Crypto Today: Vitalik Buterin says Ethereum has gotten stronger, Bitcoin rallies past $61,000, XRP lags

- Ethereum creator Vitalik Buterin shared statistics to back his claim that Ethereum protocol has gotten stronger in 2024.

- Bitcoin rallied past key resistance at $61,000 and trades at $60,839 at the time of writing.

- XRP lags under $0.60, Ripple announces flagship event Swell 2024.

Bitcoin, Ethereum and XRP updates

- Bitcoin made a comeback above $60,000, a key psychological level for BTC. BTC trades at $61,320, rallying early on Thursday. The asset climbed nearly 0.30% on the day. Data from Farside Investors shows Bitcoin ETFs have seen inflows of $236.6 million in the last five days and their net inflow since launch amounts to $17.6 billion.

- Ethereum co-founder Vitalik Buterin said on X that “Ethereum has gotten stronger.” Buterin explains that the protocol has under $0.01 transaction fees on Layer 2 chains. Layer 2 protocols Optimism and Arbitrum are at stage 1, according to Buterin.

- The Ethereum creator says Ether’s mature ZK tooling has boosted the protocol’s utility for app builders.

Ethereum has gotten stronger:

— vitalik.eth (@VitalikButerin) August 22, 2024

* Under $0.01 txfees on L2

* Two EVM L2s (@Optimism @arbitrum) now at stage 1

* Cross-L2 wallet UX has improved a lot (eg. no more manually switching networks), though still a long way to go

* Much more powerful and mature ZK tooling making life… pic.twitter.com/4jQGeZ3qEA

- XRP lags under a key psychological barrier at $0.60. Ripple announced its flagship event Swell 2024 for October 15-16.

Chart of the day

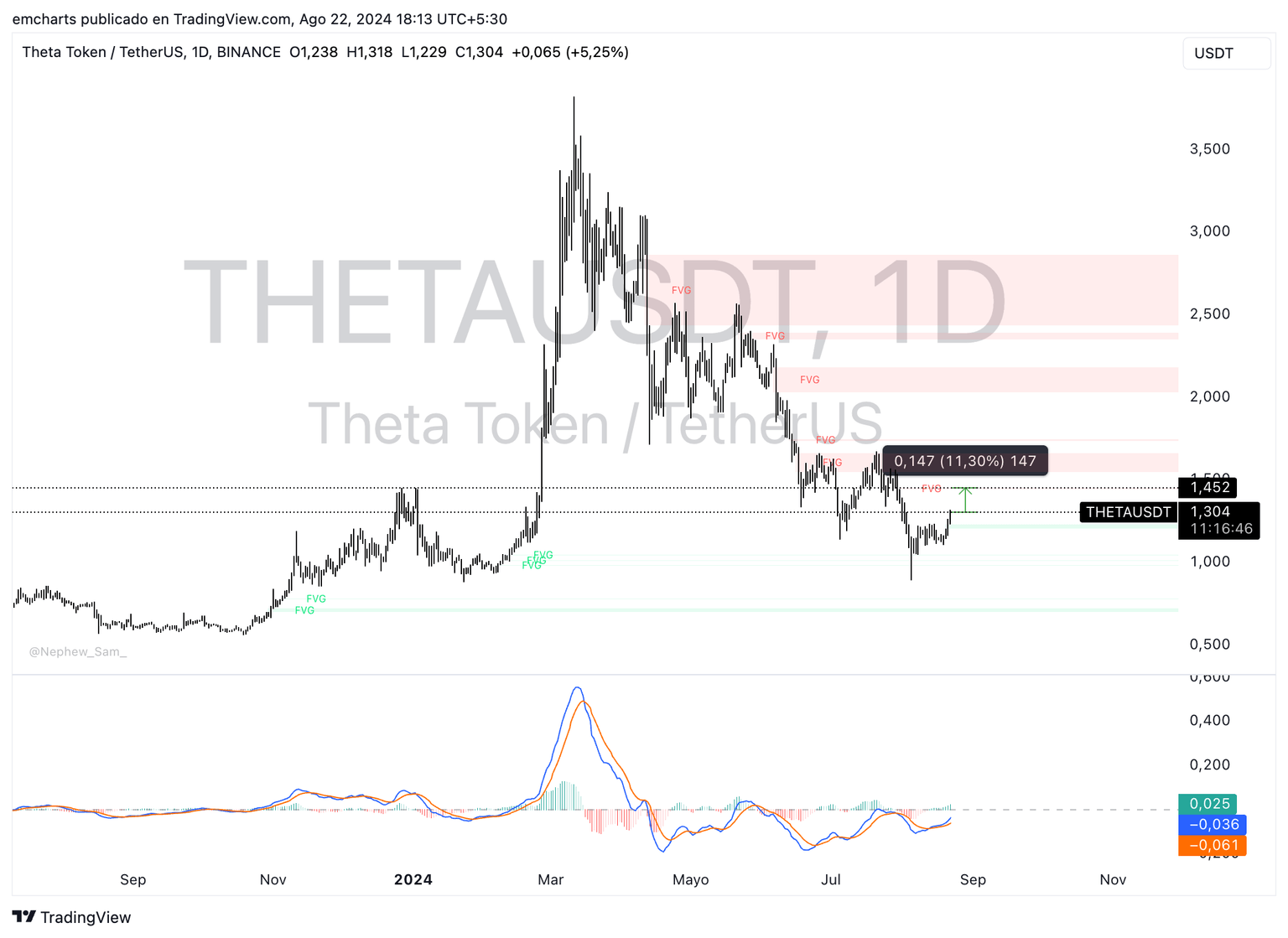

THETA/USDT daily chart

Theta Token (THETA) trades at $1,304 at the time of writing. The token extended gains by over 5% on Thursday. THETA could rally another 11.30% and hit the $1,452 level, a key support for the asset between March and August 2024.

The Moving Average Convergence Divergence (MACD), a momentum indicator, supports THETA’s bullish thesis. The green histogram bars above the neutral line imply an underlying bullish sentiment in THETA price trend.

THETA could find support in the Fair Value Gap (FVG) between $1,205 and $1,229 as seen in the THETA/USDT daily chart.

Market updates:

- Daily active addresses in AAVE hit a one-year peak on August 21, surging to 1,730 per IntoTheBlock data.

Daily active addresses

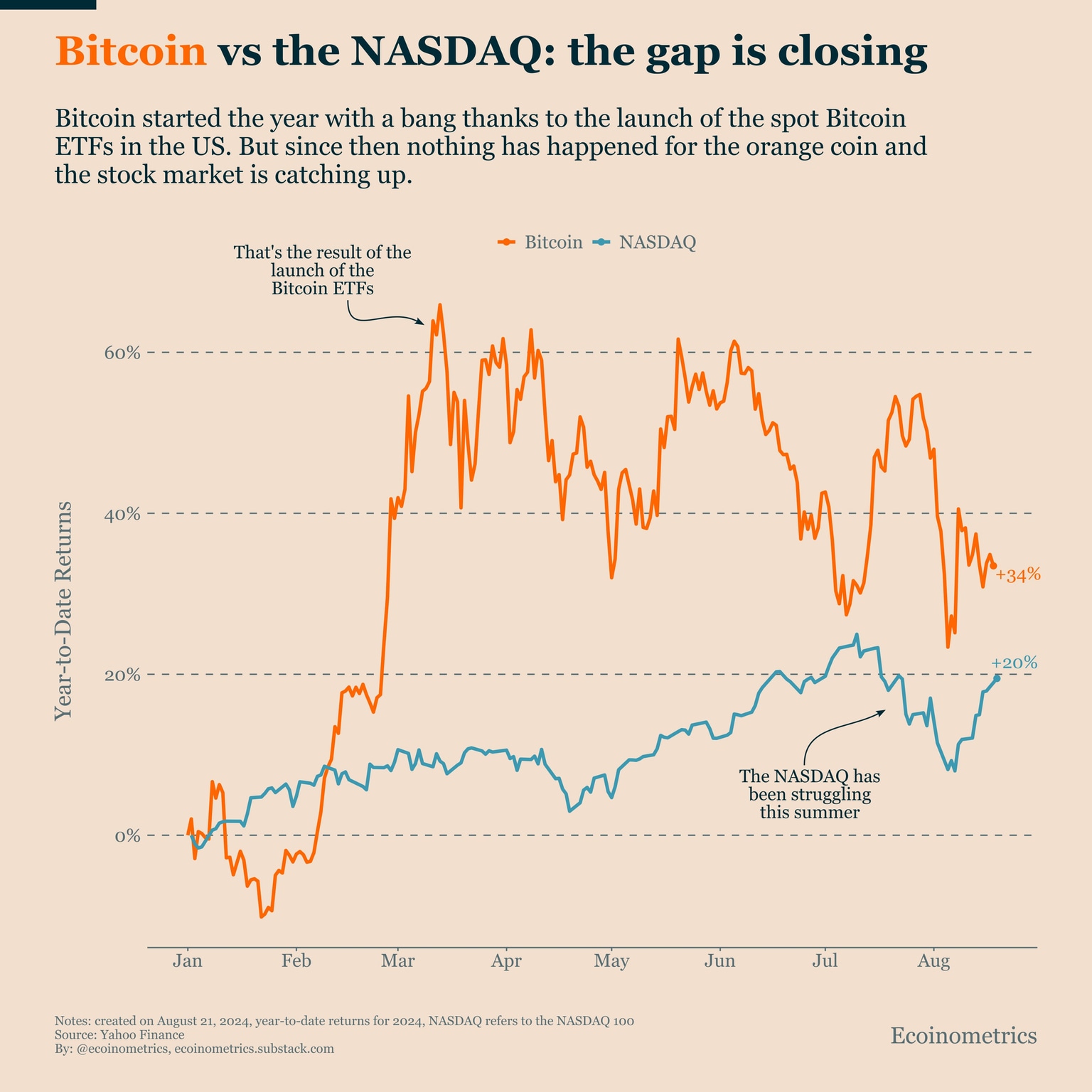

- Ecoinometrics data shows that the gap between Bitcoin and the NASDAQ is closing. BTC gained nearly 34% year-to-date, while the NASDAQ has gained 20%.

Bitcoin vs NASDAQ YTD returns

- Ethereum ETFs endured the longest outflow streak since their launch, with $92.2 million in institutional capital flowing out in five days.

Industry updates:

- Coinbase announces its support for Polygon token MATIC’s migration to POL.

- El Salvador announced Bitcoin Certification Program for 80,000 civil servants.

- A large wallet investor bought 77,270 AAVE tokens at $135 as open interest in the DeFi token spikes on Thursday.

Crazy buying of $AAVE!

— Lookonchain (@lookonchain) August 22, 2024

This whale spent 4,000 $stETH($10.4M) to buy 77,270 $AAVE at $135 in just 1 day!

Address:

0xa923b13270f8622b5d5960634200dc4302b7611e pic.twitter.com/jSMKOiTT0Z

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.