Crypto Today: Bitcoin dips under $59,000, Ethereum lags as XRP extends gains to $0.58

- Bitcoin trades under $59,000 on Monday, the largest cryptocurrency struggling to recover from recent corrections.

- Ethereum hovers around $2,500, and XRP rallies to $0.58, key support level for the asset.

- Maker protocol halts wrapped Bitcoin as collateral after Bitgo reveals plan to migrate from US to other regions.

Bitcoin, Ethereum, XRP updates

- Bitcoin trades at $58,414 at the time of writing. The largest asset by market capitalization failed to break past psychologically important resistance at $60,000. Data from Bitcoin Magazine shows that 75% of Bitcoin has not moved in the past six months. This could mean higher investor confidence and reduced selling pressure on Bitcoin, since traders holding the asset for six months and higher did not rush to take profits on their holdings.

Bitcoin held by traders for 6+ months

- Ethereum trades at $2,586.58. Data from CoinShares report shows that Ethereum funds observed $4.2 million in inflows in the last week, while BTC inflows amounted to $42 million.

- XRP extended gains by nearly 4% on Monday up to $0.58. Recent developments in the Ripple ecosystem have supported a bullish thesis for the altcoin. From stablecoin RippleUSD related announcements to the plan for its roll-out on the XRPLedger and Ethereum chain, traders are digesting the news in the Ripple ecosystem.

Chart of the day

Aptos (APT) trades at $5.89 early on Monday. The token is likely to extend gains by 27% and rally to the Fair Value Gap (FVG) between $7.46 and $7.74. APT faces resistance at $6.09 and $6.48, as seen in the APT/USDT daily chart.

The Relative Strength Index (RSI), a momentum indicator, reads 45.97, inching closer to neutral at 50.

APT/USDT daily chart

Aptos could find support in the imbalance zone between $4.94 and $5.62. A daily candlestick close under $5.61 could invalidate the bullish thesis for APT.

Market updates

- 94% of the total Bitcoin supply has now been issued, per Bitcoin Magazine data.

JUST IN: 94% of the total #Bitcoin supply has now been officially issued. pic.twitter.com/dRTvnKx5VD

— Bitcoin Magazine (@BitcoinMagazine) August 18, 2024

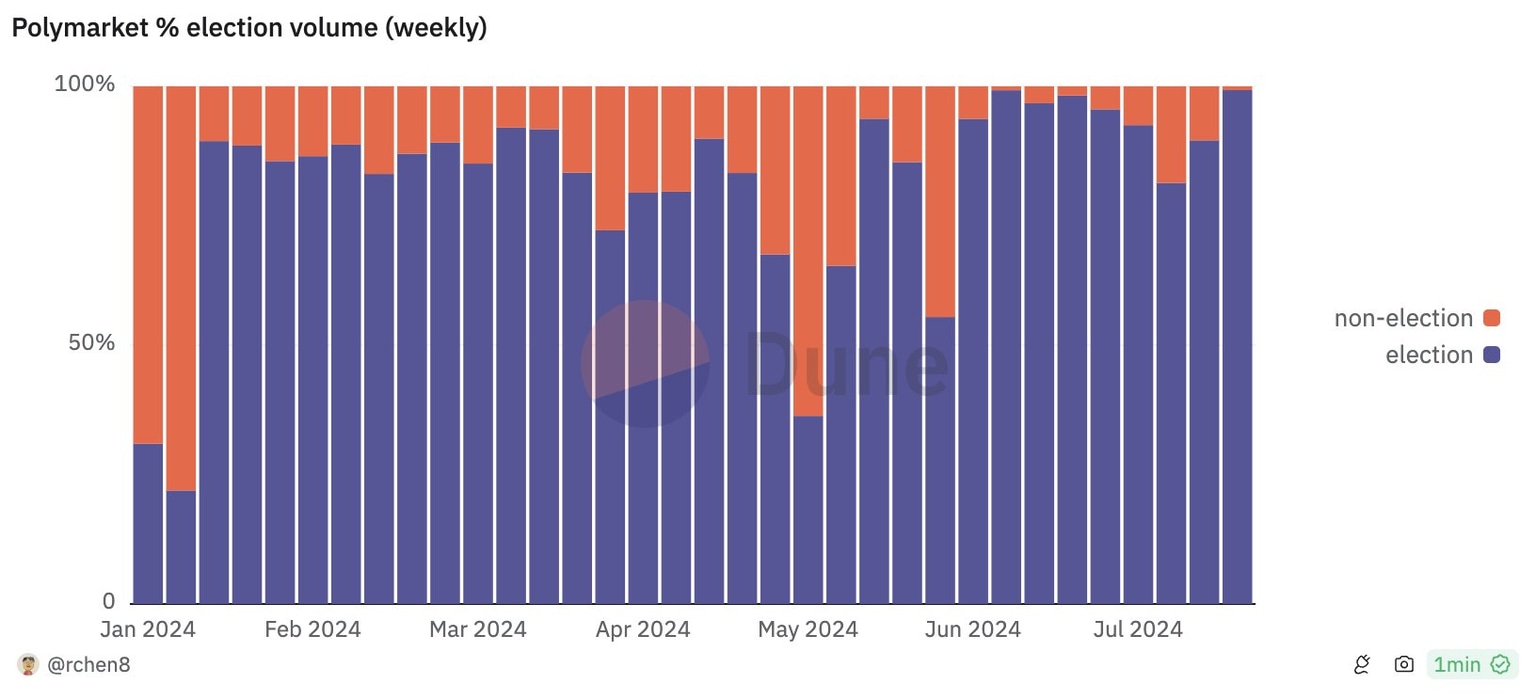

- 88% of the volume on crypto prediction market Polymarket is related to elections since the beginning of 2024, per recent data.

Polymarket election volume (weekly)

- Data from Ultrasound.money shows Ether supply increased by 60,500 since the launch of Spot Ethereum ETFs. ETH erased nearly 26% of its value since ETF launches.

Industry updates

- Maker Governance approved the latest executive vote per official announcement. Maker protocol stopped using wrapped Bitcoin (wBTC) as collateral after the custodian Bitgo shared plans to shift custody from the US to multiple regions.

The latest Executive Vote has been approved by Maker Governance.

— Maker (@MakerDAO) August 15, 2024

→ https://t.co/Y968n3VZW6

The following changes were executed within the Maker Protocol on August 15th at 13:24 UTC:

WBTC Vault Debt Ceiling Reductions

• WBTC-A, WBTC-B, and WBTC-C were removed from the… pic.twitter.com/kJHaWY3tEt

- HTX exchange lists SUNDOG perpetual futures, meme coin from SunPump launchpad.

HTX adds $SUNDOG/$USDT perpetual futures with up to 10x for long & short trades

— HTX (@HTX_Global) August 19, 2024

Make deposits and trade futures

Share a prize pool of 12,000 USDT

Details>>https://t.co/UdRIj1Vnyq pic.twitter.com/cOJS6CpFYL

- Binance Coin (BNB), Toncoin (TON) and Ethereum (ETH) rank are the top three highest trending coins on Binance per CryptoDiffer data.

TOP-15 COINS BY TRENDING SEARCH ON @BINANCE!$BNB $TON $ETH $BTC $SOL $RARE $SUI $DOGE $PEPE $TIA $SAGA $WIF $DAR $TLM $AAVE pic.twitter.com/z8lsS3t5rY

— CryptoDiffer - StandWithUkraine (@CryptoDiffer) August 19, 2024

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.