Crypto Today: Bitcoin, Ethereum and XRP gain as Tether denies criminal investigation allegations

- Bitcoin extends gains by nearly 2% on Tuesday, getting closer to its all-time high registered in March.

- Ethereum and XRP prices also increase, riding on Bitcoin's rally.

- Stablecoin Tether CEO Paolo Ardoino denies allegations of a criminal investigation in the US in an interview for Coindesk.

Bitcoin, Ethereum and XRP updates

- Bitcoin trades at around $71,400 on Tuesday, less than 5% below its all-time high of $73,777

- Ethereum gains 2% as creator Vitalik Buterin shared future plans for the altcoin in a blog post published on Wednesday.

Possible futures of the Ethereum protocol, part 6: The Splurgehttps://t.co/OabLldVCqj

— vitalik.eth (@VitalikButerin) October 29, 2024

- XRP price added nearly 1% on the day, trading back above $0.5200.

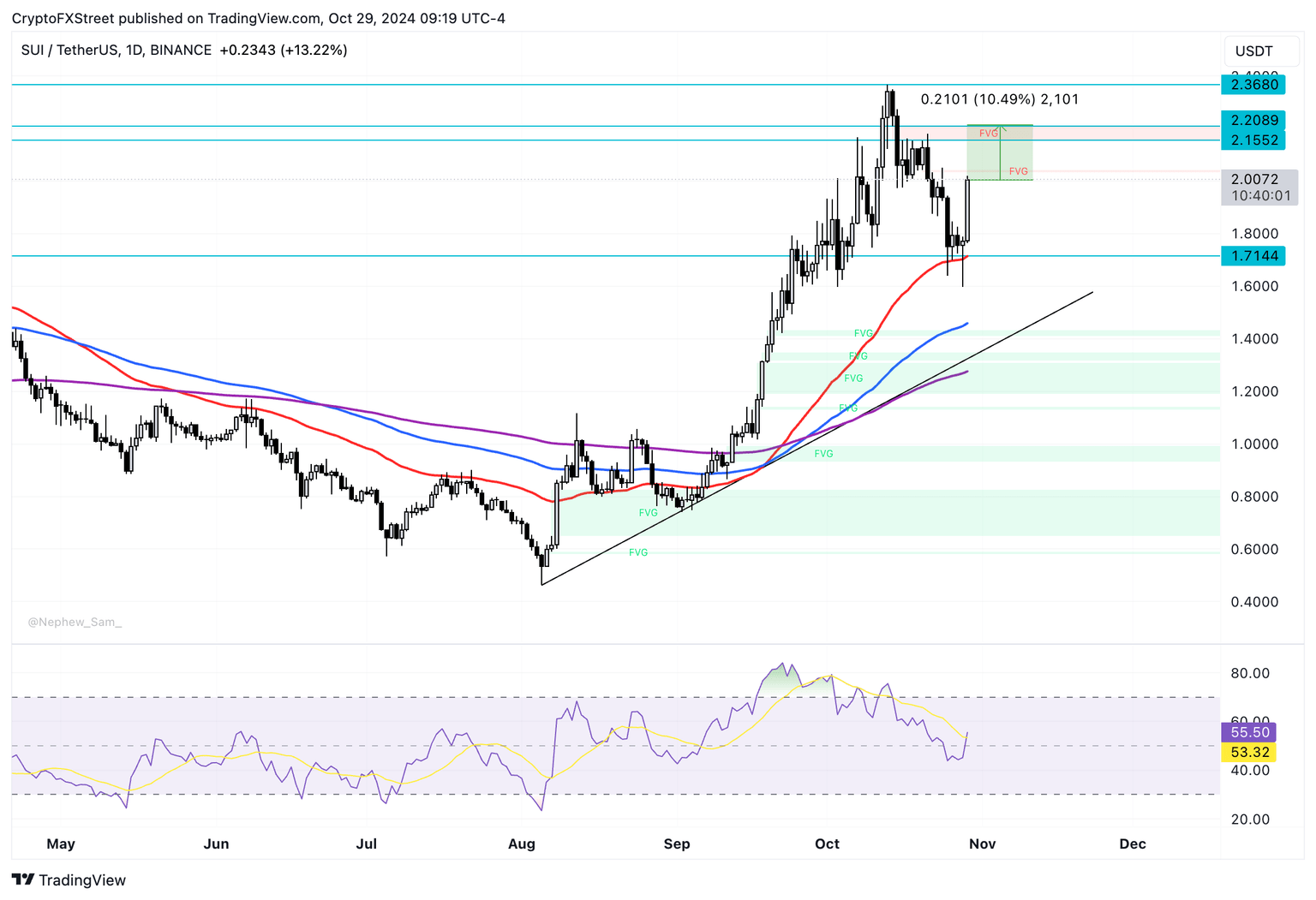

Chart of the day: SUI

Token of Layer 1 blockchain Sui (SUI) is the second-largest gainer in the past 24 hours in spot markets. SUI rallied 17.35% in the last 24 hours, post an official announcement addressing the token’s staking function.

SUI has been in an uptrend since August 5. The token could extend its gains by 10.5% and test resistance at the upper boundary of the Fair Value Gap (FVG) at $2.2089. On the way to this target, SUI faces resistance at the lower boundary of the FVG at $2.1552.

The Relative Strength Index (RSI) is sloping higher and reads 55, above the neutral level. This indicates somewhat positive underlying momentum in SUI price.

SUI/USDT daily chart

SUI could find support at the 10-day Exponential Moving Average (EMA) at $1.7144, if there is a correction in the token’s price.

Market updates

- Analysts at QCP Capital note that Bitcoin’s break past $70,000 has resulted in a “euphoria” in the market that extends to crypto-related equities. Iren Energy (IREN), a data centers firm, Hut8 Corp. (HUT) and Bitdeer Technologies Group (BTDR), Bitcoin mining firms, are among the stocks that gained in response to the recent BTC price rally.

- On-chain intelligence firm Lookonchain identified a large wallet address that withdrew BTC after the coin tested the $70,000 resistance level. The wallet has consistently withdrawn BTC in the past five days.

The #Bitcoin price increased by 3.2% and broke through $70,000 today!

— Lookonchain (@lookonchain) October 29, 2024

A whale withdrew another 570 $BTC($39.84M) from #Binance 1 hour ago.

This whale has withdrawn 2,150 $BTC($147M) from #Binance in the past 5 days and currently holds 5,073 $BTC($354.5M).

Address:… pic.twitter.com/fzc7aNBxF0

- Stablecoin issuer Tether (USDT) CEO Paolo Ardoino denied the recent allegations of a criminal investigation to the stablecoin issues, according to an interview at Coindesk. “If the U.S. wanted to kill us, they can press a button and kill us anywhere, we are not going to fight the US,” he said. Ardoino said he is “comfortable” in the company’s holdings of US Treasury Bills and its reserves with US-based Cantor Fitzgerald.

Industry updates

- South Korean crypto exchange Bithumb announced the addition of two new Korean Won trading pairs: the game chain’s token CARV and Layer 1 blockchain token OMNI.

- CoinGecko data shows that Infinex Patrons is the third-largest NFT collection, following a recent fundraise. The collection ranks after Crypto Punks and the Bored Ape Yacht Club.

Infinex Patrons by @infinex_app is now the third largest NFT collection by market cap after completing a $67.7M raise yesterday.

— CoinGecko (@coingecko) October 29, 2024

Notable investors include @peterthiel, @wintermute_t, @hiFramework, @SolanaVentures, @VitalikButerin, @aeyakovenko, and @StaniKulechov. pic.twitter.com/0ybF6SPHI6

- Stablecoin issuer Circle signed a Memorandum of Understanding (MOU) with Hong Kong Telecom (HKT), the largest telecommunications company in Hong Kong, to explore potential collaboration in developing a blockchain-based customer loyalty solution for clients in the region.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.