Crypto Today: Top 3 cryptos Bitcoin, Ethereum and XRP gain slightly as endowment reports BTC ETF position

- Bitcoin and Ethereum gain slightly on Monday, with BTC trading less than 7% below its all-time high.

- XRP holds steady above $0.5100.

- Emory University is the first endowment to report a $15.8 million position in Bitcoin ETFs.

Bitcoin, Ethereum and XRP updates

- Bitcoin trades at $68,724, increasing slightly on Monday.

- Bitcoin spot ETFs recorded $402 million in net inflows on Friday,.

- Ethereum holds above the psychologically important price level of $2,500, trading at $2,523.

- XRP trades broadly stable, exchanging hands at $0.5177.

Chart of the day: FTX Token (FTT)

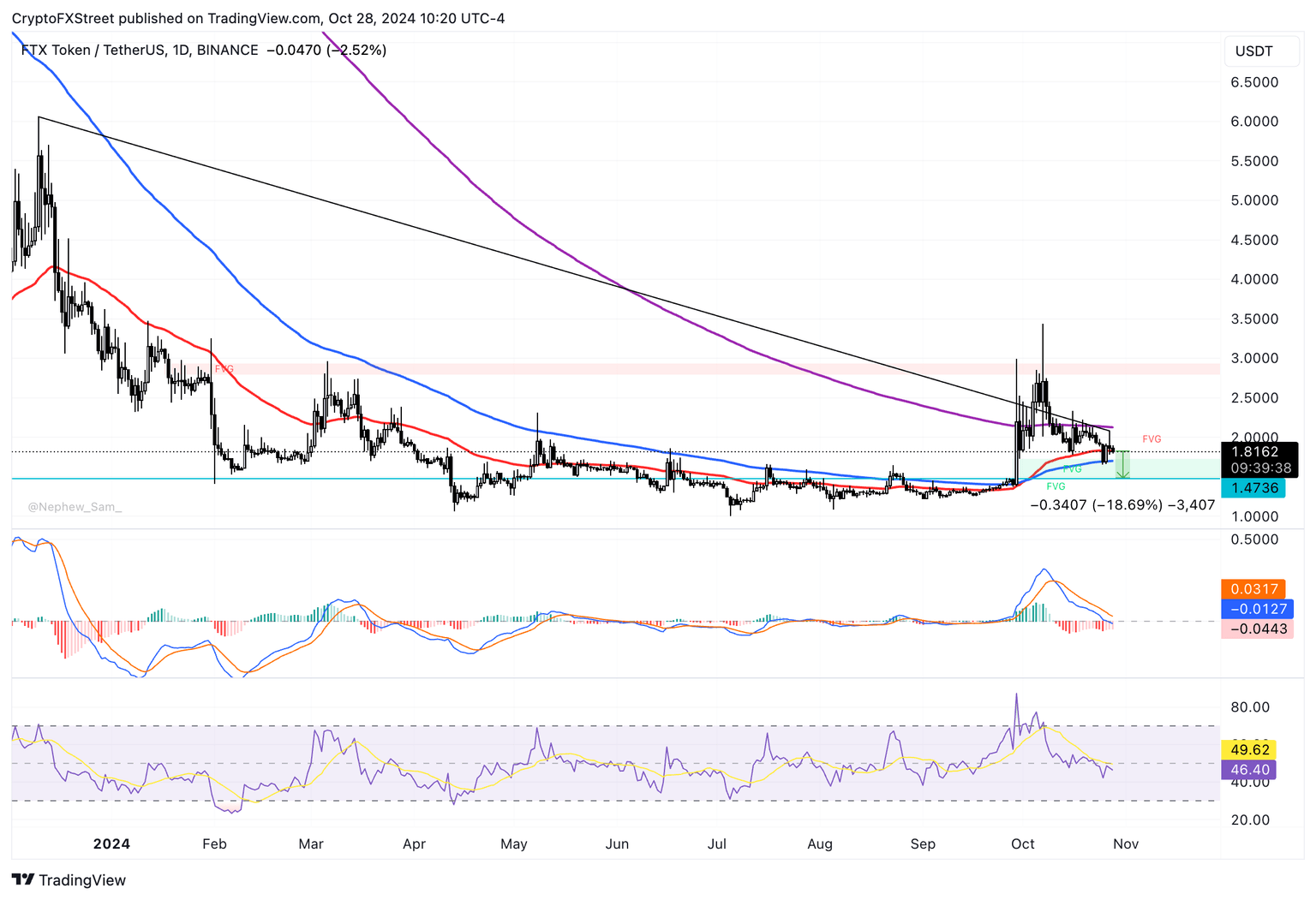

FTX Token ranks among the worst performers on Monday, losing more than 3.3% against the slight gains seen among main crypto assets. In case of further decline, FTT could find support at $1.4736, which represents the lower boundary of a Fair Value Gap (FVG).

The Relative Strength Index (RSI) is sloping downward and reads 46.40. The Moving Average Convergence Divergence (MACD) shows red histogram bars under the neutral line, meaning there is underlying negative momentum in the FTT price trend.

FTT/USDT daily chart

A daily candlestick close above the 200-day Exponential Moving Average (EMA) at $2.1252 could invalidate the bearish thesis. In an upside scenario and after this key EMA, FTT could test resistance at the October 16 high of $2.330.

Market updates

- Emory University is the first endowment to disclose Bitcoin ETF holdings worth $15.8 million in Grayscale’s Bitcoin Mini Trust, according to an SEC filing released on Friday. This is a key development for Bitcoin holders, who are looking for signs of institutional adoption of BTC.

- Phantom, a non-custodial crypto wallet, reported on Monday a service disruption due to a backend issue.

We're currently experiencing an uptime incident and some services may be temporarily disrupted.

— Phantom (@phantom) October 28, 2024

If you are in urgent need of making a transaction, please ignore simulation errors and try using a dapp.

Thanks for your patience as we work to resolve the issue

- VanEck’s Head of Digital Assets Research Matthew Sigel told in an interview at CNBC that his outlook for Bitcoin is bullish in 2025.

JUST IN: VanEck's Matthew Sigel gives CNBC a BULLISH Bitcoin outlook for 2025:

— Altcoin Daily (@AltcoinDailyio) October 28, 2024

"Just like 2020..." pic.twitter.com/wruKoffIYb

Industry updates

- Data from Solana Floor shows that the total market capitalization of Solana-based Liquid Staking Tokens (LSTs) has crossed $5 billion, a record high. Liquid staking allows users to stake their crypto while they have access to the liquidity and can use it to lend, borrow or perform other functions.

BREAKING: The Total Market Cap of @Solana Liquid Staking Tokens (LSTs) has surpassed $5 billion, a new all-time high.

— SolanaFloor (@SolanaFloor) October 28, 2024

Top LSTs by market share:

• $JitoSOL: 43.6%

• $mSOL: 17.1%

• $jupSOL: 12.1% pic.twitter.com/HumeKpw8q9

- Hong Kong’s publicly traded holdings company HKEX is set to introduce the first series of digital asset indices aligned with the European Benchmark Regulation. The indices will offer a unified price benchmark for Bitcoin and the daily price reference will be calculated at 08:00 GMT.

- On-chain intelligence tracker Lookonchain identified a $7.17 million Solana sale by Pump.fun, a meme coin launchpad in the Solana ecosystem. Typically, an increase in selling pressure or large volume sales can negatively impact the token’s price.

The https://t.co/DrKlYnPPqY Fee Account sold 41,000 $SOL($7.17M) again just now!https://t.co/DrKlYnPPqY has generated total revenue of 1,041,344 $SOL($182M) and has sold 545,843 $SOL($86.14M) at an average price of $158 so far.https://t.co/52uYlF31R9 pic.twitter.com/QigK7LDRUN

— Lookonchain (@lookonchain) October 28, 2024

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.