Crypto Today: Bitcoin, Ethereum gain between 1% and 2% on Thursday, XRP back above $0.53

- BTC is back above $58,000 and ETH hovers around $2,363 at the time of writing.

- XRP is back above $0.5369 on September 12, gains slightly on the day.

- Ethereum scaling solution Arbitrum sees over 40% increase in daily active users in the last 30 days.

- ARB gains 1.52% on the day, trades at $0.5221.

Bitcoin, Ethereum and XRP updates

- Bitcoin trades at $58,180 on September 12. The largest asset by market capitalization noted net outflows in the Spot ETFs on September 11. $43.9 million in institutional capital flowed out of the Spot Bitcoin ETFs, after two consecutive days of inflows, per data from Farside Investors.

- Ethereum is changing hands at $2,363. The second-largest cryptocurrency gained 1% on the day and noted a steep decline in gas revenue. Fees collected by the Ethereum network has been in a downward trend since a relatively high percentage of the fees is collected by the Layer 2, scaling solutions used by traders.

' @Ethereum’s revenue is the lowest it’s been since May 2020

— Milk Road (@MilkRoadDaily) September 11, 2024

But if you think $ETH is dead because its fee revenue keeps dropping, you’re wrong pic.twitter.com/ljJ2YD5LNP

- XRP is back above $0.5369. The altcoin recovers while XRP holders keep their eyes peeled for the next steps from the Securities & Exchange Commission (SEC). Though the SEC vs. Ripple lawsuit ended with an outcome that was considered a partial win for both parties; it remains to be seen whether the regulator will appeal the final ruling. An appeal could impact the legal clarity of XRP and likely hurt investor sentiment.

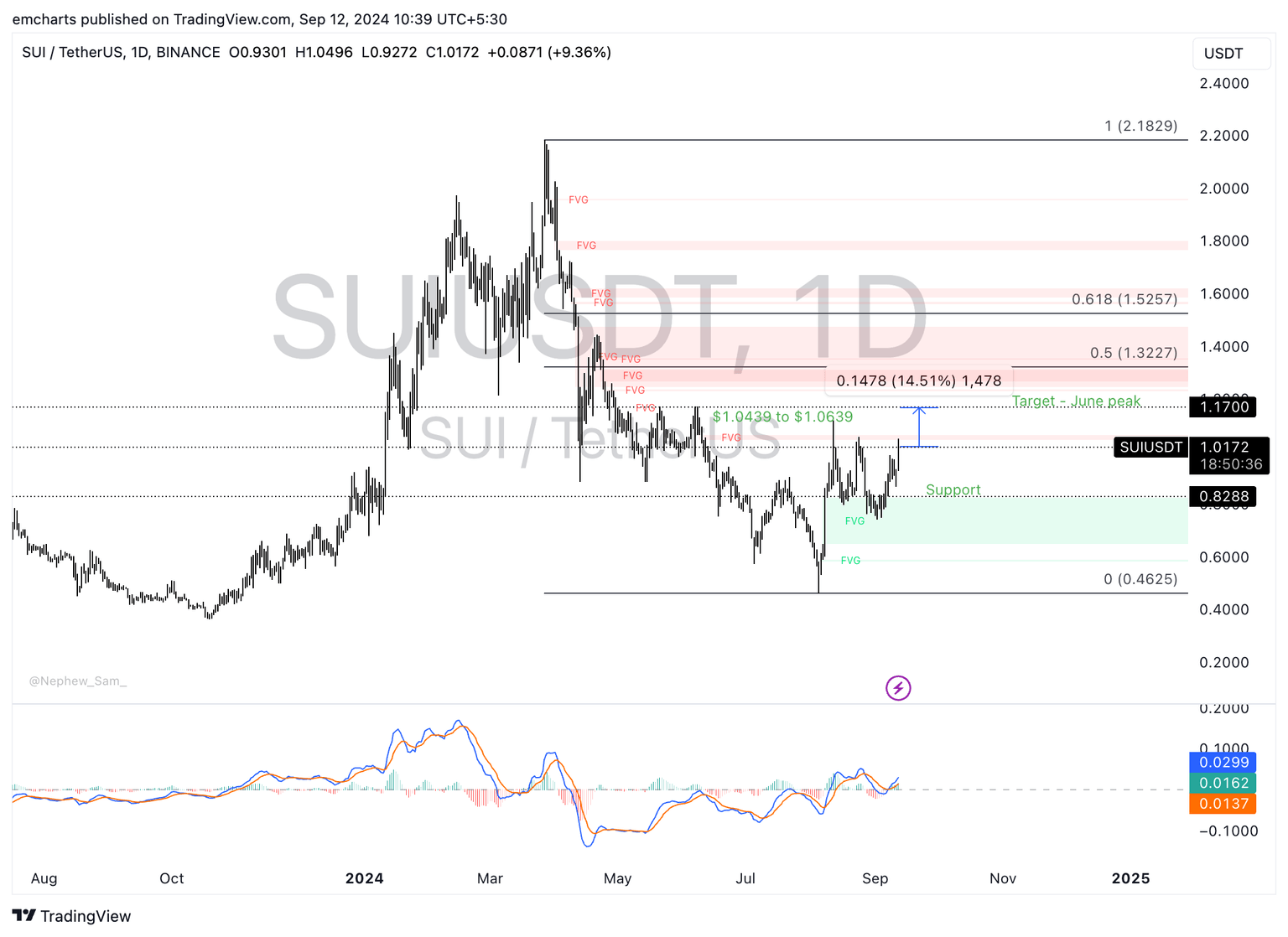

Chart of the day: SUI

SUI broke out of its multi-month downward trend with a close above $0.6167 on August 8. The DeFi token added 9% to its value on September 12. The Moving Average Convergence Divergence (MACD) indicator shows that SUI price trend has underlying positive momentum.

The green histogram bars above the neutral line support the bullish thesis. SUI could extend gains by 14.51% and target the June peak at $1.1700. SUI faces resistance in the Fair Value Gap (FVG) between $1.0439 and $1.0639.

SUI/USDT daily chart

If SUI sees a daily candlestick close below the September 11 low of $0.8663, it could invalidate the bullish thesis and the DeFi token could sweep liquidity at $0.8288. This is a key support level and the upper boundary of the FVG in the daily chart.

Market updates

- Data from crypto intelligence tracker Lookonchain shows that the wallet identified as Vitalik Buterin deposited 2.27 million USDC obtained from the sale of 950 Ether on September 11, into AAVE. Another 2,851 Ether from earlier was also deposited into AAVE.

vitalik.eth(@VitalikButerin) deposited the 2.27M $USDC obtained from selling 950 $ETH in the past 2 weeks into #Aave 3 hours ago.#Vitalik also deposited 2,851 $ETH($6.73M) into #Aave.https://t.co/UEX85tYFwW pic.twitter.com/7SVFHjnAOT

— Lookonchain (@lookonchain) September 12, 2024

- Binance announced that the exchange is working with crypto custody firm Fireblocks HQ to enhance its custody service for users.

We're excited to expand our custody offerings by integrating Fireblocks, an enterprise platform for building blockchain apps & managing digital asset operations.

— Binance.US (@BinanceUS) September 11, 2024

Through the integration, we expect to increase our token support over time & deliver added value to customers.

- Bitcoin transactions of $100,000 and higher have dropped by 33.6% since the asset’s all-time high in March. While this would typically be considered bearish, Santiment analysts note that this may not be a bearish indicator for the asset.

Crypto whale transactions

Industry updates

- Arbitrum, an Ethereum scaling solution notes a 41% increase in daily active users, per data from DYOR. This implies higher demand for the asset and relevance among traders.

The Fundamental State of $ARB (Past 30D)

— DYθR (@dyorcryptoapp) September 12, 2024

- Supply Increased by 4.70% -- [negative]

- TVL Dropped by 5.66% -- [negative]

- Fees Dropped by 70.90% -- [negative]

- Token Trading Volume dropped by 33.65% -- [negative]

- Token holders added up by 2.79% -- [positive]

- Daily Active… pic.twitter.com/T2QWO7g8sY

- Venmo and PayPal announced a partnership with the Ethereum Name Service (ENS) for crypto payments.

- South China Morning Post reports that Hong Kong is considering having its securities regulator oversee over-the-counter (OTC) crypto trading services. The Securities and Futures Commission (SFC) would oversee the task in collaboration with the Customs and Excise Department (C&ED).

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.