- The crypto market witnessed a surge in its market cap in November, rising to $3.6 trillion.

- Bitcoin dominance dropped to 57% as altcoins rallied, suggesting a potential alt season is imminent.

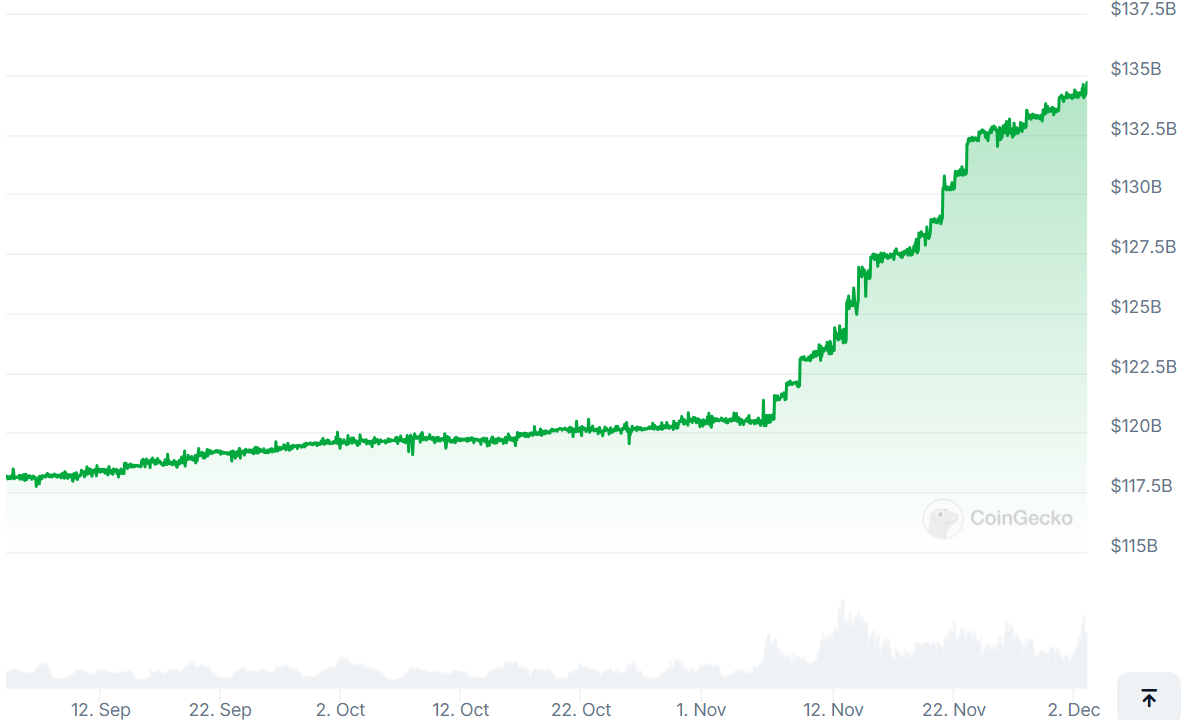

- USDT stablecoin supply rose to a high of $133.4 billion in November, fueling the bull run.

Bitcoin (BTC), Ethereum (ETH) and XRP saw a significant price increase in November following a surge in the general crypto market capitalization, which rose from $2.5 trillion to $3.6 trillion in November.

Bitcoin, ETH, XRP, SOL see price jump following crypto market rally

November was an exciting month for the crypto market marked by regulatory victories and fresh bullish sentiments for assets like Bitcoin, which jumped 40% in the month. Bitcoin's price grew significantly, with a major growth factor being the US presidential election which saw pro-crypto Donald Trump returning to the White House.

Following his victory, Bitcoin took a significant leap, smashing its previous March all-time high resistance of $73,097 and has since continued to hit new record highs, peaking at nearly $99.6K on November 22.

BTC/USDT daily chart

A majority of Bitcoin's price movement was fueled by inflows in spot BTC exchange-traded funds (ETFs) which recorded $6.4 billion net inflows in the month, per Farside investors data. The majority of the inflows came from asset manager BlackRock's IBIT, adding over $5 billion worth of assets in the month.

The crypto market grew to an incredible market cap of nearly $3.6 trillion in the month from $2.5 trillion in October. The two most dominant assets were Bitcoin and Ethereum, according to crypto data platform Ecoinometrics, surpassing US stocks in year-to-date returns.

Bitcoin and Ethereum dominated November returns.

— ecoinometrics (@ecoinometrics) December 2, 2024

US stocks did well too.

But everything else performed poorly.

Risk assets are back in force. pic.twitter.com/gCViAfbFZc

This reflects Bitcoin's growing dominance in traditional investment markets against assets like the S&P500 and other stocks. More investors and companies are picking interest in Bitcoin as a hedge against inflation, while fear of missing out (FOMO) also seems to be doing its part.

However, Bitcoin's dominance dropped from 61.7% in October to 57.4% in November, suggesting that altcoins have begun gaining momentum for a potential alt season.

Alt season is a period in the crypto market cycle where investors start shifting capital from Bitcoin towards altcoins after fully riding the BTC profit wave.

However, CryptoQuant CEO Ki Young Ju stated that the jump in altcoin volumes in November isn't fueled by rotation from BTC. Rather, stablecoin supply has risen significantly, showing real interest in these assets among investors, he added.

This is evident in USDT stablecoin supply, which rose over 11% to hit a high of nearly $133.4 billion in November. An increase in stablecoin supply suggests that new money is coming into the market to fuel real spot demand.

USDT Market Capitalization | CoinGecko

Top altcoins Ethereum, Ripple (XRP) and Solana (SOL) noted major gains in November with Ripple's XRP leading the way. XRP staged an impressive 400% rally in the month, sending its market capitalization to a staggering $155 billion and flipping Solana and Tether to hold the third position among the largest crypto assets.

This rise resulted from renewed interest and optimism toward the asset after Donald Trump's election victory and Gary Gensler's announcement that he would resign from his role as SEC Chair.

Ethereum also witnessed one of its highest monthly gains in November, characterized by a 46% rally. The Ethereum blockchain also dominated the DeFi ecosystem with over a 4% increase to 19.69M ETH in total value locked (TVL), per DefiLlama data.

Likewise, Solana also registered impressive gains last month, setting a new all-time of $263 with a monthly performance of 35%. Solana also saw a notable uptick in decentralized exchange volume which peaked at $7.14 billion in the month, following a wave of meme coin trading activity.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Bulls target $100,000 BTC, $2,000 ETH, and $3 XRP

Bitcoin (BTC) is stabilizing around $95,000 at the time of writing on Wednesday, and a breakout suggests gains toward $100,000. Ethereum (ETH) and Ripple (XRP) followed BTC’s footsteps and hovered around their key levels.

Tether mints 3 billion USDT on Ethereum and TRON as markets stabilize

Tether ramps up its minting activity amid surging demand for stablecoins, often signaling heightened trading and liquidity needs. The issuer of the leading stablecoin by market capitalization has minted 2 billion USDT on Ethereum and an additional 1 billion USDT on the TRON network.

SEC delays decision on Franklin Templeton’s spot XRP ETF to June 2025

The Securities and Exchange Commission (SEC) has postponed its decision on Franklin Templeton’s spot XRP ETF, extending the review period to June 17, 2025. XRP traded at approximately $2.24 at press time, rising 7% over the past week, according to CoinGecko.

Trump Media announces new token launch and native crypto wallet in latest Shareholder letter

Trump Media unveils plans to launch a utility token and crypto wallet to monetize Truth Social and expand its streaming services. Markets react with a 10% drawdown on the Solana-hosted official TRUMP memecoin.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.