Crypto liquidations pass $700M as altcoins take a hit from Bitcoin sinking below $40K

Bitcoin (BTC) stayed lower on Friday after an overnight bout of volatility sent the largest cryptocurrency to six-month lows.

BTC/USD 1-hour candle chart (Bitstamp). Source: TradingView

$40,000 optimism unwinds

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD reversing at $38,250 after shedding over $4,000 in hours.

Circling $39,000 at the time of writing, traders were reeling from the sudden downside, which came just as BTC had hit multi-day highs, passing $43,000.

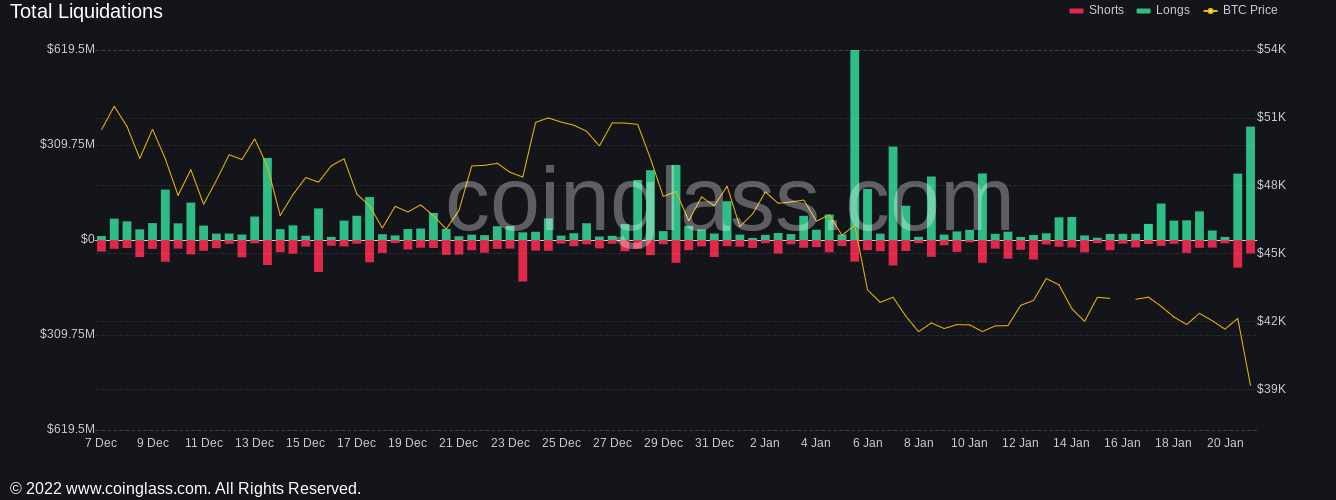

Liquidations across trading platforms were thus predictably significant. For Bitcoin and altcoins combined, 24-hour position unraveling totaled $725 million, with BTC positions accounting for $292 million.

The vast majority of the casualties were long positions, a sign that the area around $40,000 had attracted considerable faith as a solid support line.

Crypto liquidations chart. Source: Coinglass

As Cointelegraph reported, Friday’s options expiry, involving the open interest of nearly $600 million, was considered the main culprit for sparking the volatility. By contrast, outside triggers such as Russia’s proposed blanket ban on crypto trading and mining appeared to have little to no impact.

“$42.4-42.7K couldn’t continue to hold for Bitcoin, so a nuke towards the other side of the region and, most likely, continuation towards even further downwards momentum and lower lows -> happened,” Cointelegraph contributor Michaël van de Poppe explained.

The move had been long in coming, with more conservative analysts predicting a return closer to or even below $30,000 throughout January.

Ether returns to established support

Altcoins, meanwhile, took a noticeably harsher hit as Bitcoin fell.

Out of the top 10 cryptocurrencies by market capitalization, 10% drops were commonplace and rebounds limited, with only Terra (LUNA) reining in losses to under 5%.

Ether (ETH) fell to crucial support around $2,800, the site of an all-time high from last April, to cap weekly losses approaching 15%.

ETH/USD 1-hour candle chart (Bitstamp). Source: TradingView

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.