Crypto Today: Ethereum Spot ETFs debut on Nasdaq, NYSE Arca and CBOE, Bitcoin and XRP hold steady

- Ethereum Spot ETFs approved by US SEC are live on stock exchanges Nasdaq, NYSE Arca and CBOE.

- Bitcoin and XRP held steady above key support levels, as traders are optimistic with ETF launch.

- Ethereum hovers around $3,500 early on Tuesday.

Bitcoin, Ethereum, XRP updates

- Bitcoin trades around $66,500, early on Tuesday as sentiment among traders shifts from fear to greed. The index reads 71, signaling traders are “greedy” and the sentiment is bullish as BTC sustains above key support at $65,000. Mt.Gox transfers $2.85 billion in Bitcoin, what to expect from BRC-20, cat-themed meme coins

- Ethereum is hovering around key support at $3,500 early on Tuesday. The asset’s Spot Exchange Traded Funds (ETFs) kicked off trading at US-based crypto exchanges. The sentiment among Ether traders is positive, per cryptoeq.io data. This week could be explosive for ETH: Ethereum ETFs to debut in the US on Tuesday

- XRP remains relevant among market participants as traders discuss the likelihood of settlement in Securities & Exchange Commission’s (SEC) lawsuit. Ripple stablecoin unlikely to invite legal trouble from SEC, says Ripple executive

Chart of the day

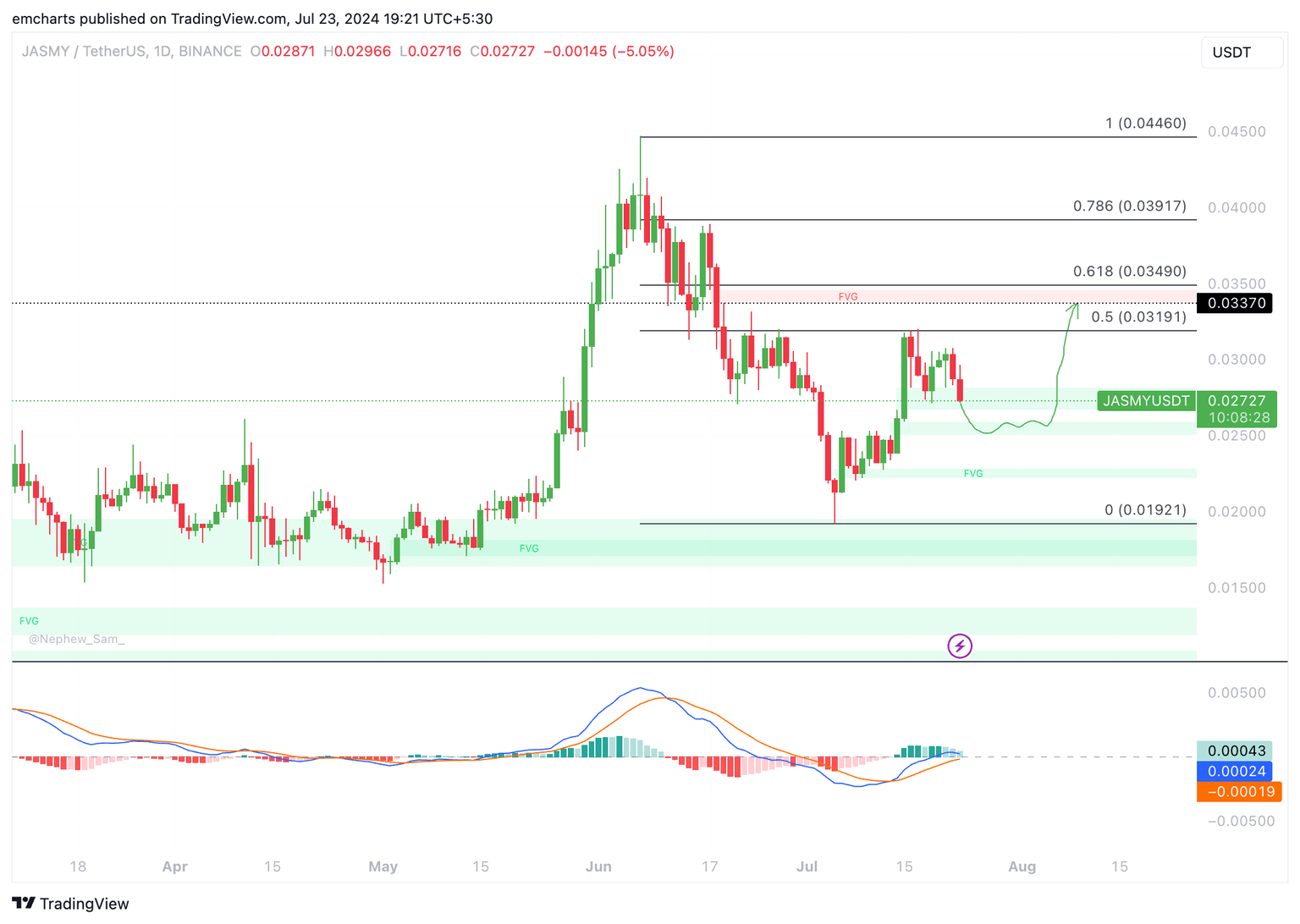

JASMY/USDT daily chart

JasmyCoin (JASMY) could extend its decline by another 8% and collect liquidity at the Fair Value Gap (FVG) shown in the JASMY/USDT daily chart. The momentum indicator shows waning positive momentum in JASMY’s price trend.

Once JASMY collects liquidity at the FVG, the asset could resume its climb to the June 19 high of $0.03370, as seen in the chart above. A rally to this level represents nearly 25% increase in the asset’s price.

Market updates

- Ronin network, the creators of blockchain game Axie Infinity, hit a key milestone with highest ever daily active addresses, over 1.8 million, on July 23.

This chart is a movie.

— Jihoz.ron (@Jihoz_Axie) July 23, 2024

Congratulations @Ronin_Network on hitting your HIGHEST ever daily active on-chain addresses! pic.twitter.com/Itqm4RjDm0

- Spot Ethereum ETFs record $112 million in trade volume within first fifteen minutes of going live, per Bloomberg ETF analyst’s tweet on X.

Here's volume after first 15 minutes of trading. Total of $112m traded for the group (which is A TON vs a normal ETF launch but only about half of what bitcoin ETFs' volume pace was on DAY ONE, altho 50% would exceed expectations IMO). Also Bitwise outperforming early. pic.twitter.com/RoN9J1VoP1

— Eric Balchunas (@EricBalchunas) July 23, 2024

- A tokenized asset manager Superstate debuted a tokenized “carry trade” fund that provides yields by buying spot and shorting Bitcoin and Ethereum futures.

Industry updates

- The Bitcoin Magazine noted that the Stock-to-Flow metric states that BTC fair valuation is over $400,000.

The #Bitcoin Stock-To-Flow metric is now giving a bitcoin fair valuation of over $400,000 in less than a year!

— Bitcoin Magazine Pro (@BitcoinMagPro) July 23, 2024

One of the more controversial forecasting models for bitcoin, let's discuss whether we should still use this chart, or if $BTC has broken this model...

Full video pic.twitter.com/mfZRamAIIz

- Crypto analyst predicts new all-time high in Ethereum based on the ETF trading numbers.

The $ETH ETF has insane numbers.

— Michaël van de Poppe (@CryptoMichNL) July 23, 2024

First 15 minutes already 50% of #Bitcoin's first day in terms of volume: $112 million.

The Ethereum ETF launch is heavily undervalued and I expect it to trade towards an ATH in the coming 1-2 months.

- The Graph protocol notes a surge in demand based on “queries” for the project on Messari, up 84% QoQ.

In Q2'24, demand for data on @graphprotocol grew 84% QoQ. This surge drove demand revenue to $113,000, up 160% QoQ.@semioticlabs introduced AI-based services utilizing The Graph's data & infra.

— Messari (@MessariCrypto) July 23, 2024

Read the full analysis by @tech_metrics:https://t.co/YqCb9VTfv1 pic.twitter.com/UlFzqYrOWU

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.