- Bitcoin trades at $59,000, Ethereum hovers around $2,500, both note a slight decline in price on Tuesday.

- XRP tests $0.57 resistance, adds more than 0.5% to its value on the day.

- Ripple announces AI and metaverse partnership, a sidechain on the XRP Ledger, and adds Korean university to Blockchain Research Initiative.

Bitcoin, Ethereum and XRP updates

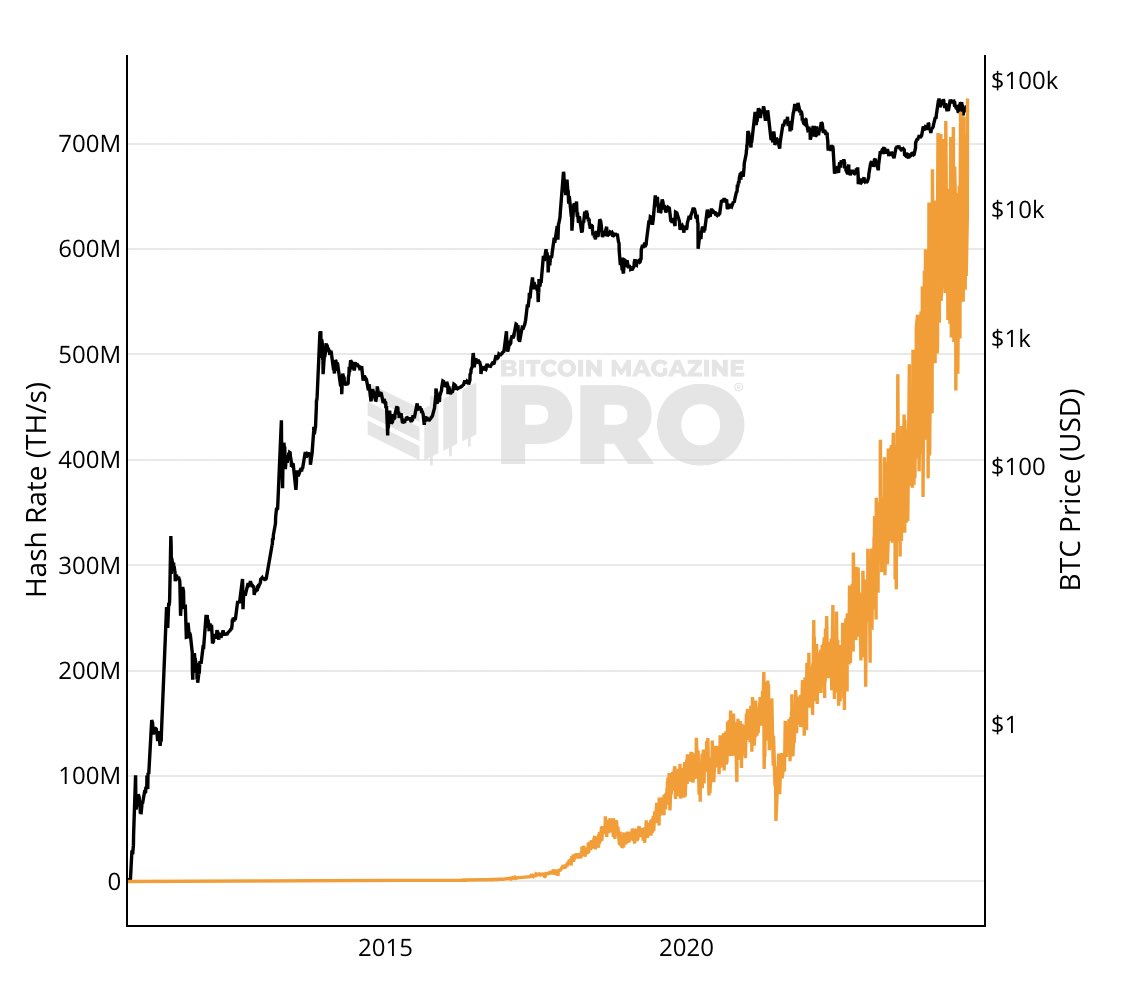

- Bitcoin trades at around $59,000 early on Tuesday. At the time of writing, the largest crypto asset by market capitalization noted a slight correction of 0.17% on the day. Bitcoin hash rate has hit a new all-time high, per Bitcoin Magazine data.

- Bitcoin network hash rate hit 746 exahashes per second (EH/s) on Tuesday, even as BTC trades under $60,000. A spike in hash rate reflects that there is an increase in computational resources spent on processing transactions and mining new BTC.

Bitcoin hash rate

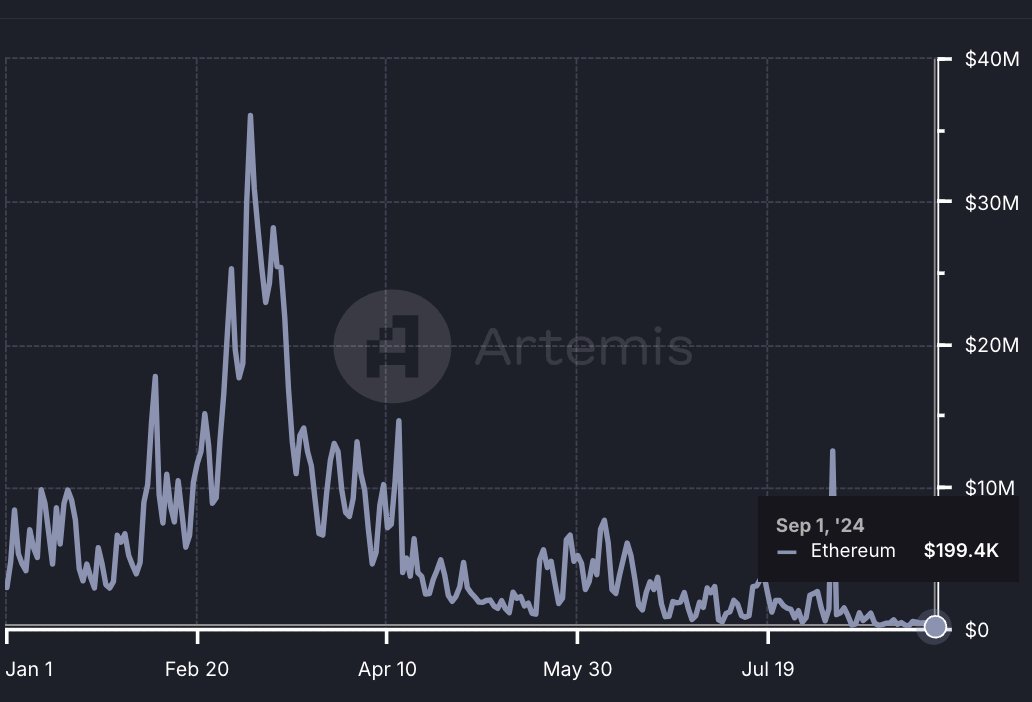

- Ethereum trades just above $2,500 at the time of writing. Data from crypto intelligence tracker Artemis shows Ethereum’s daily revenue dropped on Sunday to its lowest level in 2024, down over 90% year-to-date.

Ethereum network revenue

- XRP hit a high of $0.5724 on Tuesday and trades at $0.5690 at the time of writing. The cross-border payment remittance firm, Ripple, made several key announcements in Japan and Korea.

Ripple is on the ground this week in Korea and Japan, starting off with a few key announcements – all in service of the goal to strengthen the foundations of crypto infrastructure to support blockchain utility and usability for institutional adoption.

— Ripple (@Ripple) September 3, 2024

Chart of the day

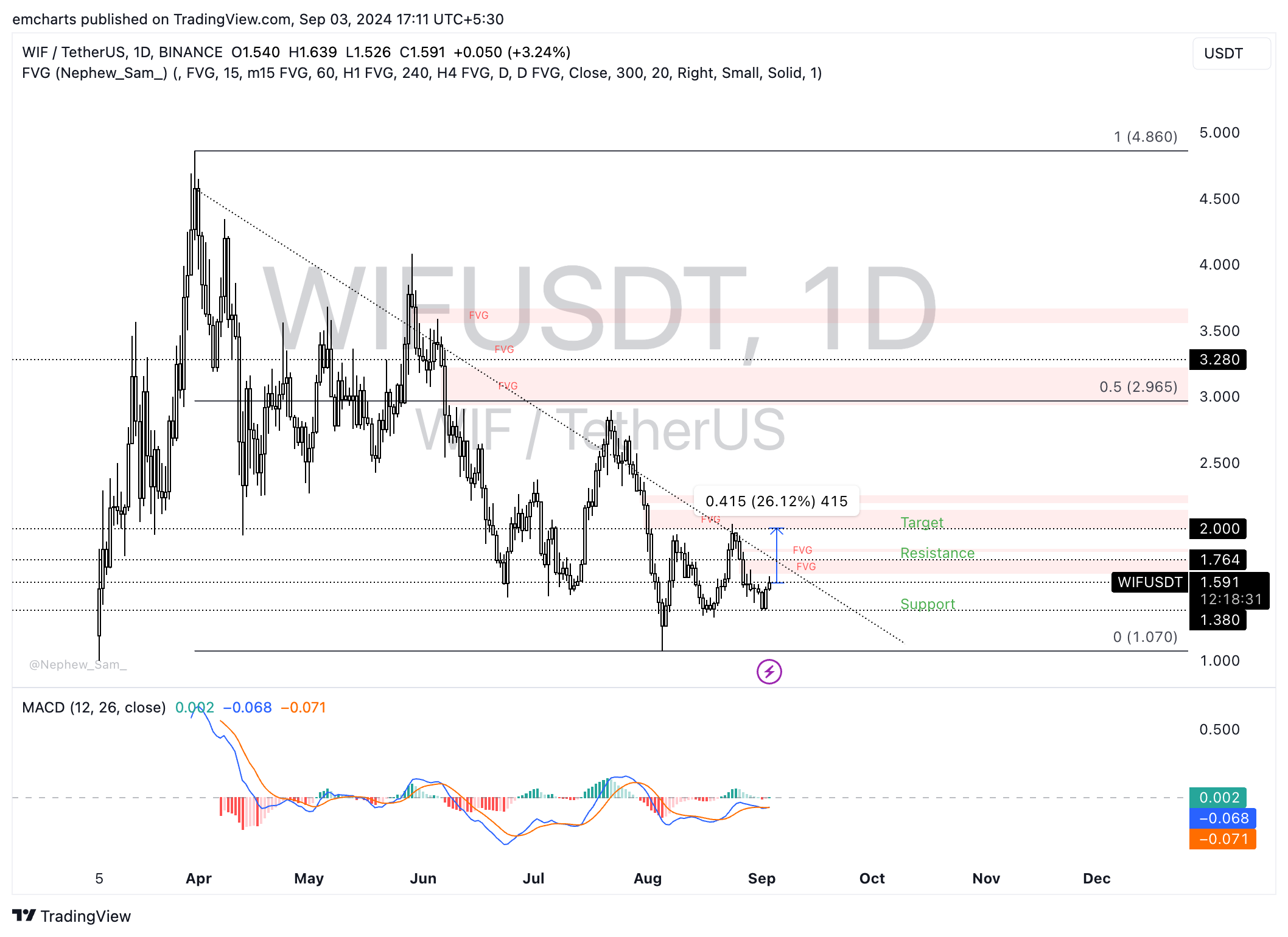

WIF/USDT daily chart

Dogwifhat (WIF) is a leading dog-based meme coin. WIF trades at $1.591 at the time of writing and noted a nearly 3% increase in price on Tuesday. WIF could extend gains by 26% and hit its $2 target.

The WIF/USDT daily chart shows an “inverted W” formation, with two distinct peaks and troughs between August 6 and September 1. The pattern helps identify key support at $1.380 and resistance at $2.

In its rally towards the $2 target, WIF faces resistance at $1.764. A daily candlestick close below $1.380 could invalidate the bullish thesis. In that case, WIF could sweep its August 5 low of $1.070.

Market updates

- DeFi project launches SkyAAVE initiative. The project’s proposal includes integration of Stable USD (USDS) and staked USDS (sUSDS) on the Aave V3 market, with native token rewards, SPK token airdrop for market suppliers, and liquidity injection into staked Ether market.

Sky Aave Force, gearing up for deployment.

— Sky (@SkyEcosystem) September 3, 2024

An unprecedented initiative by @SkyEcosystem and @Aave to accelerate the next wave of DeFi adoption. pic.twitter.com/WNc8Yz8zZj

- Arbitrum announces elections for the Security Council, six months have passed since the last round. Drops details on how to participate in the cohort.

The Security Council and its elections are integral to protecting the interests of the Arbitrum community.

— Arbitrum (,) (@arbitrum) September 2, 2024

6 months have passed since the last elections and it’s time for the next one!

Here's how you can be a part of the upcoming cohort in September pic.twitter.com/X8rodZP0rF

- DYDX is scheduled to unlock 1.55 million tokens worth $1.32 million on Tuesday. This represents 0.68% of the token’s supply, per TokenUnlocks data.

Industry updates

- Ethereum Layer 2 project Scroll released a video teasing a token issuance and airdrop for the community.

— Scroll (@Scroll_ZKP) September 3, 2024

- Prism launched PRISM Explorer today, the first AI-driven data intelligence platform to explore data and insights on the Solana ledger, with the help of AI agents.

Introducing PRISM Explorer.

— PRISM (@prism_tec) September 2, 2024

We're now making PRISM **the** data intelligence platform for Solana.

Query the chain back to Epoch 0. Use our AI agents to help you get what you need. Increase your speed across Solana. pic.twitter.com/VzXF5LLnUK

- TON accelerator announced a $2.5 million incubator program to support five projects in the TON ecosystem.

Introducing TON: Acc by TON Accelerator @accelerator_ton, backed by TON Ventures!

— TON (@ton_blockchain) September 3, 2024

This $2.5M incubation program will support 5 start-ups building on #TON. Selected projects will receive 3 months of growth support, funds, and expertise.

Apply now: https://t.co/j79kxDs85H

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Axiom’s volume surpasses $100M as meme trading platform war escalates on Solana

Axiom meme coin trading volume hit $101 million for the first time, surpassing other platforms on Solana. Axiom accounts for 30% of the ecosystem’s trading users, followed by Photon and Bullx at 24% each.

Bitcoin aiming for $95,000 as Global M2 money supply surges

Bitcoin (BTC) price edges higher and trades slightly above $85,500 at the time of writing on Tuesday after recovering nearly 7% the previous week. The rising Global M2 money supply could be a favorable signal for both Gold and Bitcoin.

Top 3 gainers Brett, Story and Virtuals Protocol sparkle as Bitcoin eyes $90,000

Cryptocurrencies have sustained a buoyant outlook since last week as US President Donald Trump’s tariff war was paused for 90 days, except for China, propping global markets for lifeline relief rallies.

Three altcoins to watch this week: ALGO, MANA and JASMY show bullish signs

Algorand, Decentraland and JasmyCoin hovers around $0.19, $0.27, and $0.015 on Tuesday after a double-digit recovery last week. ALGO, MANA and JASMY approach their key resistance levels; breakout suggests a rally ahead.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.