- Bitcoin and Ethereum gain ground on Monday after opening September in the red.

- XRP hovers around $0.55 as pro-crypto attorneys discuss the impact of a possible SEC appeal to the Ripple lawsuit ruling.

- Cardano rises slightly after successfully completing its Chang Hard Fork network upgrade.

Bitcoin, Ethereum and XRP updates

- Bitcoin trades around $58,400, early on Monday. The largest crypto asset by market capitalization opened the month in the red but recovered part of the losses on Monday. Historically, BTC has yielded negative returns for traders in September even as Q4 as a whole remains relatively profitable compared to the rest of the quarters.

- Ethereum trades at $2,520 after bouncing from key support at $2,400. Over the weekend, Vitalik Buterin discussed on X his recent on-chain Ether transfers, saying that he never sold the altcoin for a profit. Buterin added that he transferred Ethereum tokens to projects he found valuable and for charity purposes. Ethereum founder Vitalik Buterin says never sold Ether for profit, ETH slips under $2,400

- XRP edges up slightly on Monday, trading at around $0.5550 and retracing part of Sunday’s losses. Traders digest the implications for the token in case the US Securities & Exchange Commission (SEC) decides to appeal the ruling in its case against payment-remittance firm Ripple.

Chart of the day: DOGE

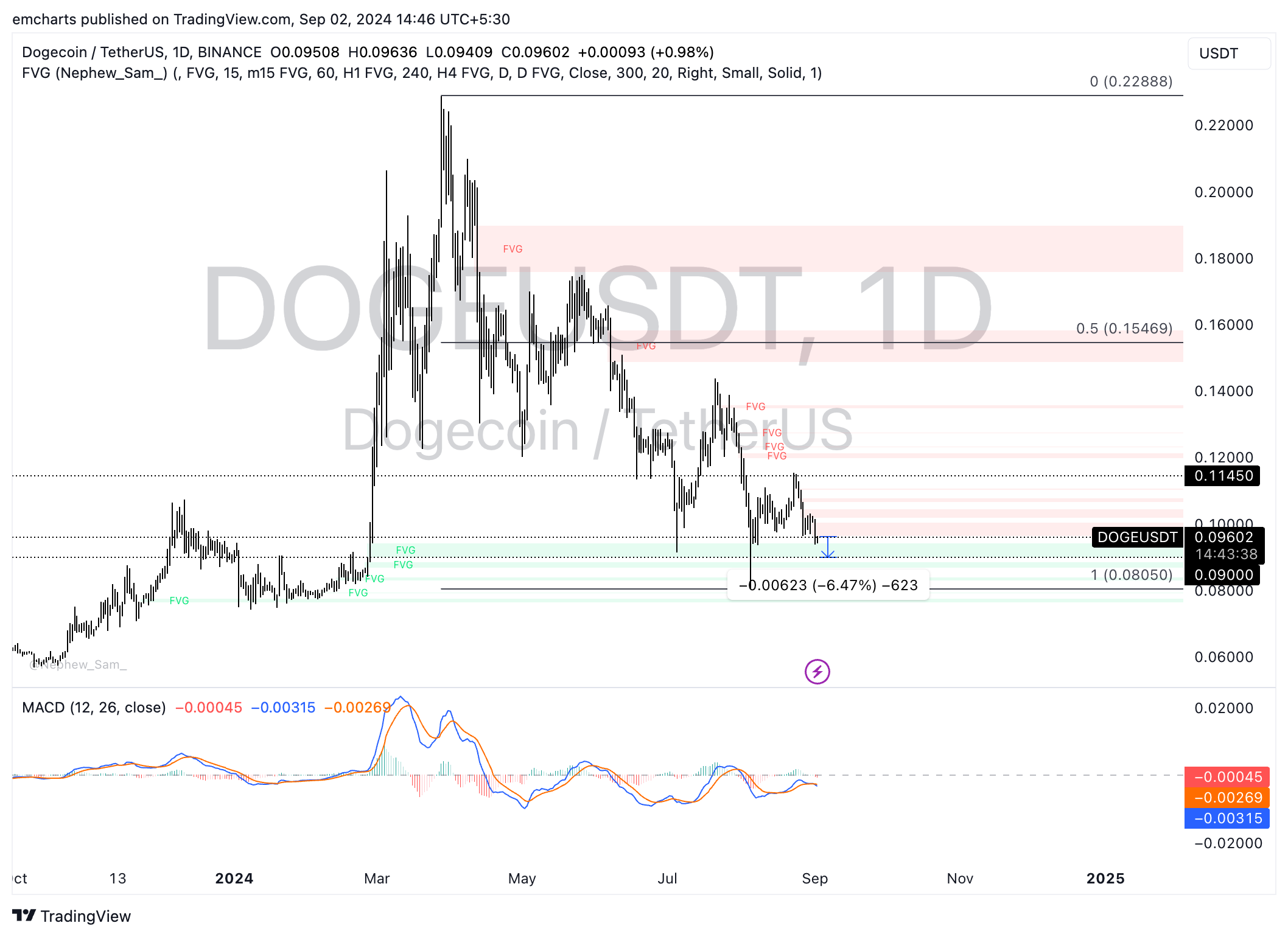

DOGE/USDT daily chart

Dogecoin (DOGE) is changing hands at $0.09765 at the time of writing. The price of the largest meme coin recovers slightly on Monday, but a look at the daily chart suggests the downward trend persists. In case of a further decline, DOGE could sweep liquidity at the lower boundary of the Fair Value Gap (FVG) extending between $0.09000 and $0.09417, representing a 6.47% price correction from the current levels.

The red histogram bars below the neutral line on the Moving Average Convergence Divergence (MACD) momentum indicator suggest a negative underlying momentum in DOGE.

Still, a daily candlestick close above $0.10000 could invalidate the bearish thesis and push the meme coin towards the next key resistance at $0.12000.

Market updates

- Cardano completed its Chang Hard Fork on September 1, further decentralizing the ADA ecosystem. The update introduced on-chain governance in Cardano and CIP-1694, a Cardano Improvement Proposal that outlines the changes and the community governance structure.

- Ran Neuner, a widely-followed CNBC crypto trader, left XRP, Shiba Inu and Cardano out of his top 20 crypto recommendations:

20 Listed. Coins. Hold for 18 months. No selling!

— Ran Neuner (@cryptomanran) September 1, 2024

1. $BTC

2. $ETH

3. $SOL

4. $AR

5. $RUNE

6. $SUI

7. $NEAR

8. $FTM

9. $INJ

10. $OP

11. $BEAM

12. $IMX

13. $CROWN

14. $SUPER

15. $OM

16. $RNDR

17. $AKT

18. $AIOZ

19. $AERO

20. $PEPECOIN

List yours below.

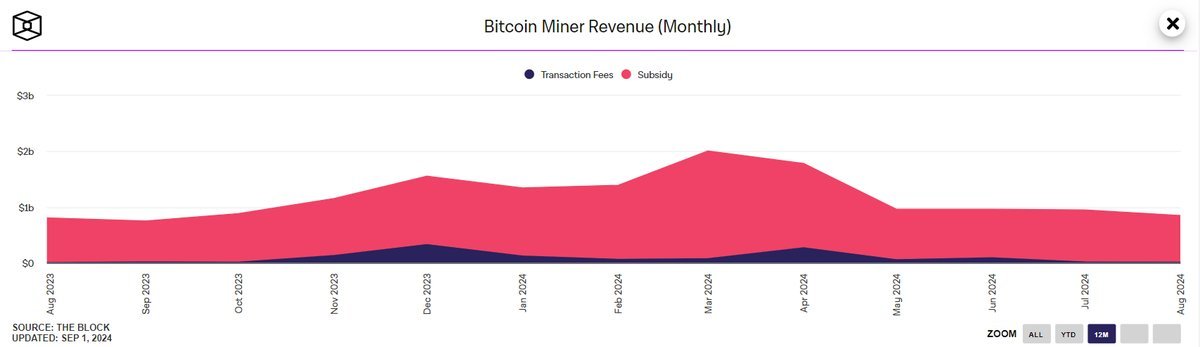

- Data from the Block shows that revenue from Bitcoin miners was at its lowest level in 2024 in August.

Bitcoin miner revenue (monthly)

Industry updates

- Crypto exchange OKX receives a Major Payment Institution License from The Monetary Authority of Singapore.

We're taking crypto to the heart of financial markets and mainstream adoption: Singapore

— OKX (@okx) September 2, 2024

We've received our Major Payment Institution (MPI) License from the MAS, allowing us to offer digital payment tokens and cross-border money transfer services.

To lead our charter in… pic.twitter.com/33y3fXM4S4

- Chief Legal Officer of Coinbase, Paul Grewal, slammed the SEC for warning bankrupt crypto exchange FTX against making payments in cryptocurrencies.

SEC warns FTX exchange against paying back creditors in stablecoins, digital assets

The SEC didn't outright state that such an action would be illegal, writing, "The SEC is not opining as to the legality, under the

— paulgrewal.eth (@iampaulgrewal) September 1, 2024

federal securities laws, of the transactions outlined in the Plan," but notes that the agency, "...reserves its rights to challenge transactions… https://t.co/zAMqY7mTcd

- Metaplanet CEO Simon Gerovich announced on Monday that the firm has collaborated with SBI VC Trade to enhance its Bitcoin strategy with support from Japan-based institutions. The collaboration is focused on trading, custody and management of Metaplanet’s Bitcoins.

Pleased to announce our collaboration with SBI Group company @sbivc_official for Bitcoin trading and custody

— Simon Gerovich (@gerovich) September 2, 2024

Japanese: https://t.co/BhsdwnU2Qk

English: https://t.co/2OUiTbMfna https://t.co/swCyOX34bP

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Bulls target $100,000 BTC, $2,000 ETH, and $3 XRP

Bitcoin (BTC) is stabilizing around $95,000 at the time of writing on Wednesday, and a breakout suggests gains toward $100,000. Ethereum (ETH) and Ripple (XRP) followed BTC’s footsteps and hovered around their key levels.

Tether mints 3 billion USDT on Ethereum and TRON as markets stabilize

Tether ramps up its minting activity amid surging demand for stablecoins, often signaling heightened trading and liquidity needs. The issuer of the leading stablecoin by market capitalization has minted 2 billion USDT on Ethereum and an additional 1 billion USDT on the TRON network.

SEC delays decision on Franklin Templeton’s spot XRP ETF to June 2025

The Securities and Exchange Commission (SEC) has postponed its decision on Franklin Templeton’s spot XRP ETF, extending the review period to June 17, 2025. XRP traded at approximately $2.24 at press time, rising 7% over the past week, according to CoinGecko.

Trump Media announces new token launch and native crypto wallet in latest Shareholder letter

Trump Media unveils plans to launch a utility token and crypto wallet to monetize Truth Social and expand its streaming services. Markets react with a 10% drawdown on the Solana-hosted official TRUMP memecoin.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.