Crypto exchanges serving Indian residents to comply with Anti-Money Laundering guidelines: Indian Parliament

- Crypto exchanges serving Indian residents to face action if not compliant with Anti-Money Laundering and Countering of Financial Terrorism guidelines.

- The process of registering offshore exchanges, Virtual Digital Asset service providers has been initiated.

- Entities that fail to comply with guidelines to face action under Prevention of Money Laundering Act in India.

In a recent development, the Indian Parliament issued a decision regarding offshore cryptocurrency exchanges that serve Indian residents. The G20 nation has not enacted any special regulation for virtual currencies and Virtual Digital Asset (VDA) service providers.

Also read: Three gaming crypto tokens to have in your watchlist as GTA 6 trailer looms: AXS, MANA and ENJ

India takes steps to regulate offshore crypto exchanges and VDAs

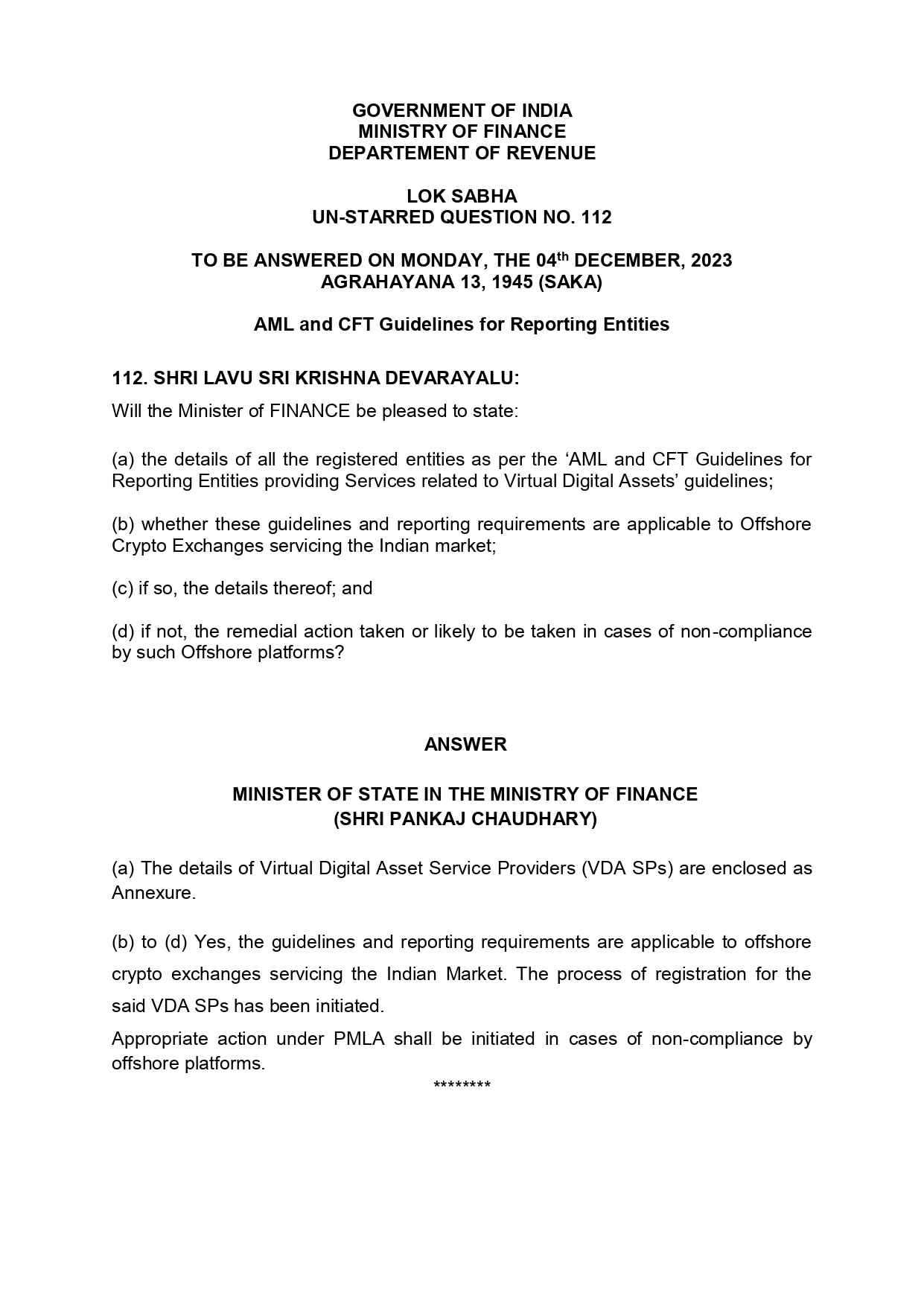

In a recent development, the Indian Parliament addressed offshore cryptocurrency exchange platforms and VDAs that serve Indian users. Existing Anti-Money Laundering (AML) and Countering of Financial Terrorism (CFT) guidelines are applicable for offshore exchanges that service the Indian market.

Lok Sabha directive on offshore crypto exchanges

The process of registering such entities has been initiated, and 28 entity names have been compiled, as seen below.

Crypto exchanges and wallet providers like OKX and Bybit that serve Indian users are required to comply with the said regulations.

VDAs and crypto exchanges servicing Indian customers

The directive explains that non-compliance of the AML and CFT guidelines would result in action against the entit, in accordance with the Prevention of Money Laundering Act (PMLA). The PMLA forms the core of a legal framework put in place by India to combat money laundering activities in the country.

Banks, financial institutions and intermediaries are collectively referred to as “entities” that comply with AML and CFT regulations under the PMLA.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.