Crypto market bounces back as KPMG Canada adds Bitcoin and Ethereum to its treasury

- KPMG Canada has added Bitcoin and Ethereum to its balance sheet.

- The professional services firm believes that institutional adoption of cryptocurrencies will continue to grow.

- Bitcoin and Ethereum are steadily recovering following their massive dips in January.

Big Four accounting giant KPMG Canada has decided to dabble in cryptocurrencies, adding the two largest digital assets by market capitalization to its corporate balance sheet. The auditing firm now believes that crypto is a “maturing asset class.”

Another institution adds crypto to its balance sheet

The Canadian arm of the accounting giant recently revealed in a statement that the firm directly invested in Bitcoin and Ethereum, joining a growing trend of institutional investors adding crypto to their treasuries, including MicroStrategy, Square and Tesla.

The auditing firm stated that their recent investment in cryptocurrencies reflected their belief that “institutional adoption of cryptoassets and blockchain technology will continue to grow and become a regular part of the asset mix.”

Although KPMG did not clarify how much they have invested in the two leading digital assets, the accounting giant added that they purchased carbon offsets to maintain a net-zero carbon transaction.

Benjie Thomas, Canadian managing partner of advisory services at KMPG stated that “crypto assets are a maturing asset class,” and investors such as hedge funds are

increasingly gaining exposure to digital assets and “traditional financial services such as banks, financial advisors and brokerages are exploring offering products and services involving crypto assets.”

KPMG established a governance committee with stakeholders from Finance, Risk Management, Advisory, Audit and Tax sectors to provide oversight and to approve the new treasury allocation.

Bitcoin price enters recovery rally

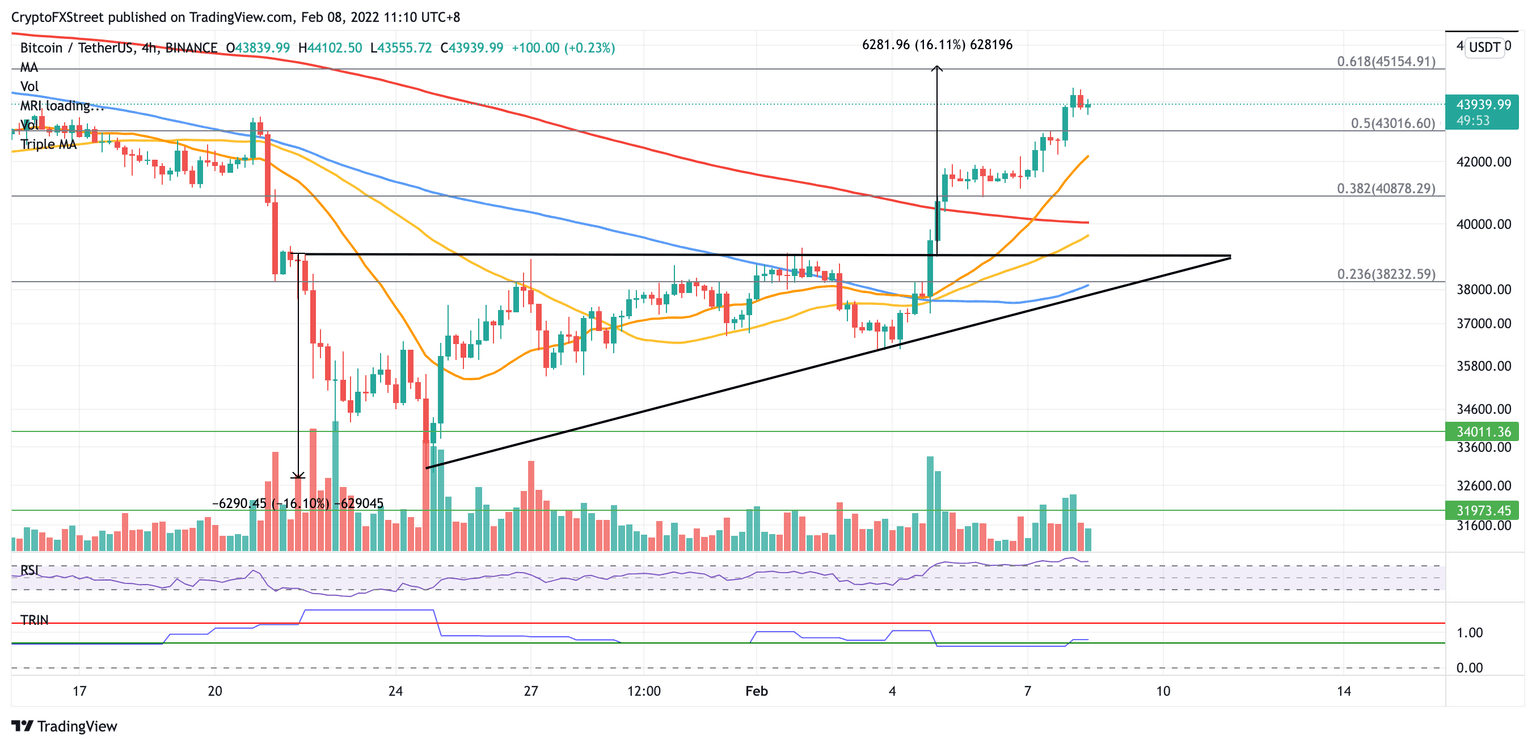

Bitcoin price has sliced above the upper boundary of the ascending triangle pattern on the 4-hour chart, putting a 16% ascent on the radar toward $45,154. BTC has nearly reached the optimistic target, coinciding with the 61.8% Fibonacci retracement level.

Bigger aspirations will target the January 5 high at $46,822 before tagging the 78.6% Fibonacci retracement level at $48,199.

BTC/USDT 4-hour chart

However, if selling pressure increases, Bitcoin price will fall toward the 50% retracement level at $43,016, then toward the 21 four-hour Simple Moving Average (SMA) at $42,177.

Author

Sarah Tran

Independent Analyst

Sarah has closely followed the growth of blockchain technology and its adoption since 2016.