Crypto Today: WazirX exploiter moves nearly $12 million Ether to new address, Bitcoin, ETH post gains

- Bitcoin trades above $58,000 at the time of writing, adding 2% to its value this week.

- Ethereum hovers around $2,300 as WazirX exchange exploiter moves 5,000 Ether to a new wallet address and a crypto mixer.

- XRP held steady above $0.5644 on Friday.

Bitcoin, Ethereum, XRP updates

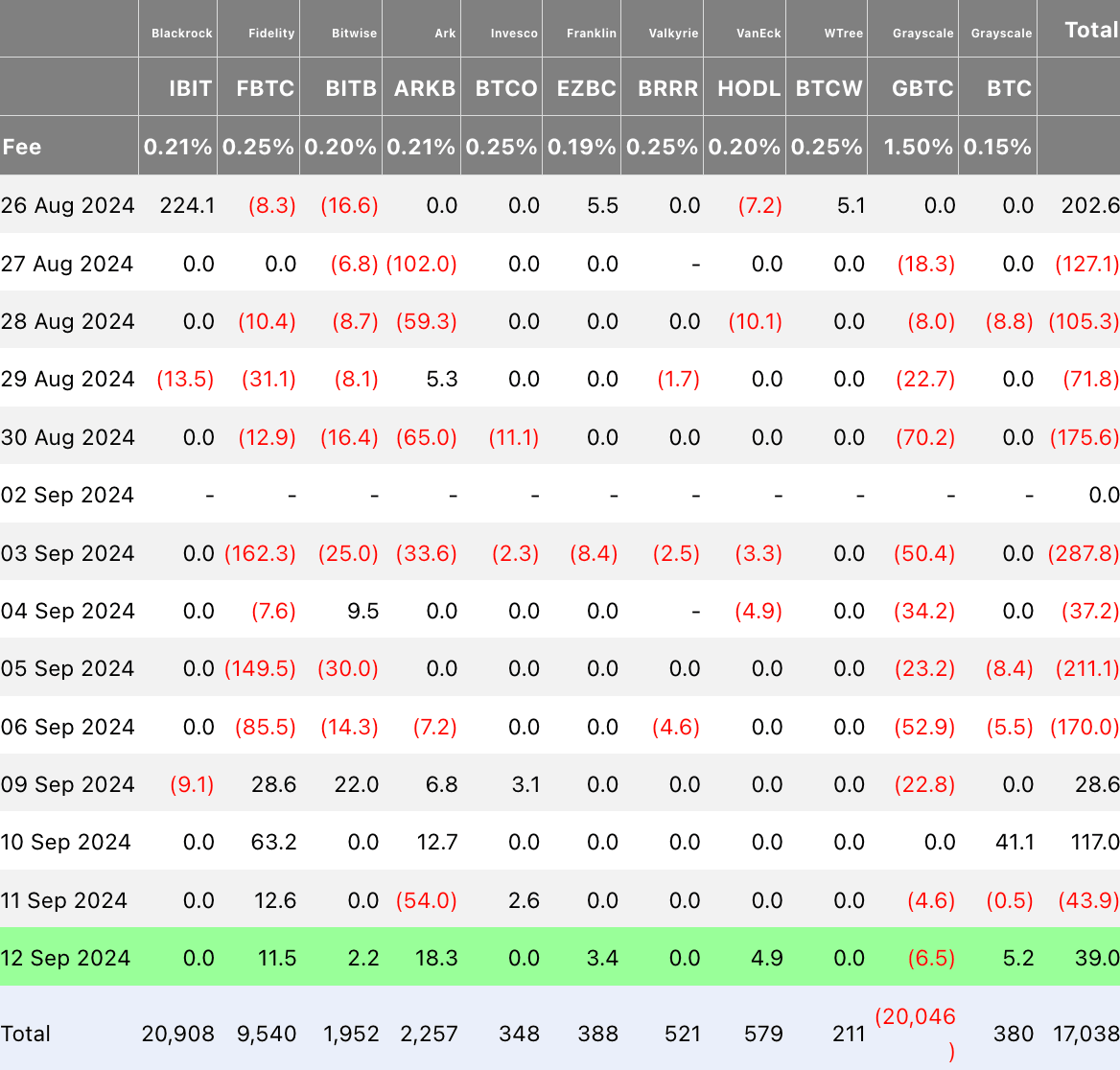

- Bitcoin added 2% to its value this week. Bitcoin Spot ETFs observed net inflows of institutional capital on three out of five days this week, per data from Farside investors. On September 12, the 12 Bitcoin ETFs noted $39 million in inflows.

Bitcoin Spot ETF inflows

- Ethereum hovers around $2,300 as investors raise concerns on likely increase in selling pressure on the asset from Vitalik Buterin’s ETH transfers.

- Wallet identified as Vitalik Buterin’s sold over $2 million in Ethereum since August

- XRP is back above $0.5644 after the initial decline to $0.5231, the weekly low for the altcoin. Ripple stablecoin announcement and details shared by CEO Brad Garlinghoue at Korea Blockchain Week are the key market movers for the asset.

Chart of the day: FET

Artificial Superintelligence Alliance (FET) broke out of its multi-month downward trend on August 22. Since the AI token has traded sideways and exchanges hands at $1.323 at the time of writing. FET erased nearly 5% of its value on the day.

The Moving Average Convergence Divergence (MACD) indicator flashes green histogram bars above the neutral line. The momentum indicator shows there is underlying positive momentum in the FET price trend.

The AI token could extend gains by 13% and target $1.500, the upper boundary of the FVG seen in the FET/USDT daily chart.

FET/USDT daily chart

FET could find support in the FVG between $1.234 and $1.273 if there is a correction in the AI token.

Market updates

- Crypto intelligence tracker PeckShield identified the WazirX exchange exploiter’s wallet address and noted that the address moved 5,000 Ether worth $11.8 million to a new address and transferred most of it to a crypto mixer.

#PeckShieldAlert The #WazirX exploiter-labeled address has moved the 5th batch of 5K $ETH (worth ~$11.8M) to a new address 0xa4d1...9845, likely preparing to launder them through a mixer. pic.twitter.com/7bQu9npzEo

— PeckShieldAlert (@PeckShieldAlert) September 13, 2024

- If the Ether hits centralized exchanges, it could negatively impact price.

- MicroStrategy, one of the largest public holders of Bitcoin, added 18,300 BTC to their holdings on Thursday, September 12. The firm spent $1.1 billion to acquire the Bitcoin.

MicroStrategy has acquired 18,300 BTC for ~$1.11 billion at ~$60,408 per #bitcoin and has achieved BTC Yield of 4.4% QTD and 17.0% YTD. As of 9/12/2024, we hodl 244,800 $BTC acquired for ~$9.45 billion at ~$38,585 per bitcoin. $MSTR https://t.co/WBBRSKxA1U

— Michael Saylor⚡️ (@saylor) September 13, 2024

- Securities & Exchange Commission amends its complaint against Binance and says that it regrets confusion that it may have invited by referring to crypto tokens as securities.

"The SEC regrets any confusion it may have invited" by falsely and repeatedly stating that tokens themselves are securities. This is the remarkable representation in Footnote 6 of @SECGov's Amended Complaint against Binance. I hope @s_alderoty is getting some good sleep tonight.… pic.twitter.com/PpbprvkGxh

— paulgrewal.eth (@iampaulgrewal) September 13, 2024

Industry updates

- PeckShield reports that bankrupt exchange FTX moved 231 BTC, sending 200 coins to centralized exchange Coinbase on Friday.

#PeckShieldAlert #Alameda labeled address has transferred 231.4 $BTC (worth ~$13.5M) out, of which ~200 $BTC was sent to #Coinbase within the last 4 hours. pic.twitter.com/GaazdqRbCp

— PeckShieldAlert (@PeckShieldAlert) September 13, 2024

- Upbit, South Korea’s largest crypto exchange, launches Nervos (CKB) token. The Layer 1 blockchain was launched in 2018 and will be introduced in KRW, BTC and USDT trading pairs.

- Starknet community approved staking STRK tokens in a new proposal, SNIP 18. Staking would boost the utility of the token and provide users with another source of income from their STRK tokens.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.