Crypto Today: ETH, SOL, DOGE short traders lead $150M liquidations as BTC price retakes $84K

- Crypto market capitalization surges 2.2% in the last 24 hours to hit $2.83 trillion on Tuesday.

- Bitcoin price led the market rebound, rising as high as $84,500 amid news of fresh BTC purchase from several corporate firms.

- Crypto market liquidations hit $225 million on Tuesday with $115 million short contracts accounting for the majority of the day’s losses.

The cryptocurrency sector has added $54 billion in the last 24 hours as buyers stepped in across global financial markets to halt the sell-off on Monday. At press time, standout catalysts for the rebound include recent Bitcoin (BTC) purchase announcements from several US-based firms and the Congress stablecoin legislation review starting on Wednesday.

Bitcoin market updates:

- Bitcoin price opened trading at $82,500 on Tuesday before rising 2% to reclaim the $84,400 level.

- Microstrategy, Tether and Japan-based Metaplanet all announced fresh BTC purchases in the last 24 hours.

Chart of the day: Blackrock’s IBIT ETF investors post $15M BTC inflows after Larry Fink’s latest statements

Bitcoin ETFs recorded aggregate net outflows of $60.6 million on Monday, positing successive losing days for the first time since March 14, according to the latest data from the analytics platform Farside.

Bitcoin ETF Flows | March 31, 2025 | Source: Farside

A closer look at the transaction stats shows that Blackrock’s IBIT ETFs stood out of the pack, posting $15 million inflows.

This comes as BlackRock CEO Larry Fink's annual letter to shareholders grabbed headlines, hinting that Bitcoin could replace the US Dollar as the world’s global reserve currency as US national debt mounts.

Altcoin market updates: SOL, ETH, XRP short traders lead $150M short liquidations

The top 25 ranked crypto assets have posted gains in the past 24 hours, with over-leveraged short traders taking heavy losses as the market rally intensifies.

According to CoinGecko data, the broader market has gained 2.2%, with every top-25 asset trading in profit.

Ethereum (ETH), Solana (SOL), and XRP have each climbed 2%, while Dogecoin (DOGE), Chainlink (LINK), and Cardano (ADA) lead with 4% gains at press time.

Despite these impressive moves, the relatively modest increase in total market cap suggests a shift in capital allocation.

Traders appear to be rotating funds from smaller-cap assets into large-cap altcoins. If market cap growth fails to hold above 2%, these leading assets may struggle to maintain their gains throughout the trading session.

Meanwhile, in the derivatives market, bulls continue to dominate, forcing a wave of short liquidations.

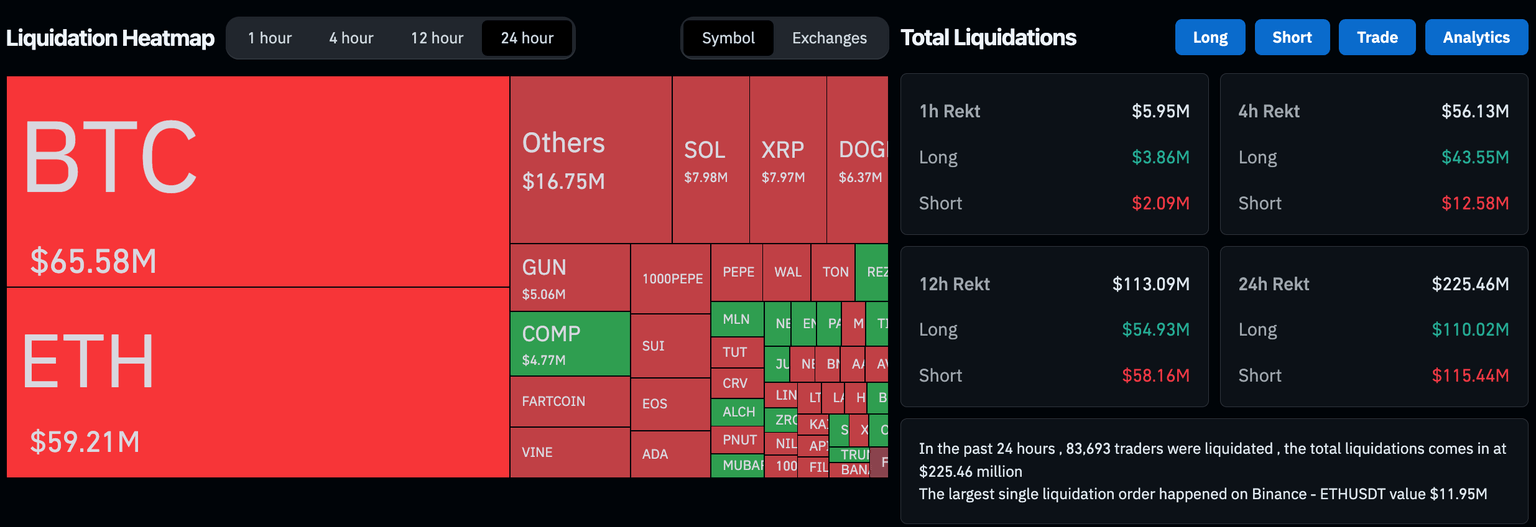

Over the past 24 hours, Bitcoin traders have lost $65.58 million, while Ethereum (ETH) shorts saw $59.21 million in liquidations. XRP and Dogecoin (DOGE) short sellers suffered major losses, exceeding $5 million respectively.

With short traders accounting for $115 million of the $225 million total liquidations on Tuesday, it suggests traders currently betting against the rally are being squeezed out as momentum shifts in favor of the bulls.

Crypto news updates:

Brian Armstrong pushes for US stablecoin regulation changes to allow interest payments

Coinbase CEO Brian Armstrong has called on US lawmakers to revise regulations preventing stablecoin holders from earning interest on their deposits. He argues that the interest generated from reserve assets backing stablecoins should be passed on to users, similar to how banks offer interest on checking accounts.

However, current US regulations prohibit this practice, limiting the potential benefits for stablecoin holders.

Bybit to shutter NFT and IDO services on April 8

Bybit Web3 will shut down its NFT Marketplace, Inscription Marketplace, and IDO product pages on April 8. Users must manage their assets before the deadline, with alternative NFT trading platforms, including OpenSea, Blur, and Magic Eden on Ethereum, as well as Element Marketplace and Mintle on Mantle. According to the announcement, IDO participants should transfer airdropped tokens to Bybit Web3 wallets secured with seed phrases or private keys.

Author

Ibrahim Ajibade

FXStreet

Ibrahim Ajibade is an accomplished Crypto markets Reporter who began his career in commercial banking. He holds a BSc, Economics, from University of Ibadan.