- Bitcoin ETF IBIT’s investors held steady even as the investment product suffered a steep correction over the last days.

- XRP made a comeback above $0.50, a key psychological level for the altcoin.

- Ronin Network bridge that secures $850 million is paused for investigation of a potential 4,000 Ether MEV exploit reported by white hat hackers.

Bitcoin, Ethereum, XRP updates

- Bitcoin rallied past $55,000 after a temporary decline under the $50,000 level on Monday. XRP made a comeback above $0.50 on Tuesday, and most cryptocurrencies ranked in the top 30 by market capitalization recovered from the corrections.

- Ethereum hovers around the $2,500 level, a key support for the altcoin. Vitalik Buterin, Ethereum co-founder, commented on cross-chain Layer 2 interoperability problems and how the user experience across the entire Ether ecosystem has emerged smoother, including Layer 1 chains, rollups, validiums and sidechains.

I think people will be surprised by how quickly "cross-L2 interoperability problems" stop being problems and we get a smooth user experience across the entire ethereum-verse (incl L1, rollups, validiums, even sidechains). I'm seeing lots of energy and will to make this happen.

— vitalik.eth (@VitalikButerin) August 5, 2024

- Ripple lawsuit is the top market mover for XRP. Traders keep eyes peeled for final ruling in Securities & Exchange Commission (SEC) lawsuit. XRP makes a comeback above $0.50 early on Tuesday.

Chart of the day

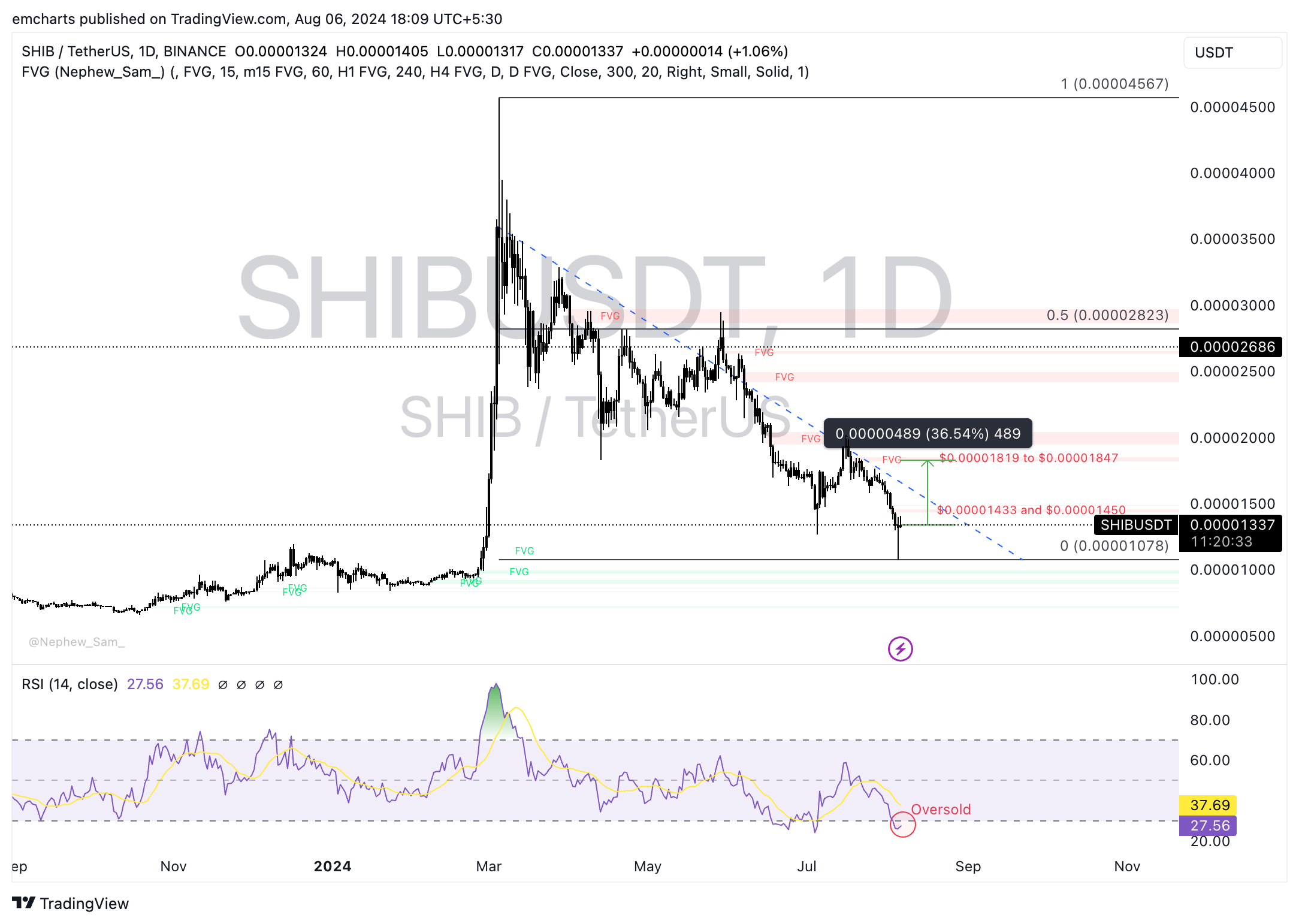

SHIB/USDT daily chart

Shiba Inu (SHIB) is currently in a downward trend that started on March 5, 2024, at its local top of $0.00004567. SHIB is in the “oversold” zone, per the momentum indicator Relative Strength Index (RSI), which reads 27.79. RSI generates a buy signal for the asset. Sidelined traders could buy SHIB while the asset is in this zone.

SHIB is likely to extend gains by over 35% and target the Fair Value Gap (FVG) between $0.00001819 and $0.00001847 as seen in the SHIB/USDT daily chart. SHIB could find support at the August 5 low of $0.00001078.

Market updates

- US financial regulator, the SEC, pushes back against Coinbase’s subpoena requests and labels them as “blatant impropriety.”

- Concentrated liquidity pools of Uni3-style could not keep up with the losses, while automated market maker Curve’s liquidity in crypto pools was automatically managed.

Missed this yesterday. It appears, that Uni3-style concentrated liquidity could not keep up with markets (moving it makes "impermanent loss" permanent), while Curve liquidity in crypto pools is automatically managed.

— Curve Finance (@CurveFinance) August 6, 2024

So while Curve is an AMM, Uni3 is closer to orderbooks pic.twitter.com/5LZ5HaOie4

- Vitalik Buterin of Ethereum praises Arbitrum and Optimism for being the first full-EVM rollups to reach stage 1 of scaling the chain.

@Arbitrum and @Optimism continue to deserve praise for being the first full-EVM rollups to reach stage 1. Looking forward to seeing the first ZK-EVM rollup join them soon! pic.twitter.com/yyiWh6RKNp

— vitalik.eth (@VitalikButerin) August 6, 2024

- Eric Balchunas of Bloomberg noted how BlackRock Bitcoin ETF (IBIT)’s investors did not pull out capital despite the steep correction in Bitcoin.

So $IBIT investors woke up on Monday to a -14% move over wknd after stomaching an 8% decline the week prior and what did they do? ABSOLUTELY NOTHING. $0 flows. Compared to some of these degens these boomers are like the Rock of Gibraltar. You guys are so lucky to have them. pic.twitter.com/Qqg9Y2E40k

— Eric Balchunas (@EricBalchunas) August 6, 2024

Industry updates

- Kiln, a protocol staking platform launched a DeFi service for stablecoin rewards, Kiln DeFi. Traders can re-stake their Ether and digital assets to generate an additional yield.

We’re excited to announce the launch of @eigenlayer native restaking for @cryptocom users, powered by Kiln!

— Kiln (@Kiln_finance) July 25, 2024

Eligible @cryptocom users can now restake ETH and earn Eigen Points.

Reach out to us if you want to offer restaking: https://t.co/gLsWe2EKA3 pic.twitter.com/LIUJemKXjZ

- South Korean crypto market maker is set to face a $59.6 million “Scam Coin” case, per a report from local news imaeil.com.

- Ripple calls security researchers to help identify potential vulnerabilities in the blockchain codebase and earn rewards through the RippleX Bug Bounty Program.

️Calling all security researchers ️

— RippleX (@RippleXDev) August 6, 2024

Help keep the #XRPLedger safe, secure and reliable by identifying potential vulnerabilities in the blockchain codebase, and earn rewards for your efforts through the RippleX Bug Bounty Program.https://t.co/02lgnOoM0u

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Crypto fraud soars as high-risk addresses on Ethereum, TRON networks receive $278 billion

The cryptocurrency industry is growing across multiple facets, including tokenized real-world assets, futures and spot ETFs, stablecoins, Artificial Intelligence (AI), and its convergence with blockchain technology, as well as the dynamic decentralized finance (DeFi) sector.

Bitcoin eyes $100,000 amid Arizona Reserve plans, corporate demand, ETF inflows

Bitcoin price is stabilizing around $95,000 at the time of writing on Tuesday, and a breakout suggests a rally toward $100,000. The institutional and corporate demand supports a bullish thesis, as US spot ETFs recorded an inflow of $591.29 million on Monday, continuing the trend since April 17.

Meme coins to watch as Bitcoin price steadies

Bitcoin price hovers around $95,000, supported by continued spot BTC ETFs’ inflows. Trump Official is a key meme coin to watch ahead of a stakeholder dinner to be attended by President Donald Trump. Dogwifhat price is up 47% in April and looks set to post its first positive monthly returns this year.

Cardano Lace Wallet integrates Bitcoin, boosting cross-chain capabilities

Cardano co-founder Charles Hoskinson announced Monday that Bitcoin is integrated into the Lace Wallet, expanding Cardano’s ecosystem and cross-chain capabilities. This integration enables users to manage BTC alongside Cardano assets, providing support for multichain functionality.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.