Crypto Today: Bitcoin, Ethereum and XRP take slight downturn as potential “Uptober” move faces uncertainty

- Bitcoin and Ethereum take slight downturns despite net inflows in BTC and ETH ETFs.

- XRP could face massive correction if it declines below the $0.572 level.

- Potential "Uptober" move for Bitcoin and the crypto market faces uncertainty amid growing correlation with NASDAQ 100.

Bitcoin, Ethereum and XRP updates

- Bitcoin took a slight downturn on Wednesday, falling 0.3%, as it continues consolidating inside the $62,000 to $64,700 range. Despite the weak move in prices, US spot Bitcoin ETFs recorded a net inflow of $136 million on Tuesday, spearheaded by inflows from BlackRock's IBIT, Fidelity's GBTC and Bitwise's BITB, per Farside Investors data.

- Ethereum is trading around $2,560 at press time, down more than 2% on the day. ETH broke the $2,595 key level and could decline to test the support around $2,395. Meanwhile, ETH ETFs posted a net inflow of $62.5 million — its highest since August 6.

- Ripple's XRP is trading around $0.584, down by a mild 0.7% in the past 24 hours. XRP appears to be consolidating within a key price boundary but risks a massive correction if it moves below a lower trendline around $0.572 - $0.576.

Market updates

- In an X post on Wednesday, Ecoinometrics analysts noted that macro factors will drive Bitcoin's price in the coming weeks. The largest cryptocurrency by market capitalization has moved in tandem with the NASDAQ 100 since August. Hence, the coming months appear risky and uncertain for Bitcoin, considering the potential risk of an economic slowdown in the US. The cautionary prediction comes as investors anticipate an "Uptober" move for Bitcoin and the entire crypto market.

Bitcoin rises after the rate cut, but the downtrend channel since March remains intact.

— ecoinometrics (@ecoinometrics) September 25, 2024

Bitcoin and the NASDAQ 100 have moved in sync since August.

It's clear that macro factors will determine where things go from here. pic.twitter.com/Tghpj3rGwH

- Between January and August, AI, DeFi, Meme, and Layer 2 topped the crypto market narrative mindshare, per Kaito AI data. Notably, discussions around chain abstraction increased by 673%, while social sentiment surrounding BRC-20 tokens declined by over 72%.

According to Kaito AI research, AI, DeFi, MEME, and L2 ranked in the top four in terms of cryptocurrency narrative mindshare from January to the end of August this year; chain abstraction grew rapidly, increasing by 673%, ranking first in growth rate; BRC20 had the largest… pic.twitter.com/9JnQMGrp0J

— Wu Blockchain (@WuBlockchain) September 25, 2024

Industry news

- Global payment firm Visa is expanding its footing in the crypto market by developing a new product that will enable banks to launch fiat-based tokens on the Ethereum blockchain. The Visa Tokenized Asset Platform (VTAP) will allow banks to exchange tokenized real-world assets powered by smart contracts. According to CoinDesk, Spanish bank BBVA will roll out a live pilot in 2025 using VTAP.

- Telegram announced that it will temporarily restrict users in the United Kingdom from accessing its Wallet feature until it registers under the Financial Conduct Authority (FCA) as a crypto asset provider. During this period, Telegram Wallet users in the UK can withdraw their assets to external wallets with zero fees.

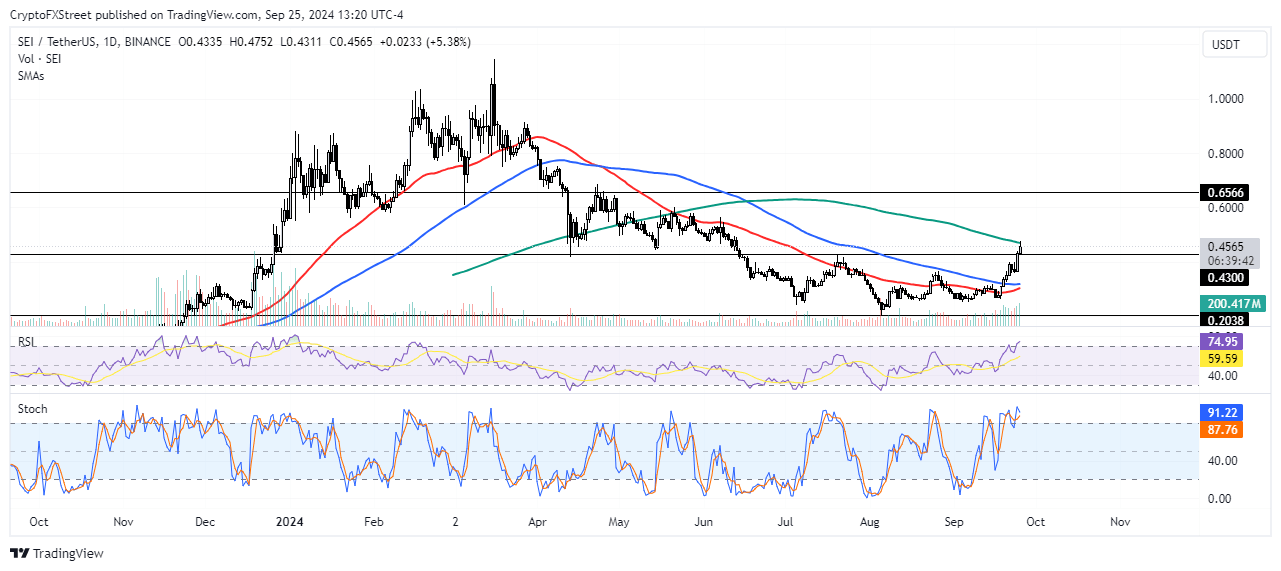

Chart of the day: SEI

SEI/USDT daily chart

- SEI has risen nearly 22% in the past 24 hours, stretching its weekly gains above 70%. SEI flipped the resistance of a key rectangle boundary into a support level. If the new support level holds, the Layer 1 token could rally by another 43% in the coming days.

- The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) momentum indicators are in their oversold region, indicating a potential price correction may be on the horizon.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi