- Bitcoin price plunges below the $99,000 mark for the first time in ten days on Monday.

- The current Bitcoin Large Transaction Total Volume of $40.9 billion shows whale wallets scaled down trading activity by $58 billion since Trump’s inauguration.

- BTC Large Holder Netflows have also declined since Thursday, with a 566 BTC whale sell-off observed 48 hours before the market crash.

Bitcoin’s price dipped as low as $98,500 on Monday, its lowest in 12 days since January 15. On-chain data trends show how whale investors’ strategic moves after Donald Trump’s inauguration may have triggered the crypto market crash.

Bitcoin price plunges 6% to hit 12-day low

Bitcoin experienced a sharp retracement after multiple bullish events surrounding Trump’s inauguration propelled the crypto markets to euphoric highs. During the inauguration, Bitcoin briefly reached a new all-time high of $109,000 on January 20, before retreating to find support at the $105,000 level for most of the week.

Bitcoin Price Action

Many enthusiasts, who had anticipated that prolonged consolidation at $105,000 could evolve into a major breakout above $110,000, were disappointed when markets turned negative with the opening of United States (US) trading on Monday.

As illustrated in the chart below, Bitcoin's price plummeted 6% over the last 24 hours, hitting a 12-day low of $98,522.

Whales cut Bitcoin demand by $58 Billion after Trump’s inauguration

Recent market reports indicate that the broader downtrend was triggered by investor concerns over AI sector valuations.

This follows the launch of Deepseek, a cost-effective large language model by China-based developers, which disrupted the valuation structures of major AI firms.

On-chain data reveals that large corporate investors significantly reduced their short-term exposure to Bitcoin, likely in anticipation of heightened volatility under Trump’s presidency.

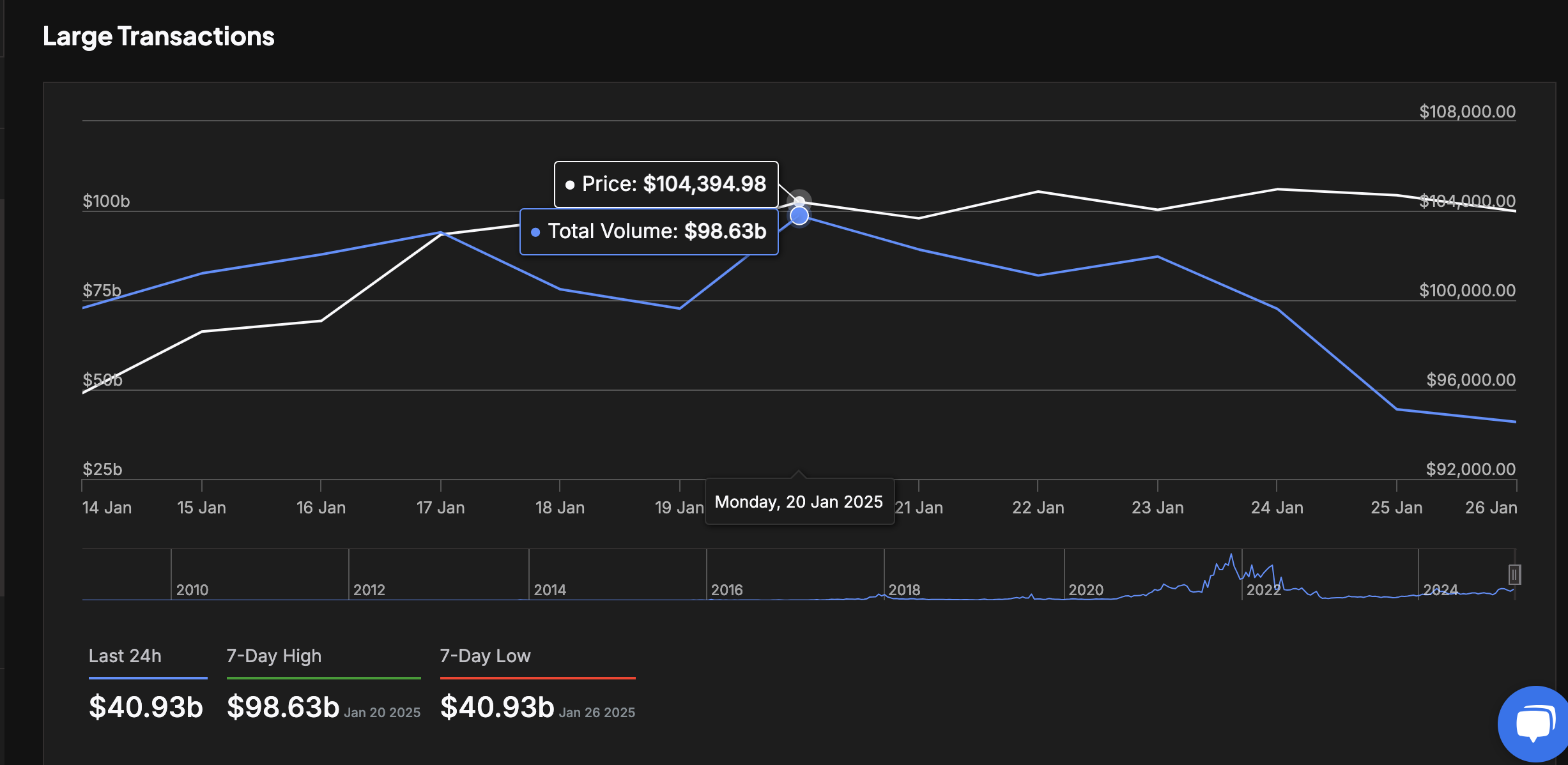

Supporting this trend, IntoTheBlock’s Large Transactions Volume chart below tracks the dollar value of transactions exceeding $100,000, providing a window into corporate trading activity around significant market events.

Bitcoin Large Transactions vs. BTC Price | Source: IntoTheBlock

The chart highlights that on January 20, Bitcoin network whale transactions peaked at $98.3 billion, driven by the inauguration euphoria.

However, as media speculated on Trump’s memes and policy updates, whales promptly scaled back their BTC trading activity.

Since the market peaked on January 20, the volume of large transactions has dropped to $40.9 billion, according to IntoTheBlock’s most recent data updated on Sunday.

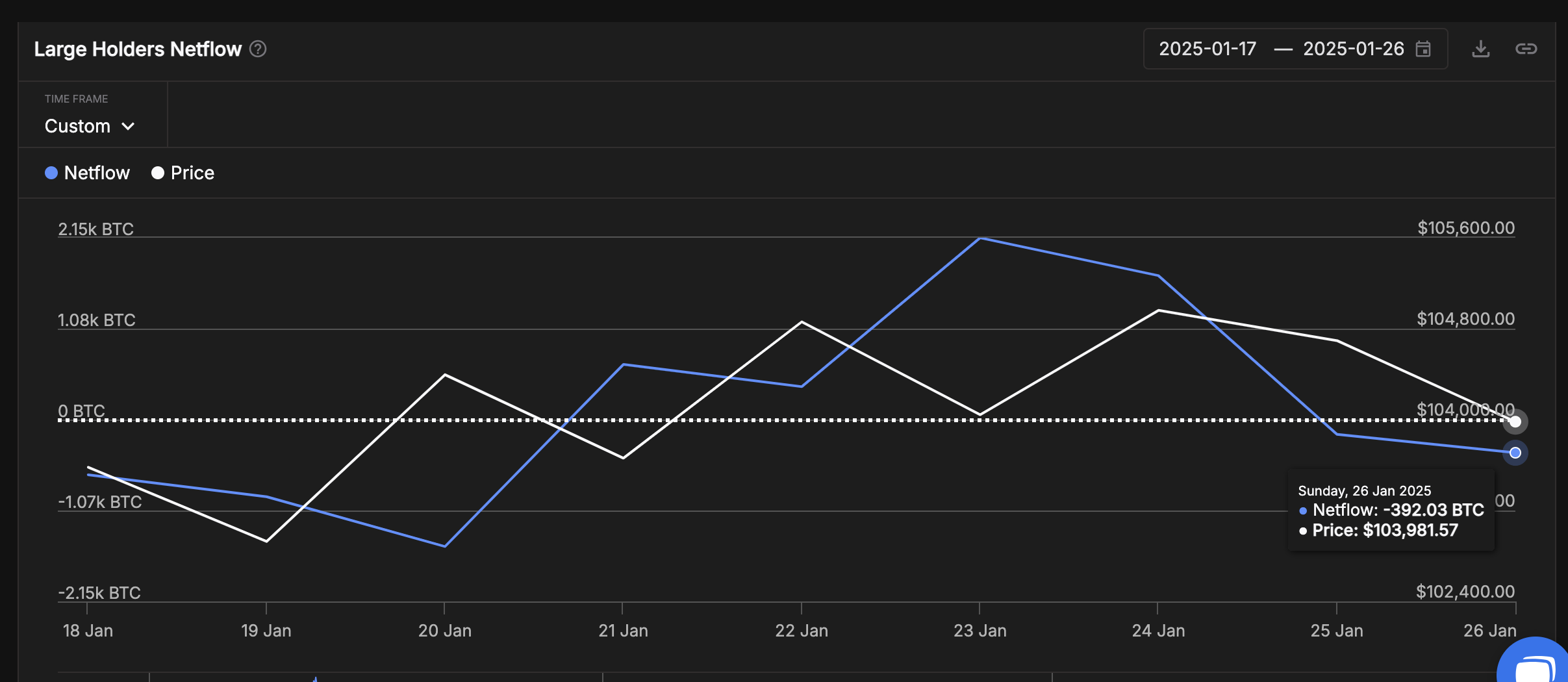

Bitcoin Large Holder Netflows | Source: IntoTheBlock

Bitcoin Large Holder Netflows | Source: IntoTheBlock

Similarly, BTC Large Holder Netflows have also declined since Thursday, with a 566 BTC ($55.5 million) whale sell-off observed 48 hours before the market crash began on Monday.

Bitcoin consolidated above $103,000 throughout Trump’s first week in office. His administration’s initial days were marked by strategic moves, including the launch of $TRUMP and MELANIA meme tokens, Gary Gensler’s official departure from the Securities and Exchange Commission (SEC), WLFI’s acquisitions and an executive order establishing Department of Government Efficiency (DOGE).

While these external catalysts sparked positive sentiment among retail traders, none fundamentally improved the underlying network value of major cryptocurrencies.

The $58 billion decline in whale transactions suggests that many corporate investors scaled back their Bitcoin exposure after Trump’s inauguration, likely anticipating the risks of a market correction.

Bitcoin price prediction: Rebound hopes alive if $97,500 support holds

On the bright side, with many corporate investors having evidently avoided the majority of the $860 million liquidation downside on Monday, there could be a lot of whale capital sitting on the sidelines waiting to find strategic re-entry opportunities around the currently falling prices.

Emphasizing this stance technical indicators on the BTCUSD daily chart present consolidation signals.

The recent bearish momentum, highlighted by the two consecutive red candles, shows a 6.28% decline in two days, with the price currently at $99,814.97.

The Parabolic SAR dots above the price action signal a bearish trend continuation unless the price reclaims $109,588, the nearest resistance level.

The Relative Strength Index (RSI) at 48.75 shows a neutral-to-weak position, indicating a lack of strong buying momentum but not yet oversold conditions.

A bullish rebound could emerge if the $97,500 support level holds, as historical bounces from this level have often attracted.

If this scenario plays out, BTC could potentially reclaim $103,260 to confirm the start of another bullish market phase.

Conversely, a bearish continuation would occur if $97,500 fails to hold.

A break below this support could trigger accelerated selling, targeting $94,000 or lower, as the RSI dips into bearish territory, signaling oversold conditions.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin, XRP and Solana slump with US stock sell-off, Lummis eyes 1 million BTC purchase

Bitcoin (BTC), XRP and Solana (SOL) prices struggle on Wednesday. The three tokens rank in the top 5 cryptocurrencies by market capitalization, and the risk-off sentiment in the crypto market has ushered in a cooling-off period.

Bitcoin hovers $82,500 as global de-risking intensifies on recession fears

Bitcoin (BTC) price hovers around $82,500 on Wednesday after recovering 5.52% the previous day. A K33 report highlights heavy sell-offs in equities and crypto markets amid rising concerns over a fragile global economy.

Uniswap plunges to 8-month low as traders offload holdings

Uniswap (UNI) price trades in the red on Wednesday at $5.84 after falling nearly 9% in the last two days. This downward trend is further supported by UNI’s Exchange Flow balance, which shows a positive spike.

BTC, ETH and XRP volatility spike expected around US CPI release

Bitcoin price hovers around $82,700 on Wednesday after recovering 5.52% the previous day. Ethereum price shows weakness while Ripple price shows signs of recovery as these coins expect volatility around the US CPI data release on Wednesday.

Bitcoin: Will Trump's Strategic Bitcoin Reserve and White House Crypto Summit support BTC recovery?

Bitcoin price extends its decline on Friday, falling over 5% so far this week. BTC uncertainty and volatility spikes liquidated $1.67 billion as the first-ever White House Crypto Summit takes place on Friday.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.