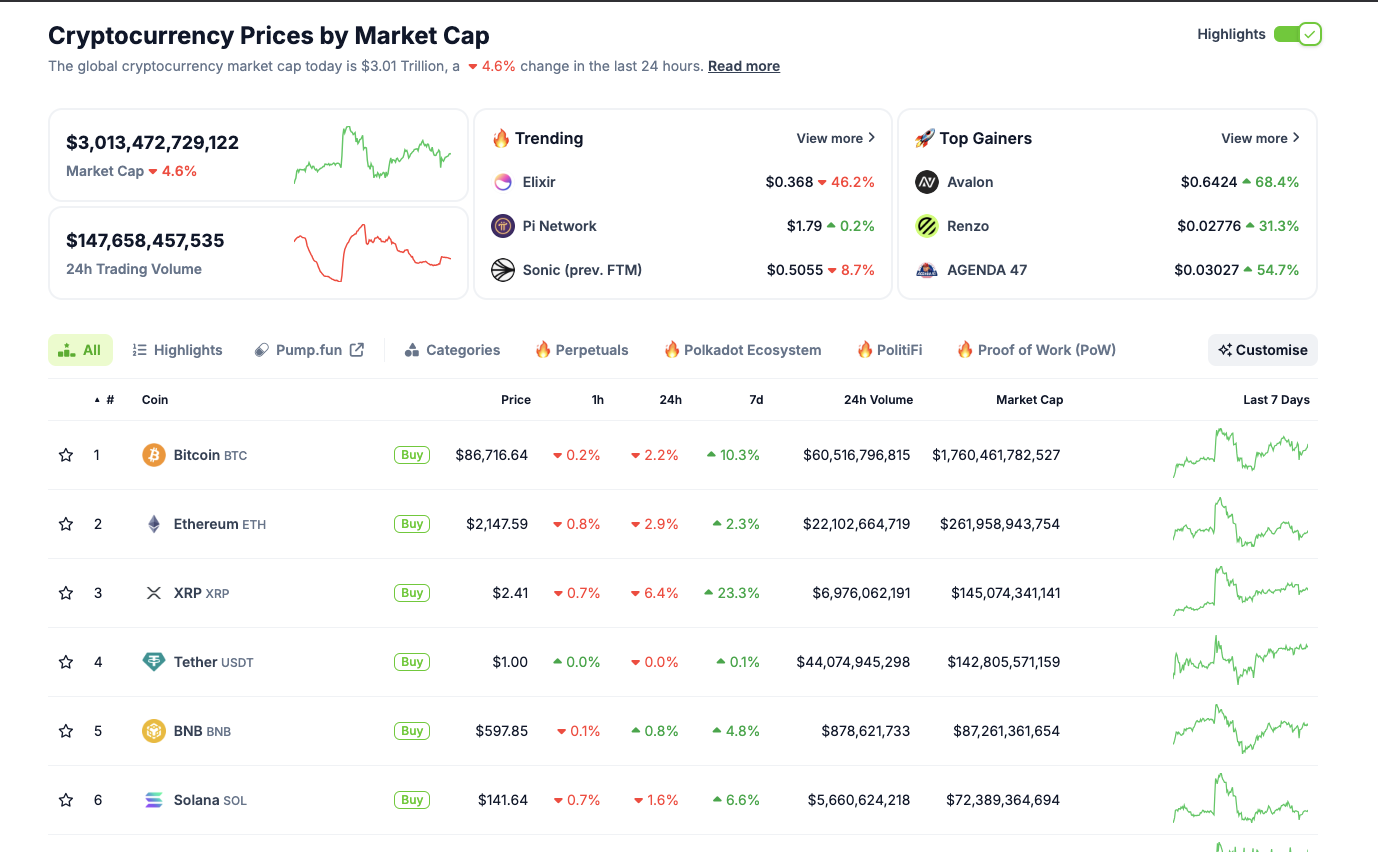

- Cryptocurrency markets dipped $17.4 billion to hit $2.87 trillion on Friday, as losses shrank to their lowest this week.

- XRP price reclaimed the $2.50 level after reports confirmed Ripple CEO Brad Garlinghouse’s attendance at the White House Summit.

- Bitcoin price rose as high as $91,200 after Trump announced a new strategic Bitcoin reserve policy.

- Derivative markets sentiment leans bearish, with $382 million long positions liquidated accounting for 73% of total losses on the day.

Bitcoin market updates:

Bitcoin price is experiencing volatile price action on Friday, bouncing within a 10% range from lows of $84,600 to $91,280 on the daily candle. United States (US) President Donald Trump's announcement of a bitcoin strategic reserve failed to lift the market following the caveat that the reserve will be funded by BTC seized in legal settlements and forfeitures.

- Bitcoin ETFs flooded another $134 million in total outflows on Thursday, contributing to BTC price struggling to breach the $92,000 resistance.

Blackrock (IBIT) BTC ETF Flows, March 7 | Source: Sosovalue

Blackrock’s IBIT ETF swung back into sell-off mode with $50 million outflows on Thursday. After the $38 million inflows on Tuesday had halted a seven-day selling frenzy.

Altcoin market updates: XRP, Cardano and Solana hold key support levels amid White House Summit

The crypto market declined by 4.8%, reflecting $150 billion outflows on Friday. The latest sell-off was largely driven by the negative reaction to hawkish readings in the US Nonarm Payrolls reports published on the day.

Crypto market performance | March 5 | Coingecko

Rather than a full-blow exit from the markets, the performance overview shows that investors are reluctant to exit top altcoins like Cardano, Ripple (XRP) and Solana (SOL) as prices approach key support levels.

The White House Crypto Summit is expected to be centered around improved regulatory clarity for the cryptocurrency sector; many anticipate major gains for tokens within the crypto strategic reserve bucket.

- Ethereum price tumbled as low as $2,100 following the US NFP data before bulls made frantic efforts to retake $2,140 at press time.

- Ripple (XRP) price continues to hold above the $2.40 mark amid optimism surrounding Ripple’s CEO appearance at the White House Crypto Summit.

- Cardano (ADA) price also clawed back significant losses in the last 24 hours, trading above the $0.80 mark at the time of writing.

- Solana (SOL) price is also consolidating above the $142 mark as traders take on a sit-and-watch approach in anticipation of fresh policy updates from the Trump administration's meeting with top crypto industry stakeholders.

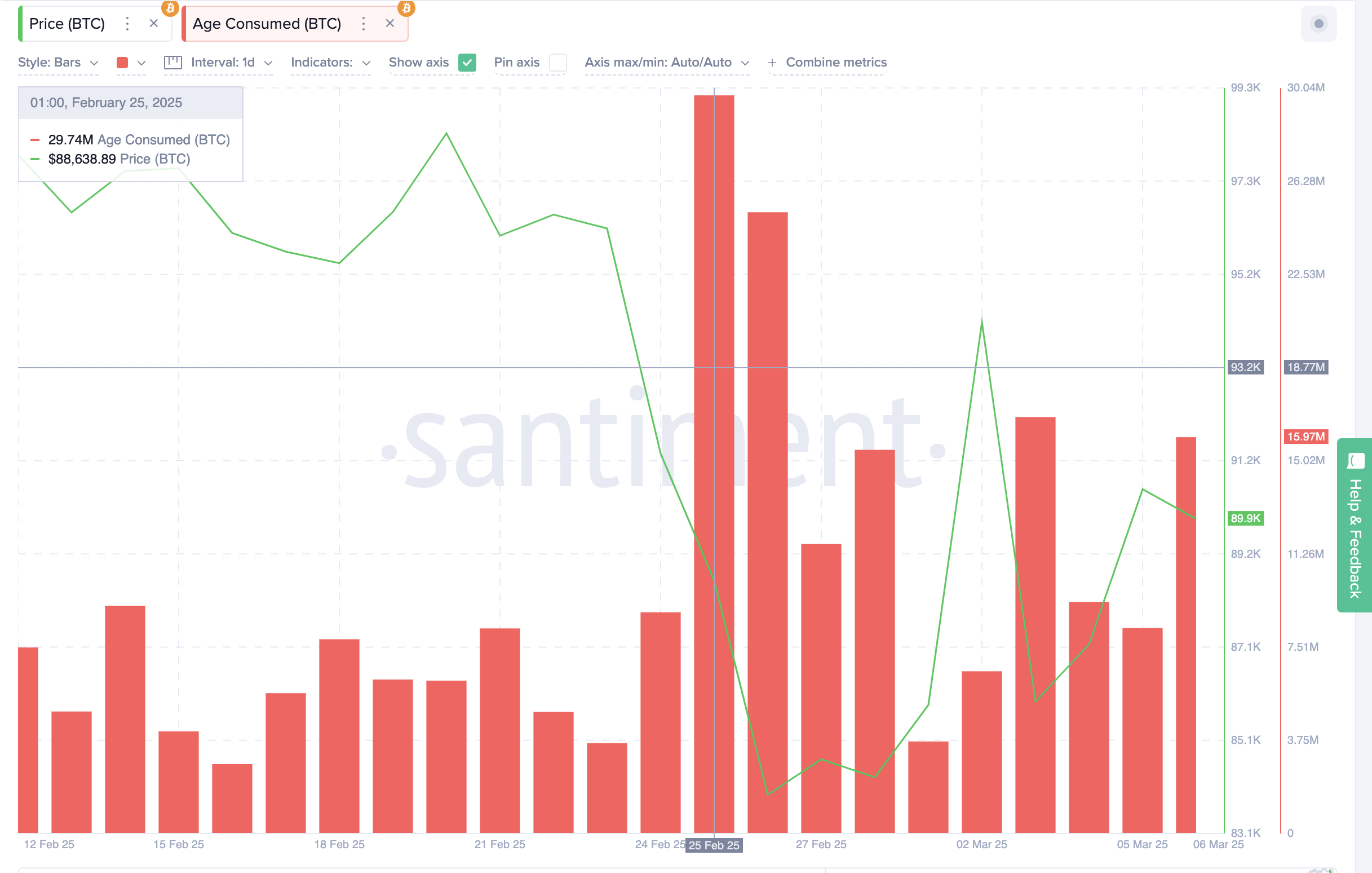

Chart of the day: Trump’s latest policies unsettled Bitcoin long-term holders

Bitcoin long-term holders appear rattled amid conflicting market signals from President Donald Trump’s recent policy updates.

On Thursday, Trump’s crypto czar David Sack confirmed an executive order mandating that expropriated BTC be added to the national strategic reserve.

Despite this positive policy announcement, Bitcoin price dipped 5%, falling below $85,000 on Friday, as concerns over hawkish readings in the US Nonarm Payrolls (NFP) report amid inflationary risks stemming from recent trade tariffs.

The market reaction suggests that macroeconomic uncertainty is outweighing optimism around Trump’s pro-crypto agenda.

Validating this stance, Bitcoin’s recent downturn coincides with significant selling pressure from long-term investors.

Santiment’s Age Consumed metric, which measures the total number of coins moved multiplied by their dormancy period, has recorded persistent spikes since Trump confirmed tariffs on February 25.

Bitcoin Age Consumed vs. BTC Price | Source: Santiment

As seen in the chart above, the Bitcoin Age Consumed surged to 29.4 million when the tariffs were first announced and has remained elevated.

On Friday, as the US Bureau of Labor Statistics released the latest NFP report, Age Consumed spiked again to 15.9 billion, marking a 450% increase from the 2.8 million recorded on February 6.

When long-held BTC floods the market, it increases short-term supply and heightens downside risk.

This explains why Bitcoin has struggled to reclaim $92,000, despite Trump’s strategic reserve announcement boosting long-term sentiment.

Going by the current market dynamics, until macroeconomic fears subside, BTC traders may continue to prioritize booking short-term gains at intervals, over holding for prolonged runs.

Crypto news updates:

-

Senator Elizabeth Warren demands public disclosures from David Sacks amid crypto policy development

Senator Elizabeth Warren has urged David Sacks, President Trump’s newly appointed crypto policy chief, to publicly disclose his financial filings to address potential conflicts of interest.

Warren’s request follows Trump’s executive order to establish a US Strategic Bitcoin Reserve and introduce new crypto regulations, raising concerns about potential market manipulation and regulatory leniency.

Sacks denied holding significant indirect crypto assets and stated that he had liquidated all his cryptocurrency investments before assuming office.

He emphasized his commitment to transparency, adding that his financial disclosures are currently under official ethics review.

Warren’s demand signals increasing scrutiny over the administration’s crypto policies as regulatory oversight debates continue in Washington.

-

Nasdaq plans to launch 24-hour stock trading in 2026

Nasdaq has announced plans to introduce 24-hour trading on its equities exchange by the second half of 2026, pending regulatory approval.

The initiative aims to meet increasing global demand for US stocks and align with similar efforts by exchanges such as Cboe and the New York Stock Exchange.

If approved, Nasdaq’s move would mark a significant shift in market structure, allowing investors to trade continuously across different time zones.

While the proposal has raised concerns over potential volatility and higher transaction costs, Nasdaq has stated that it will work closely with industry participants to mitigate risks. The exchange plans to implement measures to ensure liquidity and maintain investor confidence in extended trading hours.

The shift follows a broader trend toward round-the-clock access in financial markets, reflecting changing investor behavior and advancements in trading technology.

Coinbase executive says Trump’s Bitcoin reserve could ease $18 billion in sell pressure

In a recent post on X, Coinbase executive Conor Grogan stated that President Donald Trump’s newly signed executive order to establish a Strategic Bitcoin Reserve could reduce approximately $18 billion in potential market sell pressure.

Coinbase Exec Conor Grogan on market impact of Trump's Bitcoin strategic resever | Source: X.com

The initiative aims to retain Bitcoin previously seized by the US government, preventing it from being liquidated in public auctions.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin holds $84,000 despite Fed’s hawkish remarks and spot ETFs outflows

Bitcoin is stabilizing around $84,000 at the time of writing on Thursday after facing multiple rejections around the 200-day EMA at $85,000 since Saturday. Despite risk-off sentiment due to the hawkish remarks by the US Fed on Wednesday, BTC remains relatively stable.

Crypto market cap fell more than 18% in Q1, wiping out $633.5 billion after Trump’s inauguration top

CoinGecko’s Q1 Crypto Industry Report highlights that the total crypto market capitalization fell by 18.6% in the first quarter, wiping out $633.5 billion after topping on January 18, just a couple of days ahead of US President Donald Trump’s inauguration.

Top meme coin gainers FARTCOIN, AIDOGE, and MEW as Trump coins litmus test US SEC ethics

Cryptocurrencies have been moving in lockstep since Monday, largely reflecting sentiment across global markets as United States (US) President Donald Trump's tariffs and trade wars take on new shapes and forms each passing day.

XRP buoyant above $2 as court grants Ripple breathing space in SEC lawsuit

A US appellate court temporarily paused the SEC-Ripple case for 60 days, holding the appeal in abeyance. The SEC is expected to file a status report by June 15, signaling a potential end to the four-year legal battle.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.