-

Bitcoin holds steady above $65,500 on Tuesday, erasing less than 1% to its value.

- Ethereum and XRP prices recede slightly on the day, traders anticipate key announcements in the Ripple Swell event.

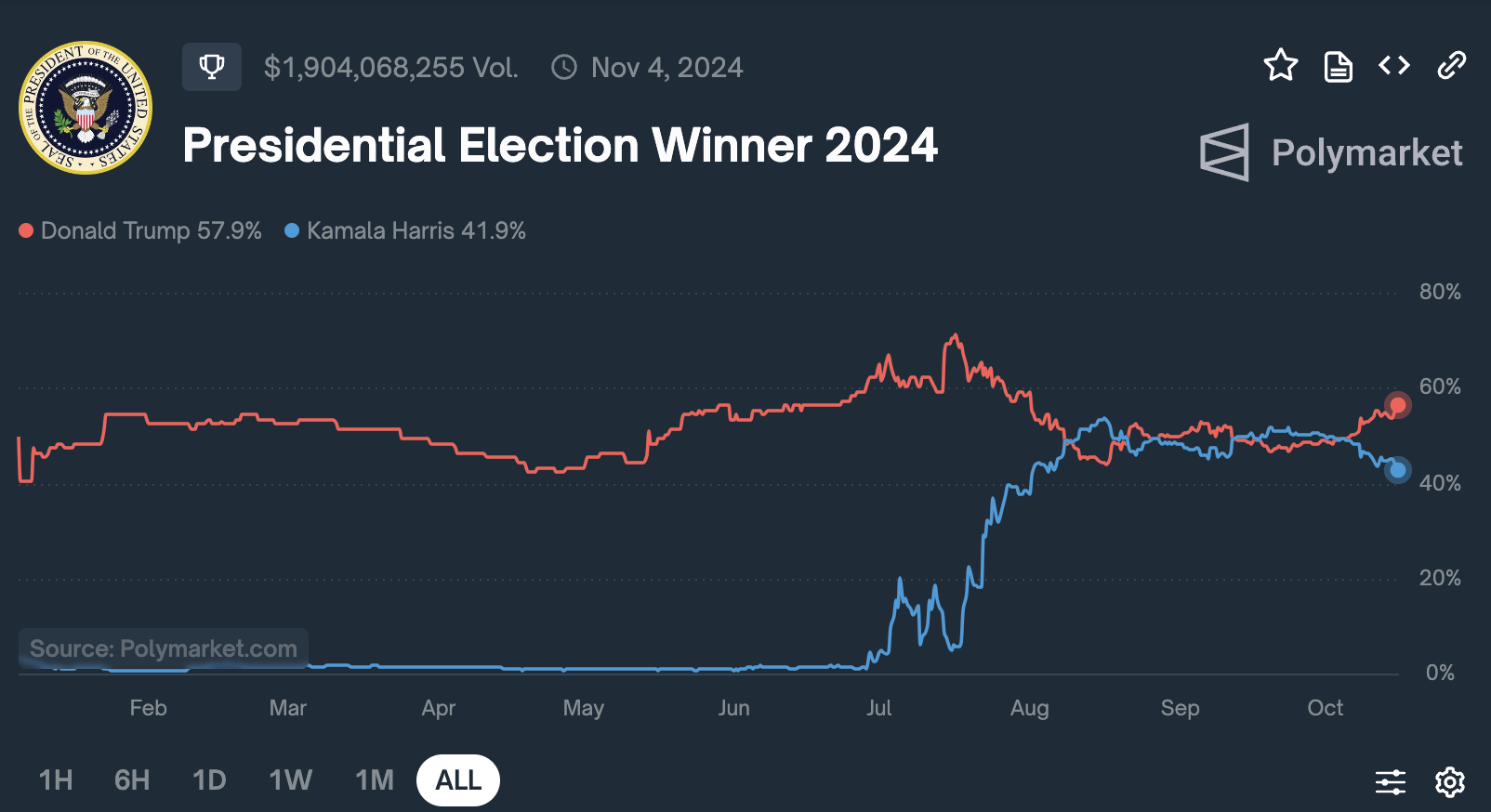

- Pro-Bitcoin US Presidential candidate Donald Trump’s odds of winning November elections shoot up on Polymarket.

Bitcoin, Ethereum and XRP updates

- Bitcoin trades at $65,777, down less than 1% on the day. Larry Fink, the CEO of asset management giant BlackRock, said that Bitcoin is an asset class in itself. The executive talks about institutions allocating capital to BTC, saying it reminds him of the early days of the mortgage market. Now at $11 trillion in market cap, Fink doesn’t think the outcome of the US Presidential election will make a difference to BTC.

Here's full Larry Fink quote on bitcoin/digital assets from the Q3 earnings call, he says bitcoin asset class in itself, they talking with institutions worldwide about allocation, dig assets remind him of the early days of the mortgage market (now $11T) and POTUS won't make dif pic.twitter.com/McvpW7cCnB

— Eric Balchunas (@EricBalchunas) October 14, 2024

- Ethereum trades at $2,558, holding steady above key support at $2,500.

- XRP trades at $0.5357, even as Ripple’s annual flagship event Swell 2024 goes live in Miami on Tuesday.

Chart of the day: Storj (STORJ)

Storj, the token of a decentralized cloud storage platform, could extend gains by another 7% and test the lower boundary of the Fair Value Gap (FVG) between $0.6835 and $0.5921 as resistance. The token broke out of its downward trend on September 16 and is making steady gains ever since.

The Relative Strength Index (RSI) is 79.87, above the overbought level at 70. This typically generates a sell signal, however, the other momentum indicator, the Moving Average Convergence Divergence (MACD), flashes green histogram bars above the neutral line. There is likely an underlying positive momentum in STORJ’s price trend.

STORJ/USDT daily chart

A daily candlestick close under the 200-day Exponential Moving Average (EMA) at $0.4496 could invalidate the bullish thesis. STORJ could slip to support at $0.4114, the 50-day EMA.

Market updates

- Nansen and MetaStreet released a pivotal report identifying crypto verticals that harbor high-yield opportunities like Artificial Intelligence (AI) Compute DePIN and NodeFi, early on Tuesday. The report highlights that the DePIN sector is a high-growth alternative to traditional DeFi yields for crypto investors.

- NodeFi, a crypto sector where licenses are provided to token-based rewards protocols, has emerged as a key source of high yield for crypto investors, per the report.

- At Ripple Swell, the firm announced its exchange partners for the Ripple USD (RLUSD) stablecoin.

Today at #RippleSwell, we’re proud to announce our Ripple USD exchange partners.

— Ripple (@Ripple) October 15, 2024

Upon regulatory approval, $RLUSD will be globally available for institutions and users from @UpholdInc, @BitStamp, @Bitso, @Moonpay, @Indereserve, @CoinMENA, and @Bullish. https://t.co/iZ7L1MHpn3

Industry updates

- Blockstream closes $210 million convertible note financing round to further its goal of driving Bitcoin adoption in global finance. The funds will be used for Layer 2 development and expanding mining capabilities ahead of the next cycle.

Blockstream has closed a $210M convertible note financing round led by @FulgurVentures, driving our mission to bring Bitcoin into global finance.

— Blockstream (@Blockstream) October 15, 2024

This capital accelerates layer-2 development, expands mining ahead of the next Bitcoin cycle, and grows one of the world’s largest… pic.twitter.com/gi1ov0LCYU

- Asset management giant BlackRock holds 1.46% of Bitcoin supply, 369,640 BTC, as of Tuesday, October 14.

- Stellar (XLM) holds steady above $0.0932 as the firm announces a partnership with web-based blockchain data analytics platform Dune.

- Polymarket shows former US President Donald Trump’s odds of winning the November 2024 elections shot up to 57.9%.

Polymarket on US Presidential Election Winner 2024

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Axiom’s volume surpasses $100M as meme trading platform war escalates on Solana

Axiom meme coin trading volume hit $101 million for the first time, surpassing other platforms on Solana. Axiom accounts for 30% of the ecosystem’s trading users, followed by Photon and Bullx at 24% each.

Bitcoin aiming for $95,000 as Global M2 money supply surges

Bitcoin (BTC) price edges higher and trades slightly above $85,500 at the time of writing on Tuesday after recovering nearly 7% the previous week. The rising Global M2 money supply could be a favorable signal for both Gold and Bitcoin.

Top 3 gainers Brett, Story and Virtuals Protocol sparkle as Bitcoin eyes $90,000

Cryptocurrencies have sustained a buoyant outlook since last week as US President Donald Trump’s tariff war was paused for 90 days, except for China, propping global markets for lifeline relief rallies.

Three altcoins to watch this week: ALGO, MANA and JASMY show bullish signs

Algorand, Decentraland and JasmyCoin hovers around $0.19, $0.27, and $0.015 on Tuesday after a double-digit recovery last week. ALGO, MANA and JASMY approach their key resistance levels; breakout suggests a rally ahead.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.