Crypto today: Bitcoin, Ethereum’s upcoming $10 billion options expiry renews optimism among traders

- Bitcoin, Ethereum’s 25% options are set to expire in the money on Friday, setting the tone for a bullish July.

- Bitcoin is struggling to break past the resistance at $62,500, trading at $61,442 on Wednesday.

- Ethereum and XRP prices are nearly unchanged in the past 24 hours, trading at $3,377 and $0.4739 respectively.

Crypto update:

- BTC/USDT is trading at $61,442 early on Wednesday, nearly unchanged in the past 24 hours. The largest asset by market capitalization has wiped out nearly 6% in the past seven days. Bitcoin has been in a choppy zone, directionless, and traders look to Friday’s option expiry for hints on what to expect from BTC.

Bitcoin steadies around $61,000 after liquidations on Defi platforms exceed $1 million

- ETH/USDT is trading at $3,377, up nearly 0.2% on the day. The altcoin has sustained above key support with the optimism surrounding the expected approval of the Spot Ethereum ETF.

Analysis shows Ethereum ETFs could impact the market with $15 billion net flows by 2025

- XRP/USDT is trading at $0.4739 at the time of writing. The altcoin is down nearly 0.40% in the past 24 hours. XRP’s social dominance is at its highest level since April 2024, as the altcoin’s relevance has increased among traders.

Ripple CEO Brad Garlinghouse slams SEC Gary Gensler for his remarks on crypto, XRP extends losses

- Meme coins and Artificial Intelligence (AI) categories of tokens noted surges in their market capitalization. Meme coins added nearly 6% to their market capitalization, pushing it to $50.89 billion. AI tokens added 3% to their market cap in the same timeframe, up to $29.54 billion.

- Luuk Strijers, CEO at Deribit, told Coindesk that over 25% of Deribit's open interest is set to expire this Friday, “in the money,” meaning the asset has already surpassed the strike price.

Chart of the day:

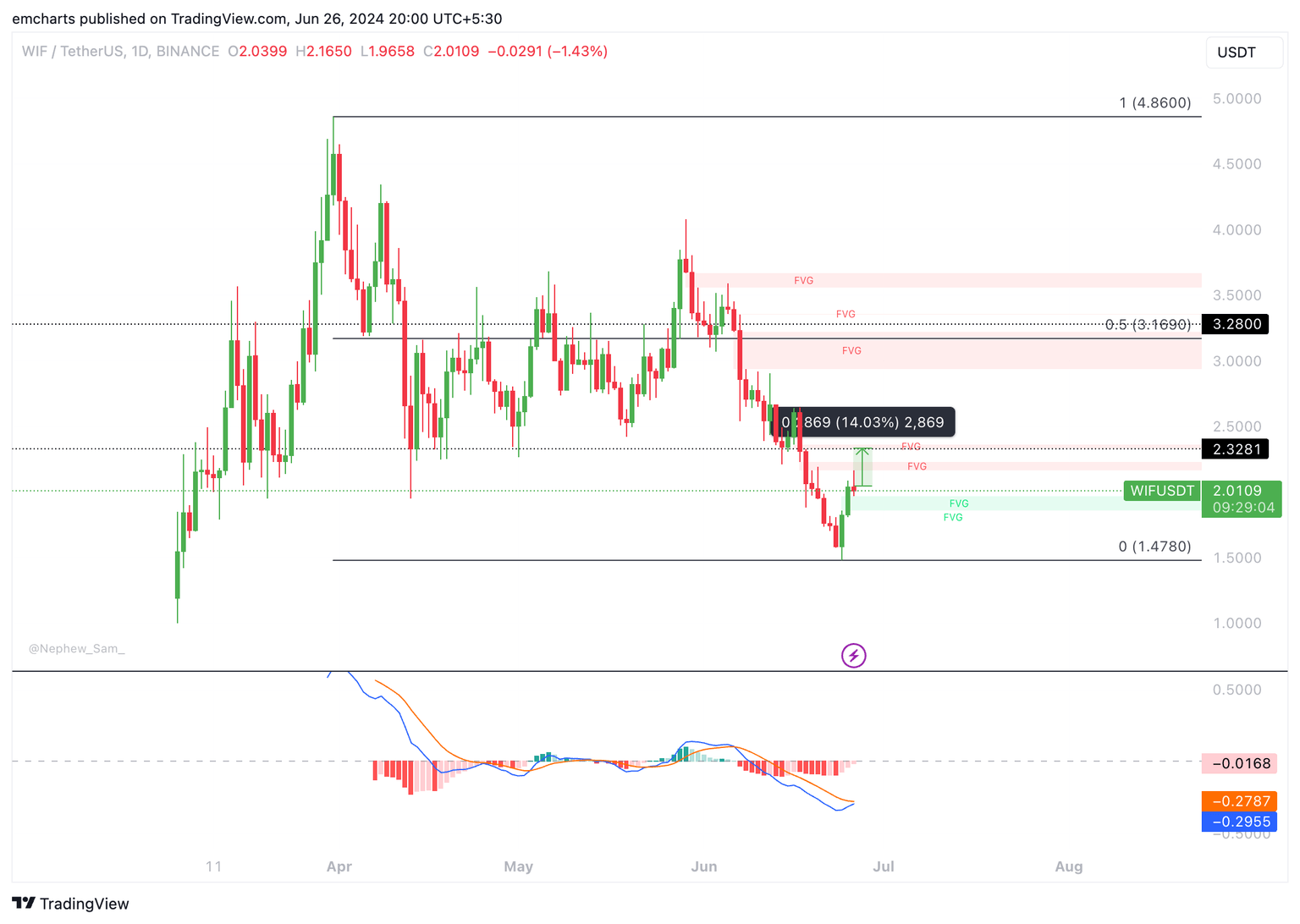

WIF/USDT daily chart

Dogwifhat (WIF) is trading at $2.0484, down 1% in the past seven days. The Moving Average Convergence Divergence (MACD) shows decreasingly shorter red histogram bars, and MACD is close to crossing above the signal line, a bullish sign for WIF.

WIF is likely to rally towards the lower boundary of the Fair Value Gap at $2.3281, a 14% rally. The meme coin could drop to support at $1.699.

Market updates:

- German government Bitcoin transfers continue, with another 750 BTC moving early on Wednesday. The following transfers were tracked by Spotonchain:

- 125 BTC moved to Kraken

- 125 BTC moved to Bitstamp

- 500 BTC moved to wallet “139PoPE1bK”

- 0.001 BTC sent to Flow Traders (likely a test transaction)

- In the past week, the German government has transferred 4,250 BTC worth $271.3 million at an average price of $63,828.

- Bitcoin ETF net inflow turned positive after seven consecutive days of outflows. $31 million flowed into Bitcoin ETFs.

30-day net inflow of Bitcoin ETFs

- Bitcoin Fear and Greed Index climbed from 30 to 46, but still remains within the “fear” zone.

Fear and Greed Index

Industry updates:

- zkSync, a Layer 2 network, announces the launch of the interoperability layer Elastic Chain to compete with Polygon’s AggLayer. Polygon is currently the largest Ethereum scaling solution in the ecosystem.

- Coin98 wallet announces support for .shib names from an identity service for the top web3 communities.

WOOF! @coin98_wallet now lets you send, receive, and store your favorite crypto & NFTs using your Viction, Core, or Shib Names!

— Shib (@Shibtoken) June 26, 2024

Who's rocking a $SHIB Name already? Let's see those epic handles in the comments! #ShibArmy https://t.co/CMGE5eDKHO

- DEXScreener, a DeFi analytics tool, announced the launch of its meme coin decentralized application (DApp) Moonshot.

Moonshot does not have an X account, don't fall for scams. Steady lads, more to come!

— DEX Screener (@dexscreener) June 24, 2024

DEX Screener just launched their own Memecoin dApp!

— 0xNobler (@CryptoNobler) June 25, 2024

Missed the early days of PumpFun? Don't waste your second chance to make millions on Moonshot!

The most complete guide on how to find the next x100 before everyone else pic.twitter.com/FVTiMEzHe5

The top 3 gainers on Wednesday are Fetch.ai (FET), Notcoin (NOT) and SingularityNET (AGIX), up 10%, 8.5% and 9%, respectively, in the past 24 hours, per CoinGecko data.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.