Crypto Today: Bitcoin slips under $50,000, double-digit decline in top 30 cryptocurrencies

- Bitcoin and altcoins in the top 30 have suffered double-digit corrections in the past 24 hours.

- XRP suffers a nearly 15% drawdown on Monday, slips to support at $0.4459.

- Ethereum slips to $2,241, a new 2024 low for the second-largest cryptocurrency.

- Solana and Ethereum-based meme coins have suffered steep corrections per CoinGecko data.

Bitcoin, Ethereum, XRP updates

- Bitcoin holds steady above $50,000 after dipping under the psychological support level on Monday. Open interest in Bitcoin is down nearly 21%, with over $339 million in long positions liquidated in the past 24 hours.

Bitcoin derivatives data analysis

- Ethereum hovers around key support, down to $2,111. The second-largest cryptocurrency by market capitalization is struggling to sustain above the $2,000 level, an important support for the asset. Ether suffered a 17% drawdown on Monday.

- XRP slipped under $0.45 support, erasing nearly 15% value in one day, as traders lose interest in risk assets amidst global stock market meltdown.

Chart of the day

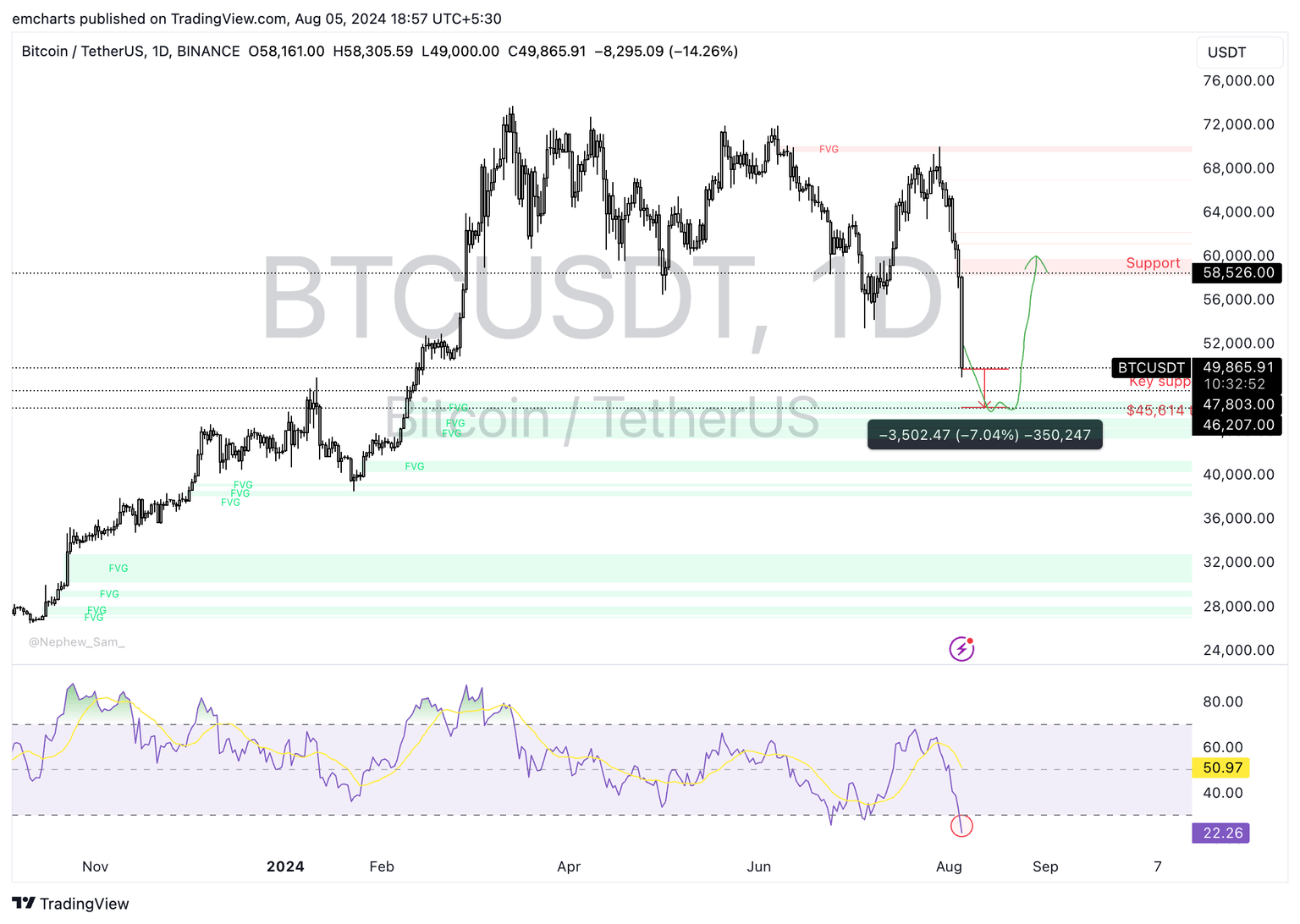

BTC/USDT daily chart

Bitcoin could extend losses by nearly 7%, down to support at $46,207 in the Fair Value Gap (FVG) between $45,614 and $46,800. As the gap is filled, Bitcoin could see recovery from the correction and target the $60,000 level for a comeback.

The momentum indicator, Relative Strength Index (RSI) reads 22.26, meaning that BTC is oversold and generating a buy signal.

Market updates

- Crypto market suffers over $1 billion in liquidation in a 24-hour timeframe, largest liquidation event in the past three years.

The biggest liquidation event in 3 years.

— Lark Davis (@TheCryptoLark) August 5, 2024

Holy smokes! https://t.co/UO2W5AMqPY

- Fear and Greed Index dropped to 26, signaling extreme fear among traders, as seen on alternative.me.

- Short-term holders lost over $850 million in the past day, realizing losses on their BTC holdings.

Industry updates

- Digital asset investment funds face their first outflow in four weeks at $528 million per CoinShares data.

- Vitalik Buterin, Ethereum co-founder, believes Artificial Intelligence (AI) could pose a threat to crypto, shares comments in recent post.

- The launch of spot Ethereum ETFs boosted crypto trading volumes in July, however most Layer 1 chains lost value, except for Solana. Data from TheBlock shows month-over-month trading volume on different chains.

The launch of spot Ethereum ETFs boosted trading volumes in July, but overall L1 valuations declined, except for a few like Solana. pic.twitter.com/qQBWSA7vb5

— The Block Pro (@TheBlockPro__) August 5, 2024

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.