Crypto Today: NFT platform OpenSea gets SEC Wells Notice, Bitcoin and Ethereum hover close to support

- Bitcoin and Ethereum hover close to $60,000 and $2,500, key support levels.

- SEC sends NFT platform OpenSea a Wells Notice, warning about possible legal action for violating securities laws.

- NFT-related coins have seen mixed reactions to the news, with Apecoin posting 6% losses.

Bitcoin, Ethereum, XRP updates

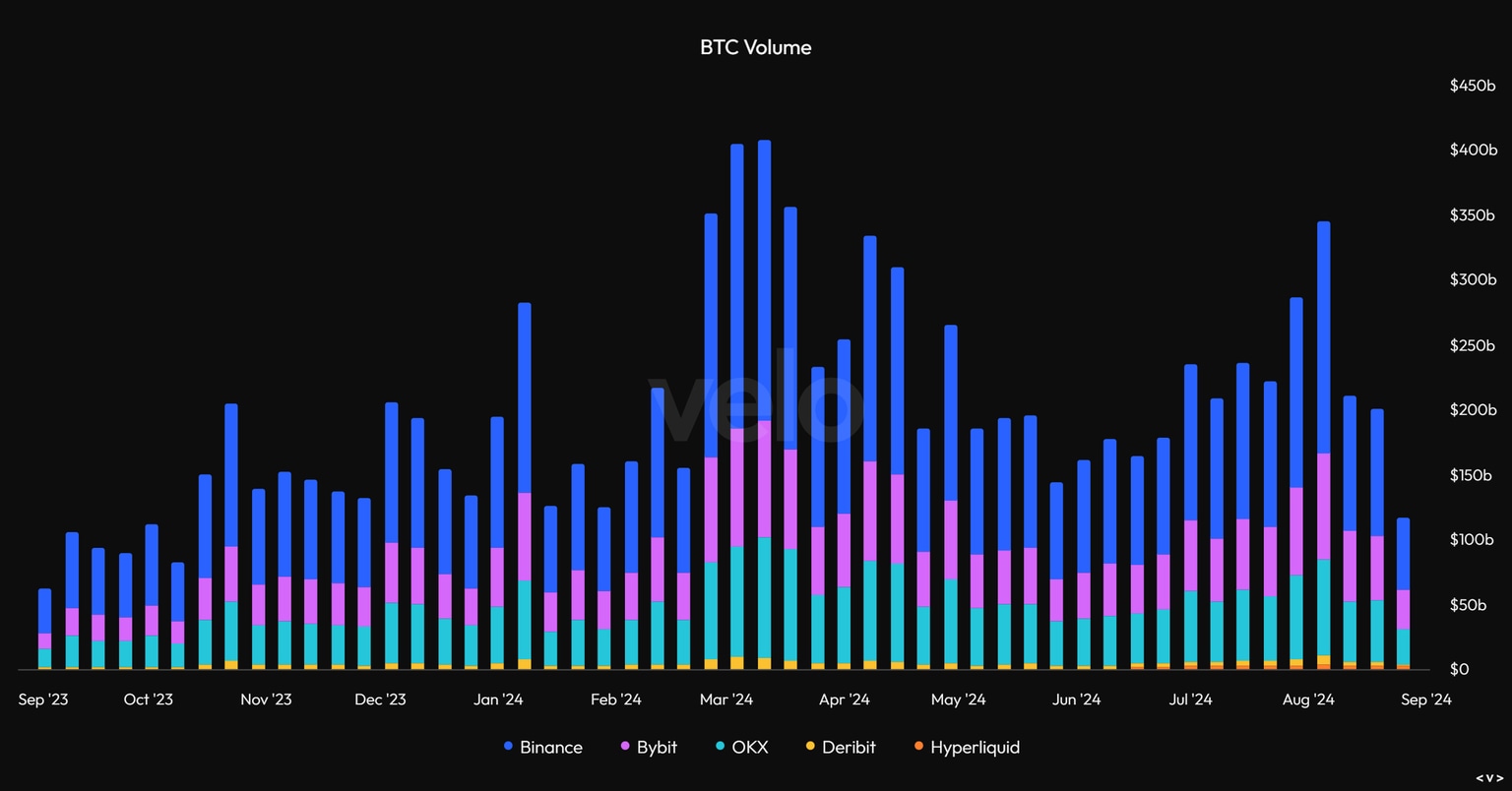

- Bitcoin trades at $60,140, close to support at $60,000. Data from Reflexivity Research shows that the trading volume for Bitcoin has continued to bleed out over the last few weeks. This implies the asset has been trading in a low-volume range, and BTC has traded sideways since the March rally to $73,777.

Bitcoin volume data

- Ethereum trades at $2,572 at the time of writing. The altcoin is struggling to break past key resistance as selling pressure on the asset weighs on prices. Data from crypto intelligence tracker Arkham shows that Abraxas Capital Management, an asset management firm, deposited 10,000 Ether worth $34.34 million to Binance. The firm unstaked these Ether tokens from Ether.Fi.

5 minutes ago, #Abraxas_Capital_Management just deposited 10k $ETH(~$34.34M) to #Binance.

— The Data Nerd (@OnchainDataNerd) July 2, 2024

Those $ETH were unstaked from @ether_fi 10 minutes ago.

Address:https://t.co/krOZnuhzUh pic.twitter.com/ijsx0rpsFO

- XRP trades at $0.5729 on Thursday, a slight 0.67% gain on the day.

- OpenSea CEO slammed the SEC for sending a Wells notice to the platform and stated that the firm will stand and fight for NFTs.

OpenSea has received a Wells notice from the SEC threatening to sue us because they believe NFTs on our platform are securities.

— Devin Finzer (dfinzer.eth) (@dfinzer) August 28, 2024

We're shocked the SEC would make such a sweeping move against creators and artists. But we're ready to stand up and fight.

Cryptocurrencies have long…

Chart of the day

Helium (HNT), the Hotspot Network Token, is in an upward trend as seen in the HNT/USDT daily chart. HNT is likely to extend gains by 8.16% to the target of $7.9994.

The Relative Strength Index (RSI) reads 60.35. While RSI is above 50 (neutral), it is below 70, so the coin is not yet at overbought levels, giving it further chances to advance. Traders need to watch RSI closely, as once it crosses into the overbought zone, it could generate a sell signal.

HNT/USDT daily chart

In case of a decline, HNT could find support at $6.9595, the 50% Fibonacci retracement of the decline from the February 15 top of $11.0689 to the June 18 low of $2.8500.

Market updates

- The Paris Judicial Court formally charged Telegram founder Pavel Durov with six crimes, including assisting in the operation of online platforms to organize illegal transactions, refusing to provide required information to the authorities, assisting in multiple crimes, money laundering, failure to declare encryption services as required, and providing encryption tools without declaration, per a Bloomberg report.

- CoinGecko report shows that the PolitiFi category of coins gained 782.4% year-to-date, outperforming meme coins, which rallied 90% in the same time frame.

Our study shows that the PolitiFi coins category rose by 782.4% from January 1 to August 25, 2024, outperforming the broader meme coins category, which rose by 90.2% in the same period.

— CoinGecko (@coingecko) August 29, 2024

Read the full study: https://t.co/Ow19XmKfVi pic.twitter.com/umFVMxcpsR

- Stacks Network activated its Nakamoto upgrade on August 28. This reduces transaction processing time on the blockchain, down from 10 to 30 minutes to five seconds.

Industry updates

- Analysts at Bitcoin Magazine Pro evaluate whether the declining strength of the US Dollar could catalyze gains in BTC.

US Dollar strength has begun to plummet!

— Bitcoin Magazine Pro (@BitcoinMagPro) August 29, 2024

As #bitcoin and the USD have historically been inversely correlated (BTC increases as USD decreases), could this drop be the catalyst to rapidly increase the $BTC price?

Let me know! ⏬ pic.twitter.com/WR78IEpFqz

- Crypto ATMs have been banned in the UK since 2022. Kent Police charged a suspect operating an illegal crypto ATM at his mobile phone establishment. The man, Habibur Rahman, was arrested and charged with operating a crypto ATM without FCA registration.

- El Salvador President Nayib Bukele told TIME Magazine in an interview that the country has $400 million in Bitcoin.However, the adoption of BTC among the population is not as successful as expected, he said.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.