Crypto Today: Bitcoin is less than 10% away from all-time high as Ethereum ETF approval anticipation brews

- Bitcoin trades around $68,000 early on Monday, less than 10% away from its all-time high of $73,777 on Binance.

- Ethereum ETF anticipation brews among traders and Ether investment products see inflow of over $45 million in the past week.

- XRP hovers around key psychological resistance as CEO weighs in on whether the SEC lawsuit against Ripple will end soon.

Bitcoin, Ethereum and XRP updates

- Bitcoin is inching closer to its all-time high of $73,777, observed on March 14 on Binance. Bitcoin trades at $67,730 at the time of writing, early on Monday. CoinShares weekly asset flows report shows Bitcoin funds received $1.27 billion in weekly inflows.

- Ethereum hovers around $3,500 at the time of writing. The altcoin’s traders are awaiting the launch of Spot Ether Exchange Traded Fund (ETF) by the Securities & Exchange Commission (SEC). Ether funds received $45.3 million in inflows.

- XRP sustained 21% gains from the past seven days and the token hovers close to $0.61 at the time of writing. Ripple CEO Brad Garlinghouse says SEC vs. Ripple lawsuit could see a resolution soon, and that he is not allowed to comment on “settlement.”

Chart of the day

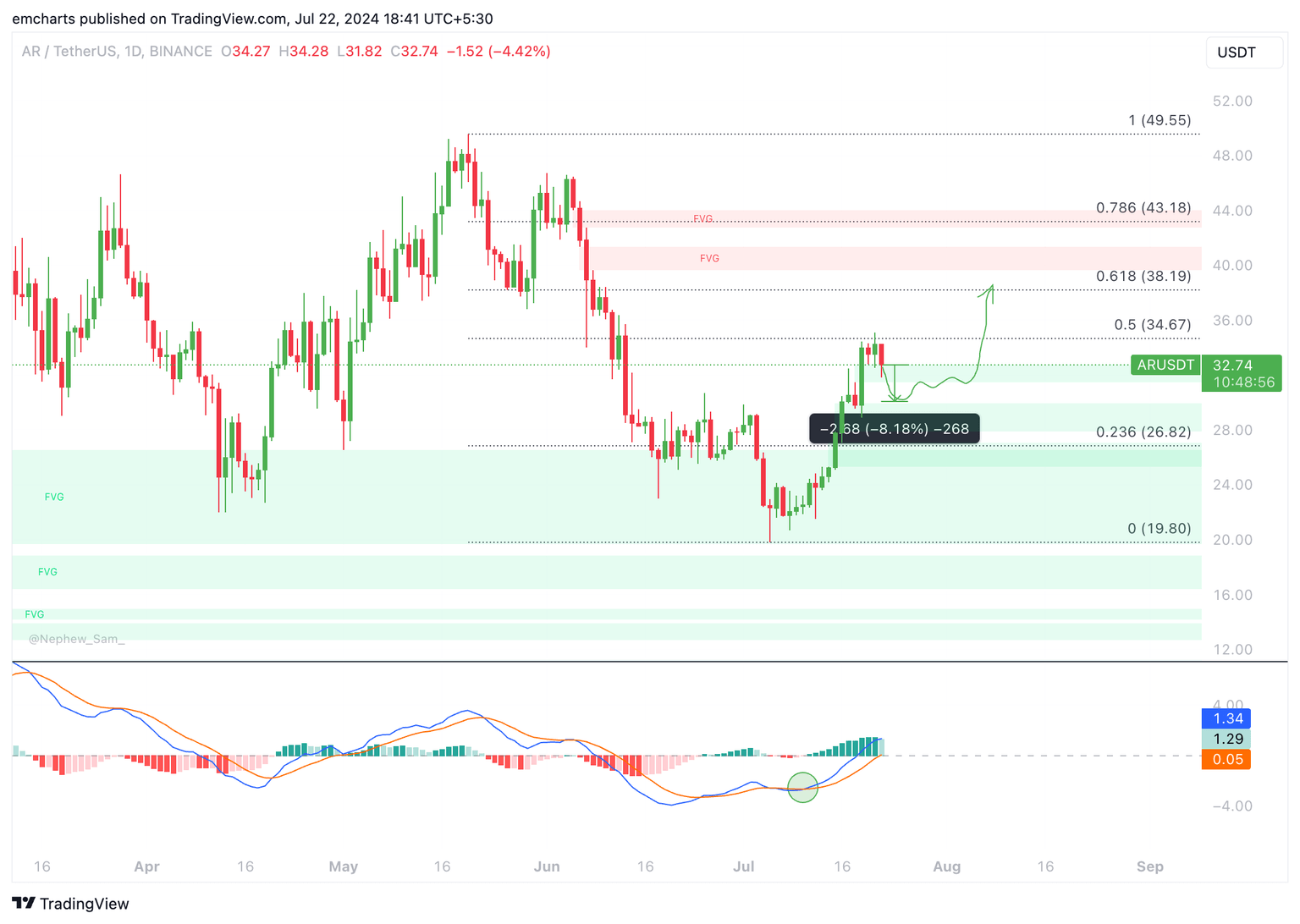

AR/USDT daily chart

Arweave (AR) could suffer nearly 8% correction before rallying towards $38.19, its 61.8% Fibonacci retracement of the decline from its May 20 top of $49.55 to its July 5 low of $19.80. AR trades at $32.74 at the time of writing.

The Moving Average Convergence Divergence (MACD) indicator supports gains in AR, green histogram bar above the neutral line shows underlying positive momentum in AR.

AR could retest resistance at $34.67, the 50% Fibonacci retracement level.

Market updates

- Crypto trade association The Digital Chamber wrote a letter to US Vice President Kamala Harris, urging her to take a forward-looking approach on cryptocurrencies. The letter requests the VP to engage crypto industry leaders and pick a pro-crypto running mate.

SCOOP: Crypto trade association @DigitalChamber has penned a letter to @VP Harris urging her to take a forward-looking approach to digital assets. The letter calls on her to include pro-crypto language in the Dem party platform, choose a crypto-friendly running mate and start… pic.twitter.com/5ldQxtQVBK

— Eleanor Terrett (@EleanorTerrett) July 22, 2024

- Solana-based meme coins Jeo Boden (BODEN), Jill Boden (JILLBODEN), and Kamala Horris (KAMA) noted double-digit price swings in the last 24 hours amidst the withdrawal announcement by US President Joe Biden from the 2024 election race.

- Data from CoinShares shows inflow of $1.35 billion to crypto asset investment products in the last week.

Industry updates

- Data from Bitwise shows that stablecoin transaction volume surged to $2.8 trillion in Q2 2024, this is considered a milestone and an all-time high.

- Ondo Finance’s yieldcoin is now live on mainnet, making it accessible to over 90 chains in the Cosmos ecosystem.

- Arbitrum announced the launch of a buildathon event for developers with $500,000 in rewards.

IYCMI: We recently launched Frame It.

— Arbitrum (,) (@arbitrum) July 22, 2024

A buildathon for developers to create @farcaster_xyz Frames on Arbitrum for up to $500k in retroactive rewards!

Epoch 5 has already begun, start framing now. https://t.co/XLy0v9c2PS

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.