Crypto market slump sees more than $538 million in liquidated long positions

- Bitcoin accounts for about $192 million worth of total market liquidations.

- Three on-chain derivatives exchanges triggered more than $52 million in liquidation.

- Around $24 million in collateral liquidations are expected if Ethereum falls to $3,008.

Bitcoin (BTC) and Ethereum (ETH) price correction on Tuesday pushed the entire crypto market capitalization down by 8%, triggering $538 million in liquidated long positions. A sustained decrease in market prices could slow down the usage of Decentralized Finance (DeFi) platforms, especially among borrowing and lending protocols.

Buying pressure winds down in the crypto market

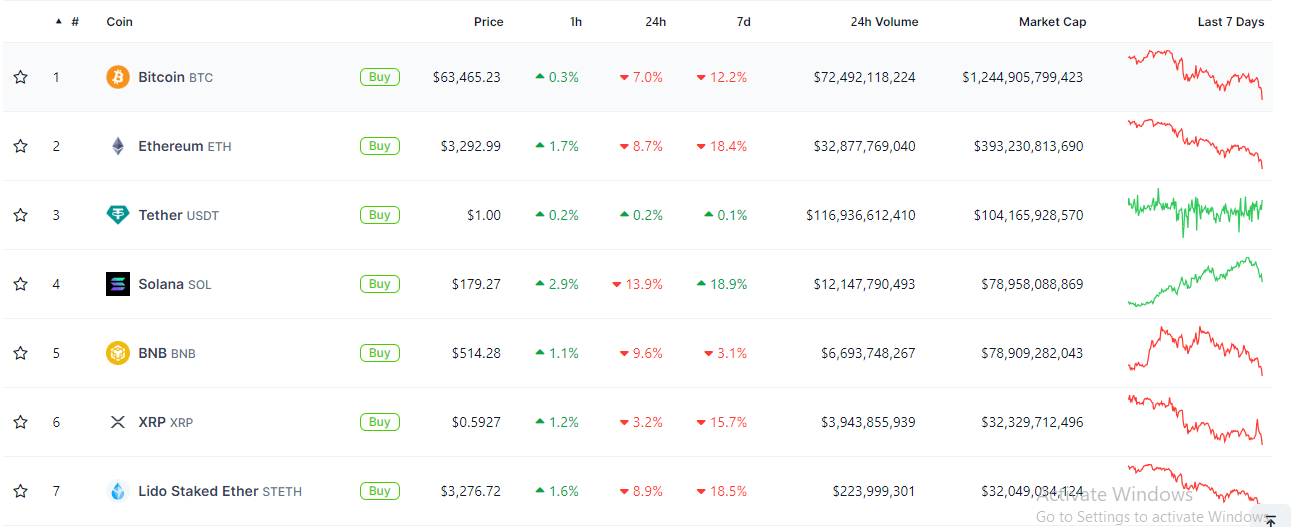

After a long bull run, the entire crypto market is down by 8% on Tuesday, with Bitcoin and Ether leading the price correction in the top 20, according to data from Coingecko.

The bearish move impacted even cryptocurrencies like Solana (SOL), whose increasing popularity and meme coins have captured traders’ attention. SOL is down 12%, along with meme coins like Book of Meme (BOME) and dogwifhat (WIF), down 15.4% and 20.6%, respectively, as of the time of writing.

Top cryptocurrencies by market capitalization

Due to the Federal Reserve’s (Fed) Federal Open Market Committee (FOMC) meeting, the market slump may partly be attributed to traders exercising caution. An outcome that sees the Fed keeping interest rates at the current levels for long may weigh on risk-perceived assets such as cryptocurrencies.

Total crypto market cap 1-hour chart

Also read: Why is the crypto market crashing?

Crypto market crash liquidates long traders

However, a few long traders were caught off-guard as crashing market prices wiped off $538 million worth of long positions in the past 24 hours. Total liquidations reached a combined $652.8 million of long and short orders from over 240,000 traders, according to data from Coinglass.

Bitcoin (BTC), Ether (ETH), and Solana (SOL) lead the 24-hour liquidation heatmap with over $192.15 million, $127.46 million, and $36.7 million, respectively. The largest CEX liquidation occurred in an OKX-BTC-USDT-SWAP worth $12.25 million.

Crypto liquidation heatmap

Notably, three on-chain derivative exchanges—GMXV2, GMX, and Kwenta—also saw more than $56 million in liquidations. The largest occurring in a position on GMX was worth over $9.3 million, according to data from Tradao.

Read more: Grayscale amends Spot Ethereum ETF filing, ETH trades sideways below $3,700

Ether collateral liquidations may hamper DeFi growth

One key area of market liquidation to look at is collateral in DeFi. Collateral liquidations occur when a borrower’s collateral is sold off by a smart contract to pay off a debt. This usually happens during volatile markets, when the collateral decreases sharply in value.

More than $5.4 million worth of collateral in DeFi was liquidated in the past 24 hours with Ether accounting for $4.27 million according to data from Parsec. The liquidations will increase to $24 million in collateral if Ether falls to $3,008, the data shows. This may hamper growth in DeFi, which has seen a recent boost during the bull run.

A critical factor that may impact all of this is the Security and Exchange Commission (SEC) Ether spot ETF decision. If the SEC gives a green light, it may cause DeFi to see explosive growth. This also comes at a time when Fidelity has adjusted its ETF application to include staking, a move that may onboard retail investors to DeFi.

Author

FXStreet Team

FXStreet