Crypto Today: BTC nears $90K, TRON on the rise, ETH fails $3,500 test, Canary Capital files for HBAR ETF

Crypto market analysis today

- The global cryptocurrency market cap shrank by $9.9 billion on Tuesday, November 12, as traders moved to take profits after a seven-day rally.

- In the derivatives market, $980 million crypto futures contracts were liquidated with bulls booking 60% of the daily time frame losses.

- According to Coinglass data, the largest single-order liquidation happened on Binance, as a whale trader lost $15.70 million on the BTC/USDT trading pair.

Bitcoin price action today

- Bitcoin price registered a new all-time high for the sixth consecutive day as it topped out at $89,940 on November 12.

- Amid a brief market correction and cascading liquidations, BTC managed to hold firmly above $85,000 on Tuesday, riding on bullish support from strong ETF demand and Microstrategy’s latest $2 billion purchase announcement.

As the US market opened, Bitcoin price has started to show signs of continuing the bullish momentum. The BTC/USD chart shows that after testing the $85,000 support, BTC has now reclaimed the $88,600 resistance.

More so, BTC is now trading above its Volume Weighted Average Price (VWAP) at $87,894, signaling that the majority of active buyers are willing to pay higher prices rather than wait to execute their orders at market clearing prices.

If BTC closes above the VWAP, traders can anticipate an imminent breakout above $90,000 in the days ahead .

Altcoin market updates: Ethereum wobbles, while TRON, Solana lead market resurgence

- Ethereum price tumbled 4.5% from $3,443 to a daily low of $3,213 on Tuesday.

- Unlike Bitcoin, which made a sharp rebound, Ethereum price is struggling to regain bullish momentum as it remains nestled below the $3,250 resistance at the time of publication.

- Meanwhile, Ethereum ETFs posted record daily net inflows of $295.5 million on Monday, November 11, offering bulls a lifeline if Tuesday inflows also turn out positive.

- Solana price survived a major correction scare on Tuesday, rebounding from $205 to reclaim the $210 level after the US markets opened.

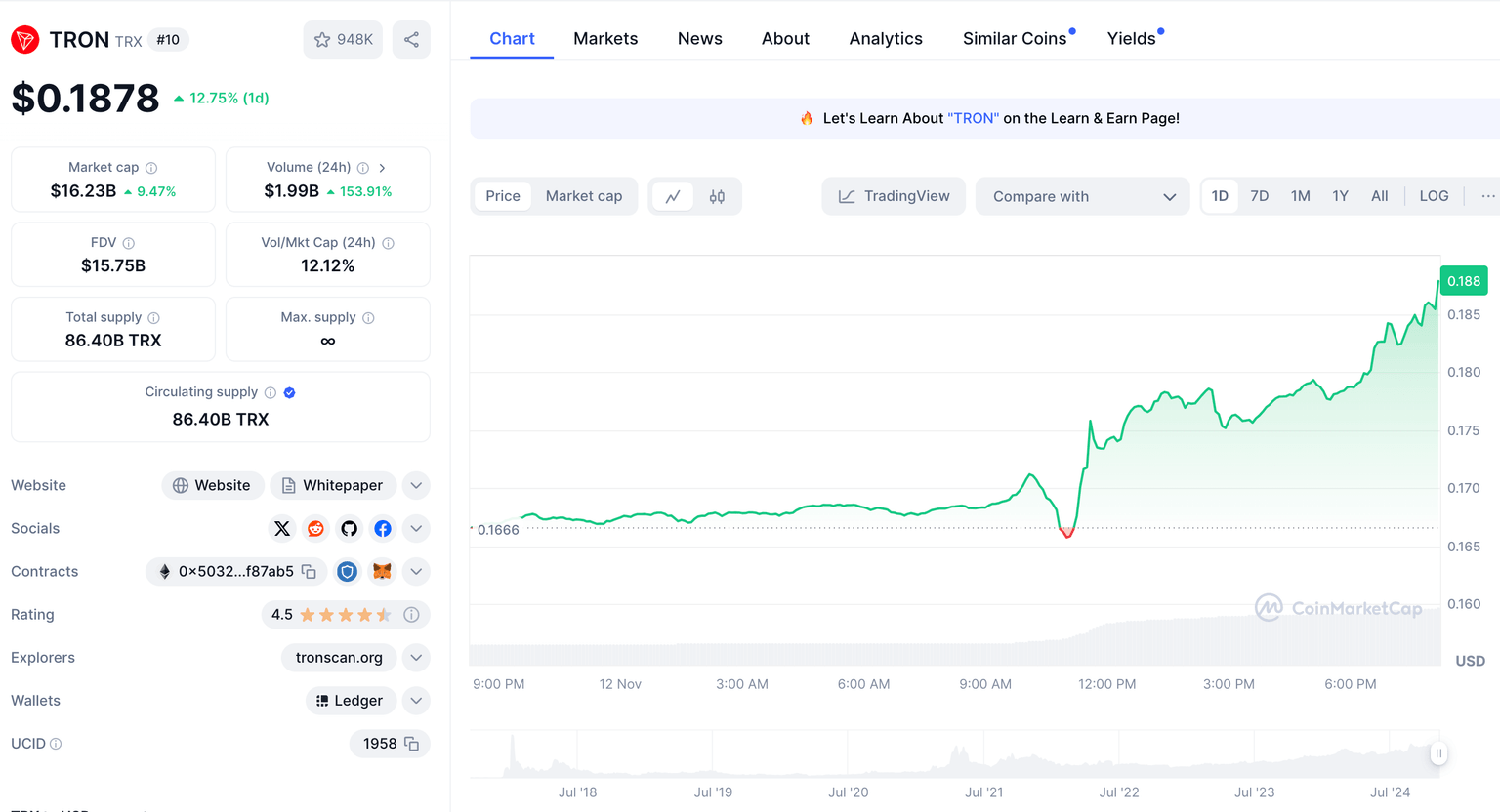

- With 12.75% daily gains, TRON (TRX) emerged as the second-best performing asset among the top ten ranked digital assets behind Dogecoin (DOGE).

Tron (TRX) price action, November 12, 2024 | Source: CoinmarketCap

In recent years, Tron’s TRC-20 token standard has become one of the most popular networks for stablecoin transfers. Hence, the TRX rally appears to be buoyed by heightened stablecoin transactions as fresh capital inflows continue to trickle into the cryptocurrency sector.

Chart of the day: Polymarket bettors price in 62% odds of BTC crossing $100K in 2024

Amid the Trump administration’s plans to select pro-crypto cabinet members for key regulatory positions, Polymarket bettors have priced in a 62% chance for Bitcoin to reach $100,000 before the end of 2024.

Bitcoin price predictions markets, November 12, 2024 | Source: Polymarkets

Total bets placed on Bitcoin price predictions have surpassed $3.14 million. Odds for Bitcoin hitting the $100,000 mark have surged from 12% at the start of November to 62% as of press time.

Crypto news updates today

- The German government has effectively missed out on gains in excess of $1.6 billion by selling off its seized stash of 50,000 BTC four months ago.

In July 2024, the German authorities sold off 50,000 Bitcoin for $2.88 billion. It was BTC confiscated from the film piracy website Movie2K.

The sale was executed at the average price of $57,600. With Bitcoin now trading close to $90,000, the stash could now be worth 56% more at $4.5 billion, reflecting missed net-gains of $1.6 billion.

- US-based asset management firm Canary Capital announced an Hedera (HBAR) ETF filing with the SEC, seeking to provide direct spot exposure for its teeming investors.

Canary Capital’s HBAR ETF filing comes just weeks after the firm filed Litecoin and XRP derivatives applications with the US Securities & Exchange Commission (SEC).

Hedera price surged 22% as Canary Capital files HBAR ETF application | November 12, 2024 | Source: CoinmarketCap

Following the news, HBAR price rose 22% within the daily time frame, reaching a three-month peak of $0.07. While all ETF filings outside of BTC and ETH remain in limbo, Trump’s win has triggered widespread expectations of new crypto ETF approvals in 2025.

Author

Ibrahim Ajibade

FXStreet

Ibrahim Ajibade is an accomplished Crypto markets Reporter who began his career in commercial banking. He holds a BSc, Economics, from University of Ibadan.