Crypto market sentiment grows negatively but this could be a bullish sign

- According to recent statistics from Santiment, the overall crypto sentiment is negative.

- High levels of FUD (Fear, Uncertainty, and Doubt) have been showing to be a positive sign for the crypto market.

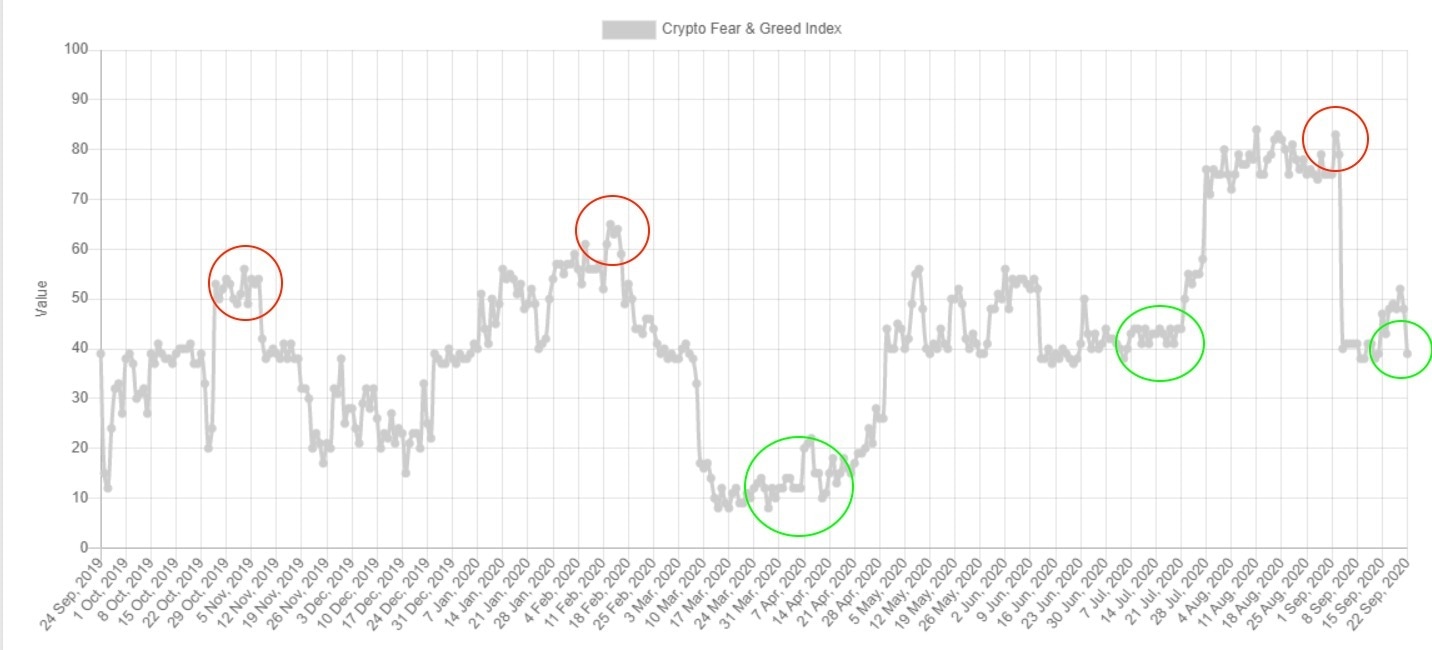

There are several theories in the crypto market and other markets that show the price action of an asset is correlated with how fearful or greedy investors are. During the month of August, the crypto Fear and Greed index showed an average of 75 points, which is considered extreme greed.

If we take a look at both the Fear and Greed Index chart and the total market capitalization of the crypto market we can observe several instances where a high greed index preceded a significant drop in market capitalization.

The first example happened around November 2019 when greed was growing higher and eventually led to a $54 billion loss. Similar events are indicated with a red circle. On the other hand, green circles show instances when the fear index was high which preceded notable boosts in value.

The crypto crowd is demonstrating a high level of FUD

According to a recent report by Santiment, during September, crypto investors have been more fearful just like it happened before the recent pump by the end of July.

https://t.co/bFKcBHUDY4

— Santiment (@santimentfeed) September 21, 2020

1) Prices of $BTC and other #crypto assets tend to bounce most precipitously when the crowd is demonstrating a high level of FUD. This is exactly what we've been seeing for #Bitcoin, #Ethereum, and many #altcoins following the early September pic.twitter.com/YiCX3kZiur

The chart shows the crowd sentiment against the current price of Bitcoinwhere we can often see an inverse correlation. Santiment uses several factors to determine the social volume of a cryptocurrency:

We trained a machine learning model on a large Twitter dataset, that contains over 1.6 million tweets, each labelled as either positive or negative. This model is then used to evaluate the sentiment of each single document in the Social Data.

In the past few instances when the Fear index was high, the total crypto market cap jumped at least $50 billion. If we expect the same this time, we could see the entire crypto market bounce back to a $386 billion market capitalization from the current value of $332 billion.

BTC/USD daily chart

Essentially Bitcoin needs to defend the $10,000 support level which has proven to be the strongest in the short-term. If bulls can hold this significant support point, we could easily see Bitcoin re-test the high of $12,400 as the digital asset usually leads the way when it comes to bullish moves.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.