Crypto Today: Bitcoin worth $16 million from Satoshi’s time are on the move, Ethereum up 3%, XRP dips slightly

- Bitcoin worth more than $16 million mined in 2009 were transferred on Friday.

- Ethereum gains over 3% as spot Ethereum ETFs end a three-day streak of outflows with $5.2 million in inflows on Thursday.

- XRP declines slightly as Ripple holders await the Securities & Exchange Commission’s next steps in the ongoing legal battle.

Bitcoin, Ethereum, XRP updates

- Bitcoin trades above $63,400 early on Friday. The largest crypto asset by market capitalization notes activity from Bitcoin wallets holding BTC that was mined in 2009. On-chain data intelligence firms identified several miners from the Satoshi-era (back when the creator of Bitcoin was active between 2009 and 2011), moving BTC held in their wallet addresses.

Please note that many miner wallets dormant for more than 15.5 years are transferring $BTC!

— Lookonchain (@lookonchain) September 20, 2024

5 miner wallets have transferred 250 $BTC($15.9M) in the past hour.

These wallets received 50 $BTC($3.18M) as mining rewards per block back in 2009.

Address:… pic.twitter.com/HktJivt7Qy

250 #Bitcoin worth $16 million has just been moved for the 1st time after mining them in Jan 2009

— Vivek⚡️ (@Vivek4real_) September 20, 2024

SATOSHI IS BACK??? pic.twitter.com/hptgCZH3Xw

- Movement of Bitcoin held by miners holds significance for traders as it could be a “profit-taking” move, influencing BTC price.

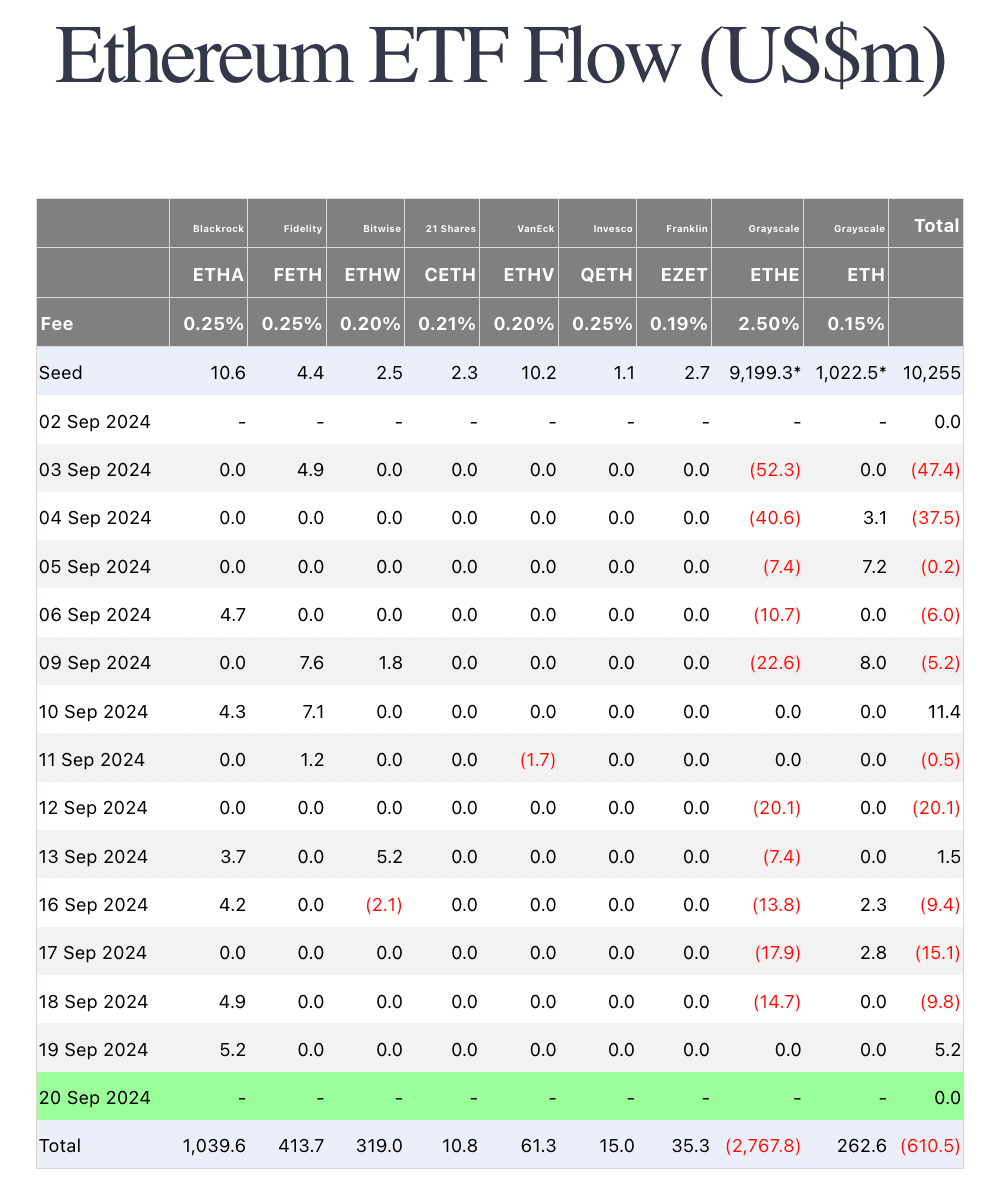

- Ethereum trades above key support at $2,500 on Friday, gains nearly 4%. The US-based spot Ethereum ETFs ended their three day negative streak and noted a $5.2 million inflow on Thursday, according to data from Farside Investors.

Ethereum ETF flows

- XRP dips 0.03%, down to $0.5869 at the time of writing. It remains to be seen whether the Securities & Exchange Commission appeals the final ruling in the lawsuit agains Ripple Labs.

Chart of the day: PUNDIX

Pundi X (PUNDIX) ranks among the most trending tokens on Binance. PUNDIX rallied 22% on Friday, touching a peak of $0.4925 before retreating toto $0.4644 at the time of writing.

PundiX unveiled Purse+, the first of its kind of Artificial Intelligence (AI) and social integration browser plugin for users. Enabling the extension qualifies users for ecosystem rewards.

PURSE+ is the first SocialFi and AI integration browser plugin on X.

— Pundi X Labs | Token2049 (@PundiXLabs) September 19, 2024

Participate in the tagging, labelling, and analysis of posts and receive rewards.

Ready to contribute to AI development? Get started now @Purse_Land @PundiAIFXpic.twitter.com/SyGnLfLGCn

The token could gain another 14.53% and hit the upper boundary of the Fair Value Gap (FVG) at $0.5331 – a key resistance level for PUNDIX – if the rally persists. On its path to $0.5331, the token could face resistance in two zones: between $0.5110 to $0.5331, and between $0.4944 to $0.4816.

The Moving Average Convergence Divergence (MACD) indicator shows green histogram bars above the neutral line, signaling underlying positive momentum in PUNDIX price trend.

PUNDIX/USDT daily chart

Looking down, the asset could find support at the September 18 low at $0.3633.

Market updates

- MicroStrategy announced the purchase of 7,420 Bitcoin for nearly $458.20 million. The firm acquired Bitcoin at an average price of $61,750.

MicroStrategy has acquired 7,420 BTC for ~$458.2 million at ~$61,750 per #bitcoin and has achieved BTC Yield of 5.1% QTD and 17.8% YTD. As of 9/19/2024, we hodl 252,220 $BTC acquired for ~$9.9 billion at ~$39,266 per bitcoin. $MSTR https://t.co/JUtgztpzBu

— Michael Saylor⚡️ (@saylor) September 20, 2024

- Germany shut down operations of 47 crypto exchanges hosted in the country, per information from a press release issued by the German government on September 19.

- These exchanges allegedly facilitated illegal money laundering activities for cybercriminals, the country’s law-enforcement agencies said.

- dYdX community votes to add SUNDOG, a Tron-based meme coin, to the exchange on Friday. Meme coins were one of the most profitable categories of tokens for traders in the first half of 2024.

Industry updates

- Ebi.xyz emerges as one of the fastest growing decentralized exchanges on the Arbitrum chain with over 145,000 new users registered in a week. This suggests rising adoption of DEXes among traders.

- Binance, one of the largest crypto exchanges, announced loanable assets at flexible rates.

New Loanable Assets Available on Binance Loans (Flexible Rate) and VIP Loan

— Binance (@binance) September 20, 2024

https://t.co/7OZSwTxk1u

- Around 97 million in USDT influx to centralized exchanges were attributed to Cumberland-related addresses. Cumberland is a professional crypto trading firm. Crypto intelligence tracker Solid Intel shares details of the on-chain transfers:

INTEL: A Cumberland-associated address received 97 million USDT from Tether in the last 20 minutes and began transferring them to centralized crypto exchanges pic.twitter.com/iWsDdUXRhU

— Solid Intel (@solidintel_x) September 20, 2024

Typically, an influx of stablecoin on exchanges represents demand for cryptocurrencies and could be accompanied by a rise in crypto prices.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.