- Ripple rallied above key psychological resistance at $0.6000 early on Thursday.

- Bitcoin and Ethereum struggled under key support levels.

- SEC lawsuit ends with Judge slashing down fine from $2 billion to $125 million, marking a victory for.

- XRP retail investors accumulated over 10 million tokens shed by whales in the price rally on August 7.

- XRP could extend gains by over 20% and hit the November 2023 high of $0.7500.

Bitcoin, Ethereum, XRP update

- Ripple (XRP) rallied past key psychological resistance at $0.60, while Bitcoin and Ethereum struggled at key support levels. XRP could extend gains by nearly 20% in response to the Securities & Exchange Commission (SEC) lawsuit ruling.

- The long-drawn legal battle with the SEC came to an end on August 7 when Judge Analisa Torres ruled on the issue of a fine to be imposed on Ripple for violation of securities laws.

SEC vs. Ripple lawsuit ends, Ripple announces key developments, XRP rallies

The legal battle between Ripple and SEC ended with Judge Analisa Torres’ ruling in the lawsuit. The Judge slammed Ripple for violation of federal securities law and sale of XRP to institutional investors, with a penalty of $125 million imposed on the payment remittance firm.

The judge upheld the July 2023 ruling where XRP received legal clarity as a “non-security” in secondary market transactions.

#XRPCommunity #SECGov v. #Ripple #XRP BREAKING: Judge Torres has issued her Ruling on the SEC’s Motion for Remedies. https://t.co/PV8R1hWtvq

— James K. Filan (@FilanLaw) August 7, 2024

Ripple recently announced a slew of positive developments and news. The payment remittance firm shared details of its stablecoin, announcing that access depends on regulatory approval. Ripple called security researchers to identify potential vulnerabilities in its codebase and participate in the RippleX Bug Bounty Program.

The firm has previously awarded $1 million in bounties as part of its program. The firm recently committed $10 million to an investment in tokenized US Treasury Bills on the XRP Ledger.

The positive developments and the final ruling in the lawsuit catalyzed gains in XRP. The native token of the XRPLedger rallied above $0.60, a key psychological level for the asset.

XRP market capitalization exceeds $34.37 billion, and the asset ranks seventh among cryptocurrencies, per CoinGecko data.

On-chain data shows whales shed XRP at a profit while retail investors collected the asset in the past two days. Network Realized Profit/Loss (NPL) metric measures the net profit/loss of all tokens traded on a given day. The metric indicates XRP traders shed their holdings at a loss on August 5 and took profits in the days after.

XRP Network Realized Profit/Loss vs asset price.

Ripple investors holding between 1,000 and 10,000 tokens and 10,000 and 100,000 tokens accumulated XRP as whales holding 100 million and higher volume of the asset shed their coins, taking profits. The Santiment chart below shows the change in holdings of different tiers of XRP investors.

XRP supply distribution

Why XRP could rally 20%

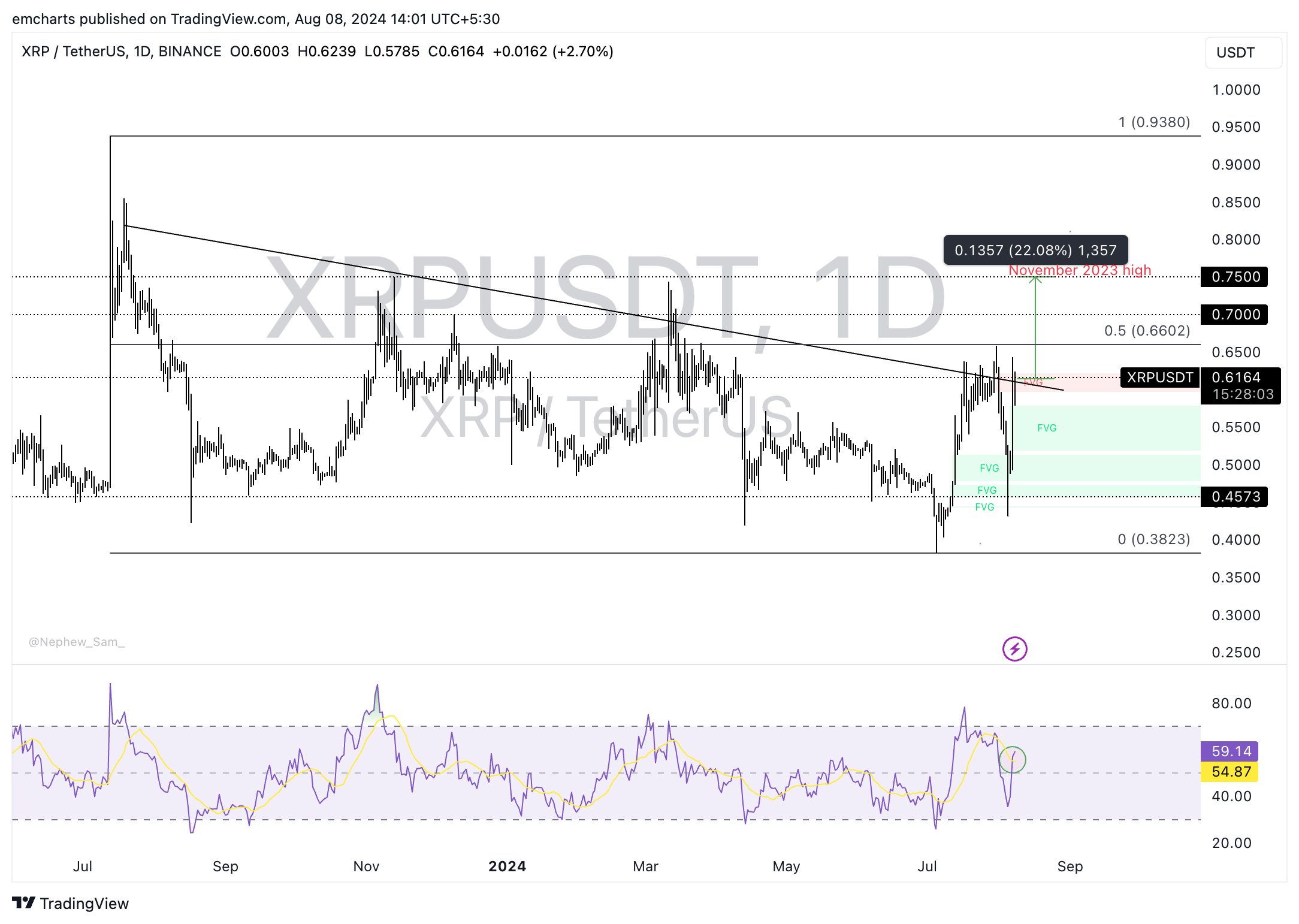

Ripple is currently in a multi-month downtrend as seen in the XRP/USDT daily chart below. XRP trades at $0.6164 at the time of writing. The altcoin could extend gains by 22% and hit its November 2023 high of $0.7500, a key level for the altcoin.

XRP faces resistance at $0.6602, the 50% Fibonacci retracement level of the decline from its July 13 top of $0.9380 and the July 5 low of $0.3823, and then at $0.7000.

The momentum indicator, Relative Strength Index (RSI), reads 59.14, above the neutral zone.

XRP/USDT daily chart

Ripple could find support at the Fair Value Gap (FVG) between $0.5188 and $0.5785 and then at the $0.4573 level, which has acted as support for several months.

Market updates

- Franklin Templeton’s OnChain US Government Money Fund is available on Arbitrum per an official announcement on X.

Franklin Templeton’s @FTI_DA OnChain U.S. Government Money Fund is now available on Arbitrum!

— Arbitrum (,) (@arbitrum) August 8, 2024

We’re excited to have access to the BENJI platform and see a major financial institution, Franklin Templeton, build on Arbitrum!https://t.co/CRWCFyz3NM pic.twitter.com/yrlwflYOow

- Over $450 million in Ponzi scheme Plustoken funds have been moved on August 8. Investors fell victim in the years 2018-19 and lost between $2 and $2.9 billion in assets. On-chain data from Arkham tracks movements of funds.

TODAY: OVER $450M PLUSTOKEN FUNDS MOVED

— Arkham (@ArkhamIntel) August 7, 2024

Plustoken wallets have been connected with dozens of wallets moving $464.7M of ETH in only the past 12 hours.

Plustoken was a 2018-19 Ponzi Scheme that scammed investors worldwide for between $2B and $2.9B in cryptocurrency. 789.5K ETH… pic.twitter.com/DCR8itinIv

- Binance announces that as of July 31, over $73 million in stolen user funds from external parties in 2024 have been secured.

As of July 31, #Binance has secured over $73M in stolen user funds from external parties in 2024, surpassing the $55M secured in 2023!

— Binance (@binance) August 8, 2024

Through proactive efforts, we've recovered lost digital funds, with ~80% related to external exploits.

Read more https://t.co/artud81OBh

Industry updates

- PeckShield data shows that a wallet linked to the $200 million hack of the Nomad Bridge, from nearly two years ago, transferred nearly 15,000 Ether to crypto mixing service Tornado Cash.

#PeckShieldAlert #NomadBridge exploiter-labeled address has transferred 14.5K $ETH (worth ~$35.2M) to #Tornadocash pic.twitter.com/beiYFxsAPb

— PeckShieldAlert (@PeckShieldAlert) August 8, 2024

- BingX exchange announces the integration of Apple Pay and Google Pay to enhance fiat trading for users.

- Bankrupt crypto exchange FTX and Alameda Research will pay $12.7 billion to creditors after a New York judge’s officially approval to an order on Wednesday, August 7.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Ethereum Price Forecast: ETH ETFs post first weekly inflows since February

Ethereum ETFs recorded net inflows of $104.1 million on Friday — their highest daily inflow since February 4, per SoSoValue data. As a result, the products saw a weekly net inflow of $157.1 million, which also marks their highest net buying activity since February.

Defi Development Corporation files to offer $1 billion in securities to boost its Solana holdings

Defi Development Corporation filed a registration statement with the Securities & Exchange Commission on Friday, signaling its intent to offer and sell a wide range of securities.

Bitwise hints at NEAR ETF following Delaware registration

The filing marks a crucial step before a firm submits an application for an ETF with the SEC. While Bitwise has not yet applied for a NEAR ETF with the SEC, similar actions preceded its previous XRP and Aptos ETF filings.

Bitcoin price could reach $285K by 2030 as Citigroup forecasts $1.6 trillion stablecoin inflows

Bitcoin price outlook strengthens as Citigroup projects $1.6 trillion stablecoin growth, calling them critical bridges between banks and blockchain.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.

%20[18.56.11,%2008%20Aug,%202024]-638587246151333096.png)

%20[14.08.11,%2008%20Aug,%202024]-638587246688973934.png)