- The total cryptocurrency market valuation grew by $175 billion, rising 6% ahead of the White House Crypto Summit.

- Bitcoin price faces stiff resistance at $93,000 as traders lean towards altcoins with high-volatility potential.

- XRP price broke above the $2.50 resistance on Thursday after a week-long consolidation phase.

- The market cap of crypto AI tokens increased by 3.9%, with Near Protocol and Render among the top gainers.

Chart of the day: Why is the crypto market up today?

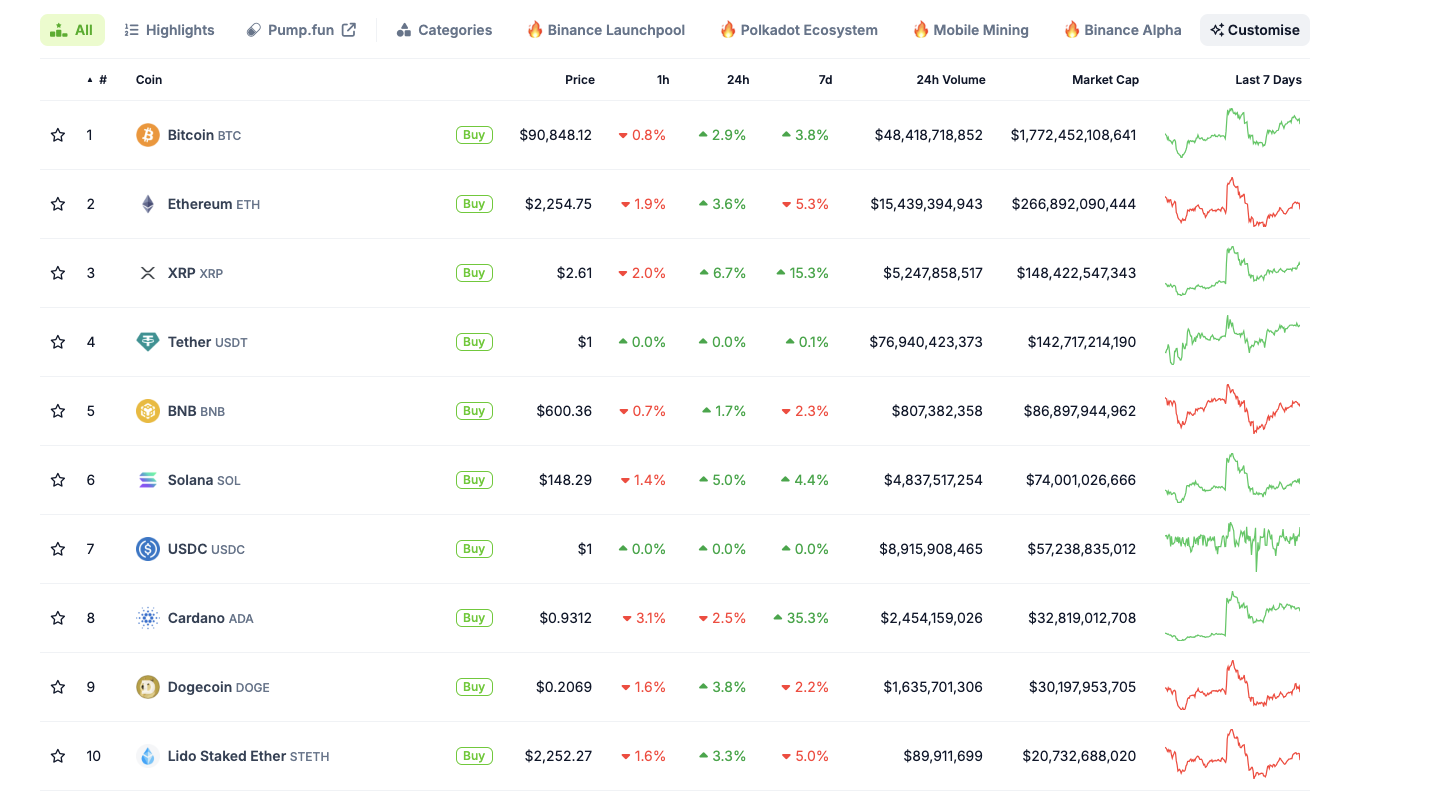

The global crypto market capitalization increased by 6.2% in the last 24 hours as traders took on bullish positions ahead of the upcoming White House Crypto Summit on Friday. Rather than double-down on BTC, sector-wide price trends show that investors are leaning towards altcoins.

Top 10 Crypto assets performance | March 6

United States (US) President Donald Trump’s decision to include four altcoins in the crypto strategic reserve has sparked expectations of more altcoin-friendly policy fallouts from the White House Crypto Summit.

Notably, tokens like Chainlink (LINK), Ripple (XRP) and Cardano (ADA), which have developed close links to the Trump administration in recent months, are witnessing considerable gains at press time on Thursday.

Crypto AI tokens also scored substantial gains, with top assets like Near Protocol (NEAR) and Render Network (RNDR) posting 9% rallies apiece, outperforming the market average.

Bitcoin market updates:

Bitcoin price pulled back below $89,900 on Thursday, down 2% from the 24-hour peak of $92,800.

With market sentiment dominantly bullish, investors are strategically leaning towards altcoins with high growth potential.

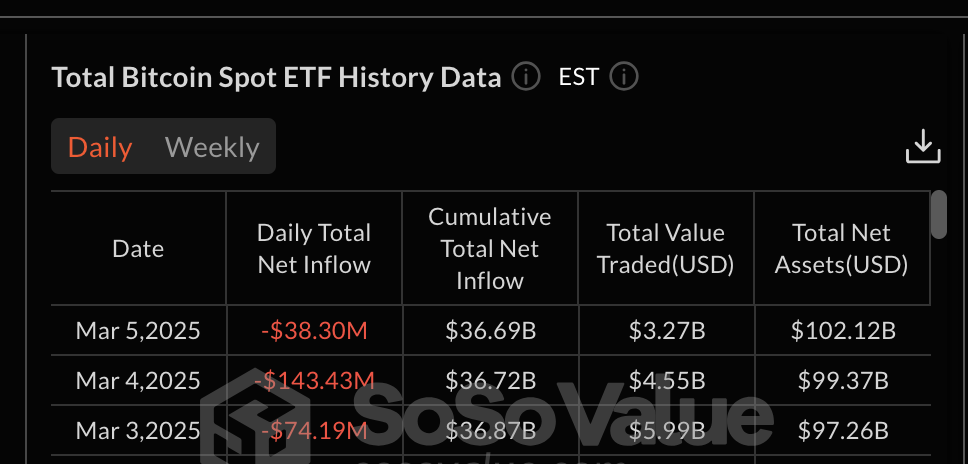

Bitcoin ETFs posted another $38 million outflows on Wednesday.

Bitcoin ETF Flows, March 5 | Source: SosoValue

This marks the third consecutive day of outflow this week, which evidently contributed to Bitcoin price retracement.

Altcoin market updates:

- Ethereum price rose 2% to reclaim the $2,200 level.

- Ripple (XRP) price increased by 4%. Having breached the $2.50 level, XRP could face weakened resistance as it advances towards $3

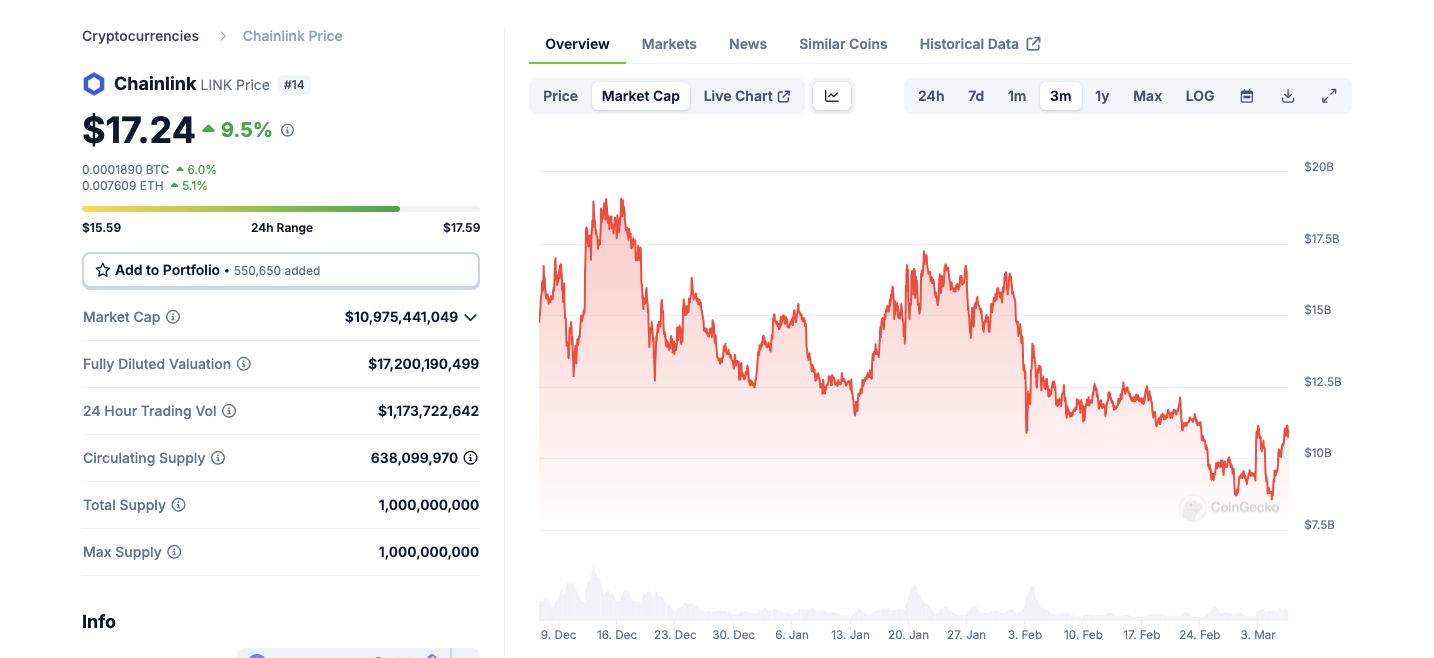

- Chainlink (LINK) price surged by up to 11% as it grazed the $20 mark for the first time this week.

Chainlink price action

Given Chainlink’s recent partnership with Trump’s DeFi platform World Liberty Financial (WLFI) and global payments giant SWIFT, investors anticipate further integration for TradFi and DeFi during the White House Crypto Summit could spark more gains.

Crypto news updates:

-

New York State Assembly introduces bill A05515 to combat crypto fraud.

The New York State Assembly has introduced a new bill, targeting cryptocurrency-related fraud, including "rug pulls," private key theft and undisclosed token interests.

The bill, sponsored by Clyde Vanel, establishes new categories within the state’s penal code to address virtual token fraud, illegal rug pulls and fraudulent failures to disclose financial interests in tokens, aiming to bolster protections for investors in the growing digital asset market.

The bill comes amid increasing reports of crypto scams, with provisions that could impose penalties of up to $25 million for corporations and prison terms of up to 20 years for individuals found guilty of such offenses.

-

Brazil’s Méliuz adopts new treasury strategy, allocates up to 10% in Bitcoin

Brazilian fintech company Méliuz announced that its board of directors has approved a new treasury strategy, allowing the allocation of up to 10% of its cash reserves into Bitcoin.

The company has already purchased 45.72 Bitcoin for approximately $4.1 million, marking it as the first publicly-listed firm in Brazil to incorporate the cryptocurrency into its corporate reserves, according to a securities filing and reports from local news outlets.

The move reflects Méliuz’s aim to maximize long-term shareholder value through Bitcoin investments, joining a global trend of traditional finance companies adopting cryptocurrency strategies.

The company specified that it will continue to monitor and analyze the strategy, including the potential for Bitcoin to become a primary strategic asset in its treasury, while acknowledging risks associated with market volatility and regulatory challenges.

-

Dubai’s Emirates NBD partners with Aquanow to launch crypto trading on digital banking platform

Emirates NBD, Dubai’s largest bank, announced on Thursday a partnership with digital asset platform Aquanow to introduce cryptocurrency trading services through its digital banking arm, Liv X.

The collaboration allows customers to buy, sell, and trade major cryptocurrencies, including Bitcoin and Ethereum, via the Liv X app, marking a significant step in integrating digital assets into the UAE’s financial sector, according to a statement from the bank and reports from financial news outlets.

The initiative aligns with Dubai’s broader strategy to position itself as a global hub for cryptocurrency innovation, leveraging Aquanow’s infrastructure, which is licensed by the Dubai Virtual Assets Regulatory Authority (VARA).

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin holds $84,000 despite Fed’s hawkish remarks and spot ETFs outflows

Bitcoin is stabilizing around $84,000 at the time of writing on Thursday after facing multiple rejections around the 200-day EMA at $85,000 since Saturday. Despite risk-off sentiment due to the hawkish remarks by the US Fed on Wednesday, BTC remains relatively stable.

Crypto market cap fell more than 18% in Q1, wiping out $633.5 billion after Trump’s inauguration top

CoinGecko’s Q1 Crypto Industry Report highlights that the total crypto market capitalization fell by 18.6% in the first quarter, wiping out $633.5 billion after topping on January 18, just a couple of days ahead of US President Donald Trump’s inauguration.

Top meme coin gainers FARTCOIN, AIDOGE, and MEW as Trump coins litmus test US SEC ethics

Cryptocurrencies have been moving in lockstep since Monday, largely reflecting sentiment across global markets as United States (US) President Donald Trump's tariffs and trade wars take on new shapes and forms each passing day.

XRP buoyant above $2 as court grants Ripple breathing space in SEC lawsuit

A US appellate court temporarily paused the SEC-Ripple case for 60 days, holding the appeal in abeyance. The SEC is expected to file a status report by June 15, signaling a potential end to the four-year legal battle.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.