- Bitcoin, Ethereum trade above key supports at $65,000 and $2,600, as of Friday.

- XRP corrects slightly, holding steady above $0.5892.

- Worldcoin climbs 3% as Polymarket bet shows a 66% chance of OpenAI becoming a “for profit” entity before April.

Bitcoin, Ethereum and XRP updates

- Bitcoin trades at $65,281 early on Friday. The largest asset by market capitalization notes 0.16% gains on the day. According to Farside Investors data, Bitcoin Spot ETFs noted positive inflows consecutively for the past six days. Thursday’s inflows totaled a record $365.70 million.

- Ethereum held steady above support at $2,600. Vitalik Buterin, the founder and creator of Ethereum recently started lending support to Layer 2 projects with a shoutout on his X account. Celo, an Ethereum Layer 2 chain earned a mention in a recent tweet by Buterin. Celo surpassed Tron in daily active addresses for stablecoin usage in mid-September, according to Artemis data.

This is amazing to see. Improving worldwide access to basic payments/finance has always been a key way that ethereum can be good for the world, and it's great to see @Celo getting traction.

— vitalik.eth (@VitalikButerin) September 25, 2024

See also their recent posts:

* @Celo becoming an Ethereum L2: https://t.co/08U7G7q69s

*… https://t.co/Qq7vcmZ6e3

- XRP stays above support at $0.5888 on Friday. The altcoin’s holders are digesting the $125 million fine, even though the final ruling in the lawsuit was considered a partial victory for Ripple. The monetary fine signals regulatory gaps and challenges.

Chart of the day: Shiba Inu (SHIB)

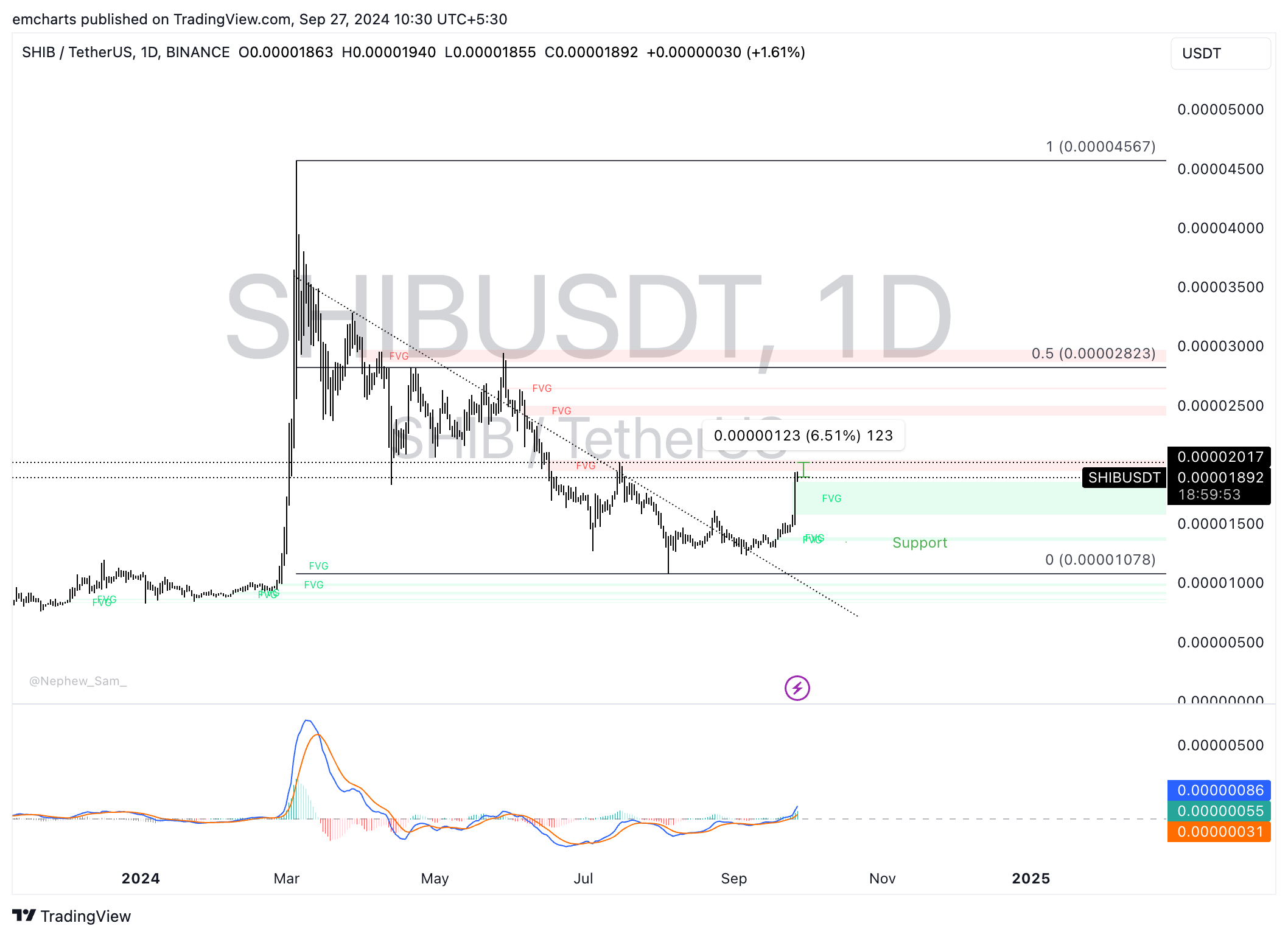

Shiba Inu surged to $0.00001940, its highest level since July 18 on Friday. The meme coin could extend gains by another 6.51% and climb to $0.00002017, the July 16 peak and a key resistance level for the asset.

The Moving Average Convergence Divergence (MACD), a momentum indicator supports the thesis of gains for SHIB as it flashes green histogram bars above the neutral line.

SHIB/USDT daily chart

Shiba Inu could find support in the Fair Value Gap (FVG) between $0.00001576 and $0.00001855, if there is a correction in the meme coin’s price.

Market updates

- Ebi.xyz, a perpetual DEX built on Arbitrum One, announced a delay in the launch of the highly anticipated Hamster Kombat airdrop claims. The project cited the increase in traffic from millions of users transacting on the platform. All affected users will receive 50,000 EBI points each, per the announcement.

- Binance CEO Changpeng Zhao is set to end his prison sentence on Friday, per a Fortune report.

- Options Data shows that 89,000 BTC options and 718,000 ETH options are about to expire on September 27. The notional value of the expiring options is over $7.7 billion.

Industry updates

- Ethena Labs announced a new product offering UStb, an asset that will be collateralized by BlackRock and Securitize BUIDL, per an official announcement.

We are excited to announce Ethena's newest product offering: UStb

— Ethena Labs (@ethena_labs) September 26, 2024

UStb will be fully backed by @Blackrock BUIDL in partnership with @Securitize, enabling a separate fiat stablecoin product alongside USDe

Details below on why this is important: pic.twitter.com/jOIoMef7W3

- Crypto project Celestia faces criticism for the Foundation’s OTC sales for failure to make necessary disclosures to the community. The project allegedly disguised coin sales as financing news according to on-chain analyst @Ericonomic

It was really easy to make things right for Celestia with this raise. All they had to do was:

— Ericonomic (@ericonomic) September 25, 2024

>Disclose the valuation and the vesting

>Disclose that it was an OTC (if it actually was) and not a fundraising; the team just sold some tokens (or the fundation, whatever it really… pic.twitter.com/ehftFLbeJM

- Telegram Wallet to suspend the in-app wallet function for UK residents soon, the project needs to register itself with the Financial Conduct Authority (FCA) to obtain relevant licenses to support wallets for UK-based users.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Ethereum Price Forecast: ETH ETFs total net assets plummet over 60%; Justin Sun says he won't sell ETH

Ethereum traded just below $1,600 on Thursday following a 60% plunge in the total net assets of US spot Ether ETFs.

Binance Coin price nears $600 breakout as CZ reacts to BNB listing on Kraken

Binance Coin price posted considerable gains on Thursday, fuelled by investor optimism tied to its upcoming listing on the U.S.-based crypto exchange Kraken.

Binance CEO affirms company's involvement in advising countries on Bitcoin Reserve

Binance CEO Richard Teng shared in a report on Thursday that the cryptocurrency exchange has advised different governments on crypto regulations and the need to create a strategic Bitcoin reserve.

Slovenia moves to impose 25% tax on crypto traders

Slovenia has become the latest European Union member state to crack down on untaxed crypto gains, unveiling a proposal to impose a 25% tax on personal profits from digital asset disposals starting in 2026.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.