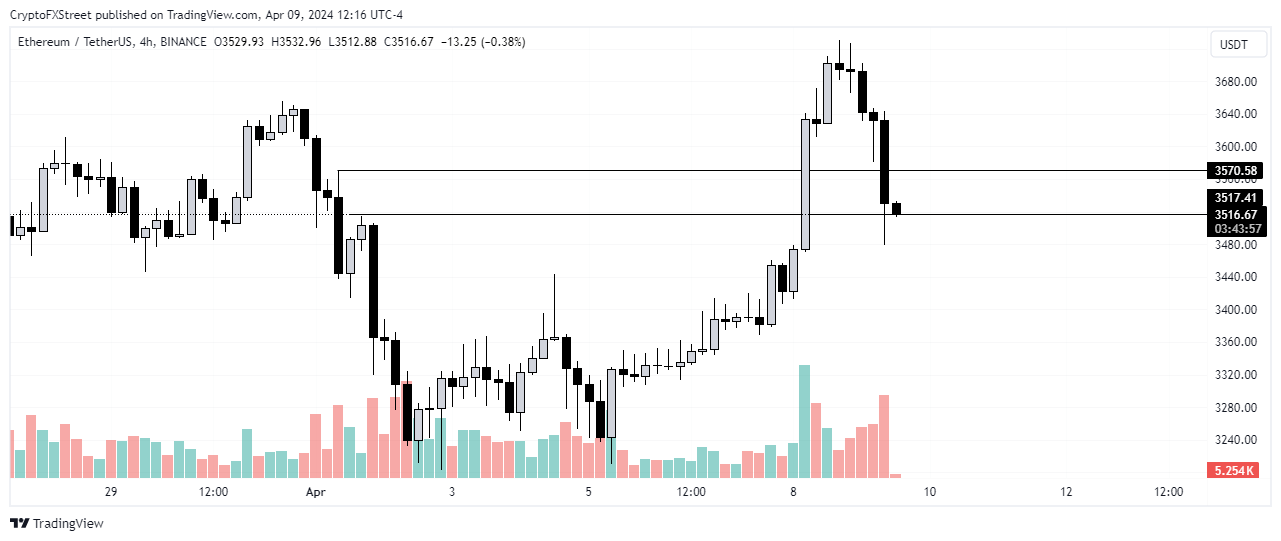

Bitcoin skyrocketed to an all-time high of $73,737 on March 14 after experiencing increased buying pressure caused by the Bitcoin ETF approval in January. However, Bitcoin's correction after reaching its all-time high has caused the market to stagnate.

Data from Santiment shows crypto trading volume has decreased steadily since March 6. While the meme coin boom of March sparked attention in the market, most of them were low-capped and couldn't garner impressive volume.

Read more: Bitcoin halving is a few days away. Here's what key crypto community members are saying

Crypto trading volume

Several top altcoins alongside Bitcoin have largely maintained a sideways movement indicating indecisiveness among traders. Despite the increasing social activity these coins have been receiving as Bitcoin halving approaches, investors may still be highly skeptical about which direction to take with their trades. Trading volume will begin to grow consistently once their price maintains a clear direction.

While the market correction indicates sell pressure, Santiment data indicates other traders may be buying the dip following increased usage of the #dipbuy and #halving in 10 days across crypto community members.

AI and Big Data category lead in gains

Another Santiment data also shows that AI and Big Data, Liquid Staking, and DeFi were among the top categories that posted impressive gains in the last 24 hours. Data from CoinGecko also shows that the Liquid Restaking category experienced gains of 6.6% on Tuesday despite the wider crypto market correction.

Also read: Fetch.ai, Ocean, and SingularityNET merger a step closer after proposal approval

The recent growth in the AI & Big Data category may have been caused by Fetch.ai's community approving the three proposals for its underlying FET token to merge with Ocean Protocol (OCEAN) and SingularityNET (AGIX) to form the Artificial Super Intelligence (ASI).

In the case of Liquid Restaking, it may be due to their high yields and the recent launch of Eigenlayer on the Ethereum Mainnet.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

XRP funding rates flashes negative, eyes $2.17 following 4% decline

Ripple's XRP declined 4% on Friday following a decline in its funding rates. The remittance-based token could decline to test the $2.17 support level if the crypto market decline extends.

Pro-crypto Senator Lummis likely to chair potential crypto subcommittee

In a post on Thursday, Fox Business reporter Eleanor Terret unveiled the Senate Banking Committee's latest plan to kick off a new subcommittee committed to crypto, likely to be headed by Bitcoin strategic reserve advocate Senator Cynthia Lummis.

Lack of Bitcoin allocation could be risky for nations in 2025: Fidelity

Fidelity Digital Assets' Look Ahead report for the crypto market in 2025 highlights key trends expected for the year, including increased Bitcoin adoption by governments worldwide, broader use cases for stablecoins and more app blockchain launches.

Crypto Today: BTC traders hold $90K support as SUI, LTC, TIA see green

The cryptocurrency market’s losing streak entered its third day; aggregate market cap declined 10.9% to hit $3.1 trillion. Bitcoin price stabilized around the $91,800 area as bulls moved to avoid further downside.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.