Crypto Today: XRP loses 3% value, Bitcoin, Ethereum hold steady as Metaplanet sells BTC options

- XRP loses 3% on Thursday, sweeping liquidity at $0.5228.

- Bitcoin and Ethereum prices are nearly unchanged as Metaplanet sells BTC options at $62,000 strike price to earn a premium.

- BTC and ETH trade at $60,499 and $2,355 respectively.

Bitcoin, Ethereum and XRP updates

- Bitcoin and Ethereum fall less than 1% on Thursday. Despite the slight decline, the top two cryptocurrencies by market capitalization are holding above support levels with no real direction.

- XRP corrected more than 3% on the day, trading at $0.5228. XRP holders digest the US Securities & Exchange Commission’s (SEC) appeal against the final ruling in the Ripple lawsuit.

- Crypto asset manager Bitwise filed an S-1 registration on Wednesday for a Spot XRP ETF.

Chart of the day: FTX Token (FTT)

FTX Token (FTT) is trending among top cryptocurrencies that yielded negative returns in the last 24 hours, according to Binance data. FTT erased 8.72% of its value on Thursday. The token could extend its decline by another 10% and sweep liquidity at September 30 low of $1.7276.

The, Moving Average Convergence Divergence (MACD) momentum indicator shows green histogram bars above the neutral line, but these bars are getting shorter, signaling the underlying positive momentum in FTT price is fading.

FTT/USDT daily chart

A daily candlestick close above $2.5247, the September 30 high, could invalidate the bearish thesis. In such a scenario, FTT could attempt a recovery towards the September 29 high of $2.9900.

Market updates

- Metaplanet Inc, a Tokyo listed Bitcoin holder firm, sold their BTC options to earn a premium of nearly 24 BTC worth $1.44 million.

- Grayscale, a crypto asset management firm, introduced Aave Trust, an investment product to help investors gain exposure to the AAVE token. AAVE is a DeFi lending and borrowing protocol.

We are proud to announce the creation of a new single-asset crypto investment fund, Grayscale $AAVE Trust, which will be available through private placement.

— Grayscale (@Grayscale) October 3, 2024

Available to eligible accredited investors.

Read the press release: https://t.co/cJf6spWdnh pic.twitter.com/YMFftGnSCE

Visa announced the launch of a tokenized asset platform for the issuance and management of digital assets. The move could bolster adoption of cryptocurrencies.

Industry updates

- The US SEC approved options on BlackRock’s Bitcoin ETF. Options on an ETF will allow investors to gain exposure to the index’s performance and hedge against a decline in the asset’s price. Analysts at Coin Bureau explain why this approval is a bullish catalyst for BTC.

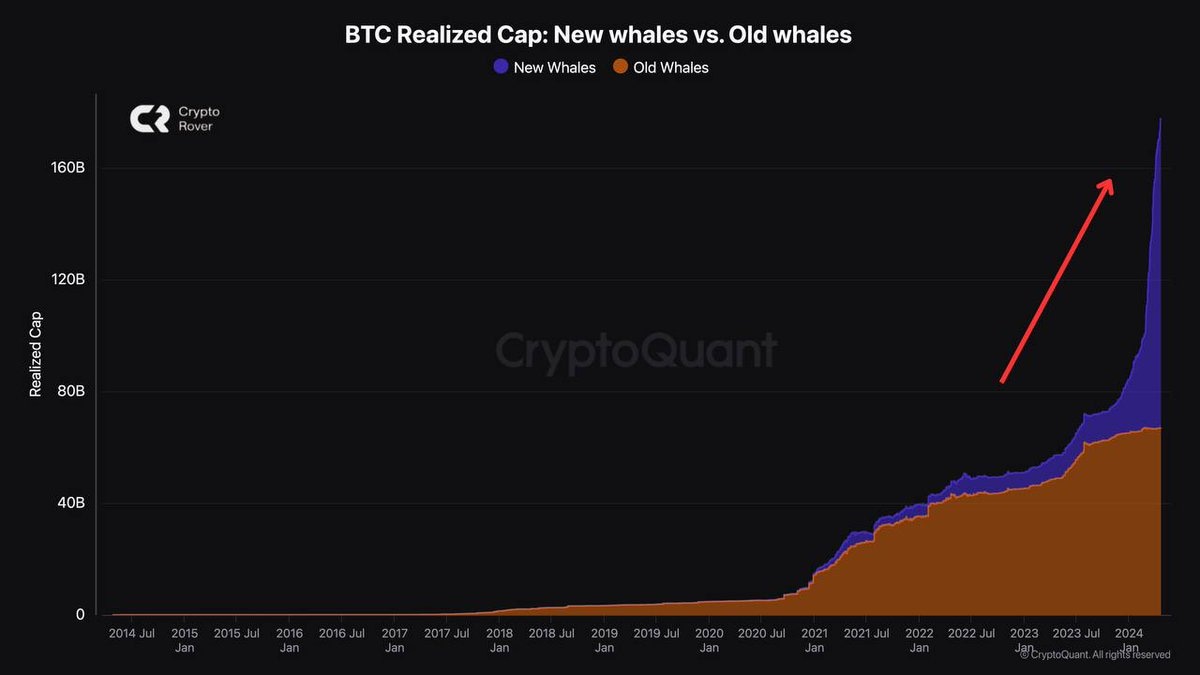

- Bitcoin is experiencing a sharp rise in “new” whales, meaning wallet addresses or entities that started accumulating BTC less than 12 months ago, Crypto Quant data shows.

Bitcoin realized cap: new whales vs. old whales

- Spain’s second largest bank BBVA plans to launch a stablecoin in 2025, according to a Fortune report. The bank partnered with Visa and is likely to roll out the stablecoin in the operation stage next year.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.