Crypto today: Bitcoin price holds $82,000, TON and TRX post gains while XRP, SOL and ADA tumble

- Cryptocurrencies market capitalization dips 3% on Monday to reach $2.75 trillion.

- Bitcoin continues to find buyers at $82,000 as investors hedge against the impact of US President Trump’s tariffs.

- Investors are reducing exposure to XRP, SOL and ADA on concerns about Paul Atkins’ potential conflicts of interest.

- Toncoin price posted considerable gains over the weekend but now struggles at the $4 resistance.

In the cryptocurrency markets on Monday, Bitcoin holds $82K as investors hedge against Trump’s tariffs whole XRP, SOL, ADA slide further as Paul Atkins faces congress' scrutiny.

Bitcoin market updates:

- Bitcoin’s price has held firmly above $82,000 over the weekend as investors continue to hold BTC as a hedge against macro risks from President Donald Trump’s tariffs.

- US Congress’ scrutiny of Trump’s Securities and Exchange Commission (SEC) chair nominee placed additional bearish pressure on BTC price action.

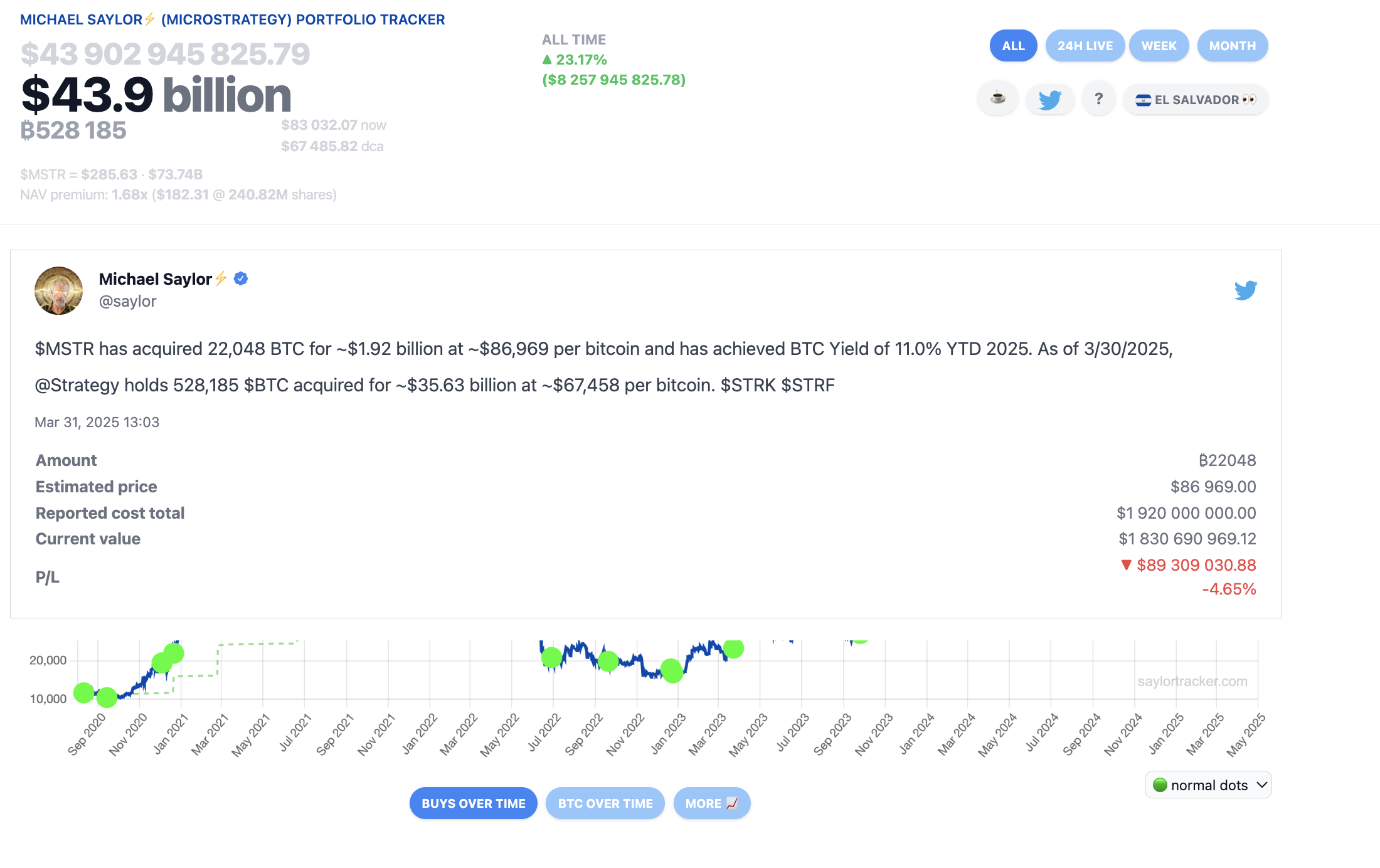

- Michael Saylor has announced that Strategy purchased 22,048 Bitcoin for approximately $1.9 million between March 24 and 30.

Strategy (MicroStrategy) Total Bitcoin Holdings | Source: SaylorTracker

Strategy’s total BTC holdings now stand to 528,185 BTC, worth approximately $44 billion at press time — maintaining its place as the largest corporate Bitcoin holder globally.

Chart of the day: Bitcoin ETFs halt 10-day buying spree

Bitcoin ETFs saw $93 million in outflows on Friday, marking the end of a 10-day streak of positive net inflows.

According to Fairside data, ETFs accumulated $1.07 billion between March 14 and March 27 before experiencing a reversal as investors took profits.

Bitcoin ETF Flows as of March 31 | Source: Fairside

A closer look at the Fairside chart above reveals that 100% of Friday’s outflows came from Fidelity’s FBTC.

Meanwhile, BlackRock’s IBIT and the other nine actively traded US ETFs held steady, signaling a neutral stance from investors.

This coincides with heightened uncertainty in US equities as firms reassess the impact of Trump’s proposed tariffs on corporate earnings.

With interest rates paused, stock markets under pressure and geopolitical tensions rising, Bitcoin holders may opt to stay on the sidelines, awaiting clearer macroeconomic signals before making further moves.

Altcoin market update: XRP, SOL and ADA tumble as Paul Atkins faces Congress scrutiny

The global cryptocurrency market cap declined by 3% in the last 24 hours as traders responded to mounting macroeconomic uncertainty and regulatory pressures.

A key bearish catalyst emerged from Washington, where former SEC commissioner Paul Atkins faces scrutiny in Congress over potential conflicts of interest. The controversy has fueled concerns over regulatory overreach, adding to market-wide risk-off sentiment.

-638790310109591693.png&w=1536&q=95)

XRP price has dropped 3.6% to $2.08, extending its weekly losses to 15.8%.

The token struggles to find support amid weak trading volumes. Solana (SOL) followed a similar trajectory, down 0.6% in 24 hours to $124.11, marking a 12.4% decline for the week. Cardano (ADA) posted one of the steepest losses, falling 4.5% to $0.6438 as sellers maintained control.

Despite the bearish trend, Toncoin (TON) outperformed the market, surging 3.1% before facing resistance near $4.

The rally was fueled by news of a $400 million investment from major Silicon Valley firms, including Sequoia Capital, Ribbit Capital, and Draper Associates.

However, profit-taking has capped further upside at the $4 resistance level, as broader market uncertainty lingers.

Crypto news updates:

FTX to begin creditor repayments on May 30, sparking token valuation concerns

FTX will start repaying major creditors on May 30, distributing funds from its $11.4 billion reserve. The exchange, which filed for bankruptcy in November 2022, is offering payouts that could reach 118% per claim. However, the repayments are calculated based on crypto prices at the time of bankruptcy, not accounting for significant price increases since then.

Solana, Bitcoin, Ethereum, and XRP have surged in value, with Solana up approximately 650% since FTX’s collapse. Despite this discrepancy, creditors will receive an additional 9% annual interest on their claims for the waiting period.

Trump’s sons partner with Hut 8 to launch ‘American Bitcoin’ mining venture

Eric Trump and Donald Trump Jr. have teamed up with Hut 8 to launch ‘American Bitcoin,’ a new mining firm aiming to become the world's most efficient Bitcoin operation. The venture follows a merger between American Data Centers and American Bitcoin, with Hut 8 holding an 80% stake while American Data Centers retains 20%. The company targets over 50 EH/s hash rate and plans to integrate Bitcoin into its balance sheet.

“By combining Hut 8’s proven operational excellence in data centers with our shared passion for Bitcoin and decentralized finance, we are poised to strengthen our foundation and drive significant future growth,"

- Eric Trump.

American Data Centers, established by Dominari Holdings in partnership with the Trump sons, will focus on AI infrastructure alongside Bitcoin mining.

With this move, the Trumps aim to capitalize on Bitcoin’s long-term growth while positioning American Bitcoin as a publicly traded industry leader.

Author

Ibrahim Ajibade

FXStreet

Ibrahim Ajibade is an accomplished Crypto markets Reporter who began his career in commercial banking. He holds a BSc, Economics, from University of Ibadan.