Crypto storm triggers new lows for 2022 in Ethereum

- Ethereum price is set to slip below $2,000 as more downward pressure is added.

- ETH price seems not able to use the steady dollar for a short recovery rally.

- Expect to see new lows in the coming weeks, around $1,404, as downward forces are still in play.

Ethereum (ETH) price is one of the top 3 cryptocurrencies not enjoying any brand support from the broad audience. Where usually big names are defended or supported because of their brandings, like coca-cola or Boeing, Ethereum price has not seen that type of defence in the price action these past eight weeks. With another consecutive negative close in the making, pressure is mounting for price action to drop and close below $2,000, opening up more room to the downside towards $1,404.

ETH price set to drop another 35%

Ethereum price has been put in the penalty box as several institutional funds and banks issued price alerts for the top 3 cryptocurrencies. ETH price is being seen as caught in a negative spiral where several technical pressures coincide with global market sentiment going against cryptocurrencies overall. It will be hard for Ethereum price to brush up on its image to overcome all these harmful technical elements outweighing any upside.

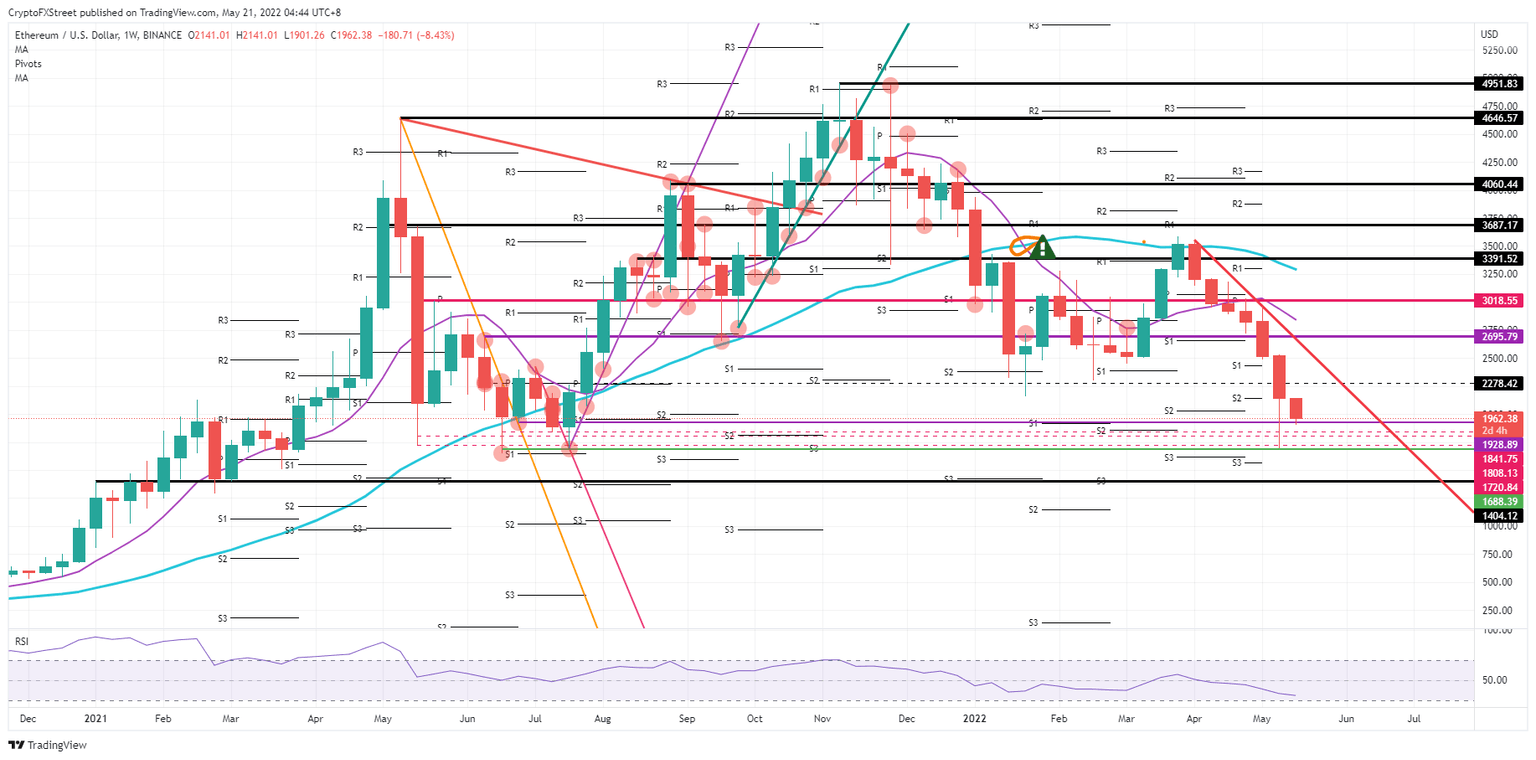

ETH price is under the scrutiny of several elements that need to be considered before markets can start to focus on a turnaround and uptrend. First of all, the already mentioned death cross in previous articles is a significant sentiment indicator that is pushing ETH price towards $1,841 - $1,720.00, secondly the red descending trend line is almost going alongside the 55-day Simple Moving Average, making it a double corridor to the downside which will be very hard to come by for bulls. At least these two elements are pretty enough to reprice Ethereum around $1,688.39, and if the dollar would add another round of strength anytime soon, the window is open for a pullback to $1,404.12, testing the low of March 2021.

ETH/USD weekly chart

Of course, a rebound is always possible, but some big key themes should be overturned. Elements like the big global inflation issues, persisting supply issues, monetary tightening, geopolitical tensions, and so forth are all vast themes intertwined with the dollar's strength and are not solved overnight. However, any of these could be the catalyst for the turnaround towards a test of the red descending trend line and a possible breakthrough towards $2,695.79, which will be the line in the sand going forward if the downtrend has stalled or has finally come to an end.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.