Crypto Today: Bitcoin, Ethereum correct as traders continue pulling BTC off exchanges

- Bitcoin, Ethereum hover around key support at $57,000 and $2,300, respectively, observe slight correction on Wednesday.

- Bitcoin leaves exchanges in large volumes, traders pulled $14.22 billion in BTC off exchanges within the last two months.

- Simon’s Cat meme coin receives BNB chain ‘Meme Heroes’ reward.

Bitcoin, Ethereum and XRP updates

- Bitcoin trades at $57,635 at the time of writing. There were two consecutive days of inflows to Bitcoin Spot ETFs, supporting a thesis of recovery in institutional demand for the asset.

- Ethereum trades at $2,294 at the time of writing. The second largest cryptocurrency by market capitalization erased nearly 4% of its value on the day. While crypto market participants critique Ether for the recent correction in the asset’s price, analyst Michaël van de Poppe says he ‘remains invested’ in the Ethereum ecosystem.

The $ETH ecosystem is waking up!

— Michaël van de Poppe (@CryptoMichNL) September 10, 2024

▫️ $AAVE hits heighest point in 2+ years

▫️ $OP hits heighest point since end of July

▫️ $WOO & $ENS waking up

I’m happily invested into the Ether ecosystem.

- XRP trades at $0.5286 early on Thursday. The altcoin corrected 2% on the day, XRP traders anticipate launch of Ripple stablecoin.

Chart of the day: Dogwifhat (WIF)

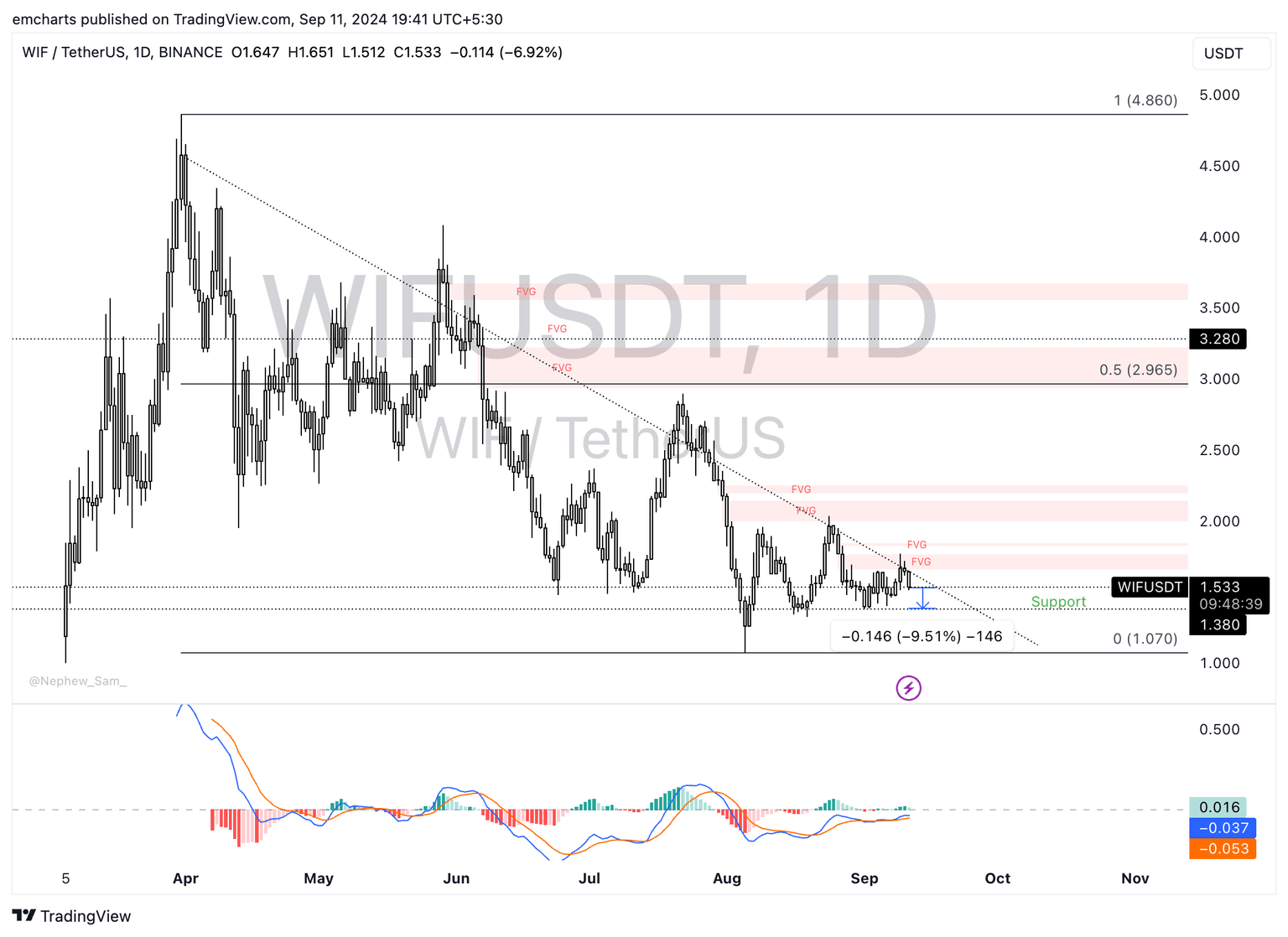

Dogwifhat (WIF) is in a multi-month downward trend that started on March 31, 2024. WIF trades at $1.533 at the time of writing. The meme coin could extend its decline and erase another 9.5% from its value by dipping to support at $1.380.

$1.380 represents an important level for WIF, and it is the September 1 low for the asset, as seen in the WIF/USDT daily chart.

WIF/USDT daily chart

The meme coin could rally toward the imbalance zone between $1.659 and $1.764 if WIF closes above the lower boundary at $1.659. A failure to close above this level would imply further correction is likely.

Market updates

- Bitcoin Spot ETFs note two consecutive days of inflows, $28.6 million on September 9 and $117 million on September 10, according to data from Farside Investors. As Bitcoin ETFs see positive net flows, it points to likely recovery in institutional investor demand for the asset.

Bitcoin ETFs saw $117M in net inflows yesterday.

— Wealth Mastery by Lark Davis (@WealthMastery_) September 11, 2024

Fidelity's $FBTC ETF led with $63.2M in net inflows. pic.twitter.com/jRBkI80qjL

- BNB chain announced the winner of its ‘Meme Heroes’ program, Simon’s Cat meme coin received a reward of $50,000 as support to its liquidity pool.

- Indodax exchange loses $22 million in a hack on September 11, per Lookonchain data. The hacker converted the tokens into Ethereum (ETH), Tron (TRX), Polygon token (POL) and 25 Bitcoin (BTC). Traders should keep their eyes peeled for selling pressure on these assets across crypto exchanges.

Indodax(@indodax) was hacked for $22M 10 hours ago, including:

— Lookonchain (@lookonchain) September 11, 2024

6.14M $USDT;

1,047 $ETH($2.48M);

25 $BTC ($1.41M);

2.2M $MATIC($849K);

1.4M $ARB($749.6K);

2M $ENA($465K);

...

The hacker has converted most of the stolen assets into native tokens and currently holds:

5584… pic.twitter.com/mX2wmj75k7

Industry updates

- Data from CryptoQuant shows that $14.22 billion in Bitcoin has been pulled off exchanges in the last two months. A reduction in Bitcoin reserves on exchanges eases the selling pressure in the asset and points at potential for gains.

Bitcoin exchange reserve

- Tron Super Representative Council proposes reducing network fees and boosting trading activity by raising the energy cap to 150 billion. This change would allow Tron staking to generate more energy.

The Tron Super Representative Council has proposed raising the energy cap to 150 billion. This is another adjustment following the previous increase to 120 billion, aimed at allowing TRX staking to generate more energy, thereby reducing network fees and boosting network activity.…

— H.E. Justin Sun(hiring) (@justinsuntron) September 11, 2024

- Marshall Beard, COO at Gemini crypto exchange, says that crypto owners will consider a presidential candidate’s cryptocurrency policies when voting in the November US presidential election.

¾ of US crypto owners will consider a Presidential candidate's digital asset policies when voting - @beardmars pic.twitter.com/B11EtVwBmc

— Gemini (@Gemini) September 11, 2024

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.