Crypto observers still hopeful on Trump despite silence on first day

The lack of crypto-related executive orders from President Donald Trump on his first day back in office has worried the crypto community. Still, many are hopeful that action is yet to come.

Trump signed a raft of executive orders on his first day in office on Jan. 20, but as of yet, none of them have addressed crypto assets or policy.

The president, who courted the crypto industry in his campaign, hasn't mentioned Bitcoin (BTC $102,306) or digital assets in his speeches or statements, which has seen crypto markets dip on the day, with Bitcoin falling 6% from an all-time high of $108,786 to $102,000.

However, some industry commentators and investors were not overly concerned.

“He has already fully expressed his dedication to crypto with his actions all weekend,” Futures trader “Satoshi Flipper” posted to their 225,000 X followers in a mention to Trump’s newly-launched memecoin.

“He’s fully locked in, buying hundreds of millions worth of altcoins, and people out here paranoid the top is in because Trump didn’t say ‘Bitcoin’ today,” they added.

Reflexivity Research co-founder Will Clemente wrote on X that online commentators were “freaking out because Trump didn’t do anything with regard to crypto on the first day he got sworn in.”

“We live in such a bubble. Pro-crypto regulations are coming,” he added.

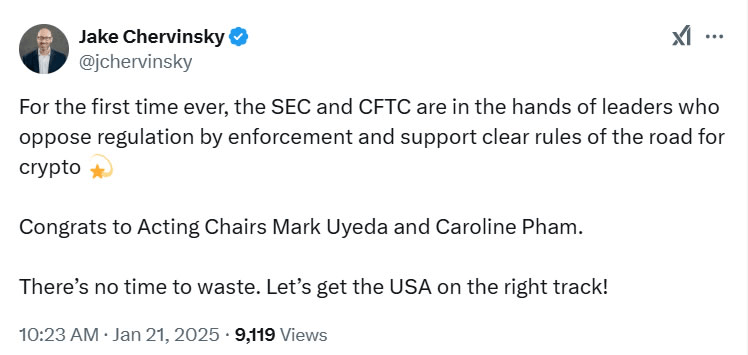

Meanwhile, crypto lawyer and Blockchain Association board member Jake Chervinsky noted the new crypto-friendly acting chairs of the Securities and Exchange Commission and Commodity Futures Trading Commission, Mark Uyeda and Caroline Pham.

“For the first time ever, the SEC and CFTC are in the hands of leaders who oppose regulation by enforcement and support clear rules of the road for crypto,” he stated.

Source: Jake Chervinsky

Asset management and monetary policy commentator “MacroScope” said that nobody should be surprised that Bitcoin wasn’t mentioned in Trump’s inaugural speech as it was “not an appropriate topic for that speech, to say the least.”

“There will be more than enough headlines about it in the coming days and weeks,” they said.

Circle CEO Jeremy Allaire told Reuters at the World Economic Forum in Davos on Jan. 20 that he expects renewed activity from Congress on crypto regulations. “We expect Committee work to be very active, literally in the coming weeks,” he said.

Allaire also called for a repeal of an SEC’s Staff Accounting Bulletin, called SAB 121, which prevents banks and financial institutions from holding crypto assets on their balance sheets.

“I would hope that President Trump would take that action,” he said.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.