Bitcoin (BTC) chalked out a vigorous rally on Tuesday after a U.S. court ruled that the Securities and Exchange Commission (SEC) was wrong in denying crypto asset manager Grayscale's request to convert its bitcoin trust into an exchange-traded fund (ETF), asserting that the decision was "arbitrary and capricious."

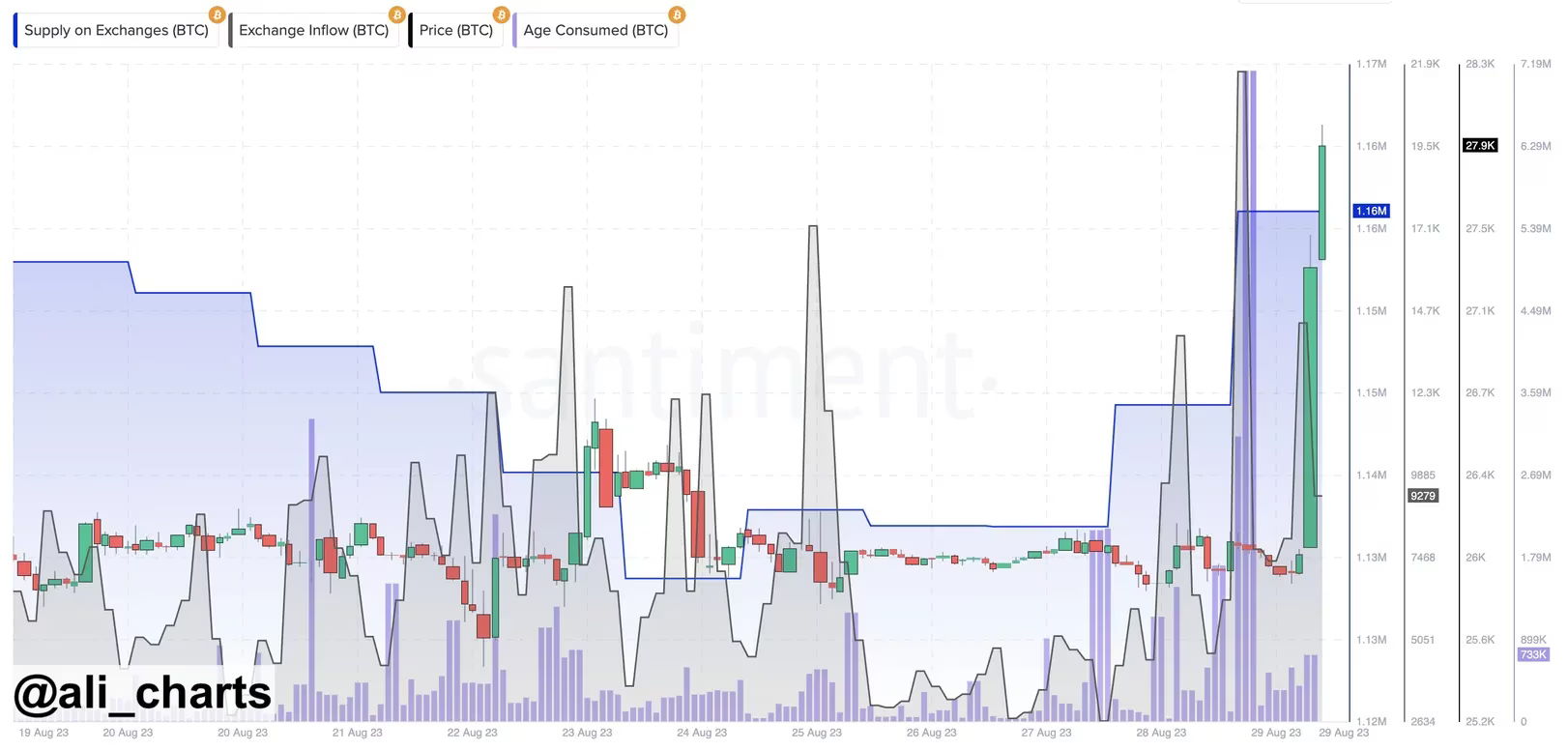

Ahead of the pivotal ruling nearly 30,000 BTC, worth $822 million at the going market rate of $27,400, were moved to addresses tied to centralized exchanges, according to data tracked by analytics firm Santiment. The ruling led to a 6% surge in Bitcoin prices pushing the top cryptocurrency to $28,000.

Perhaps some traders anticipated the price boost and prepared for the same in advance by moving coins to exchanges. Investors typically move coins to exchanges when they are intending to liquidate holdings or deploy their coins as margin for derivative trading. Hence, an uptick in exchange inflows is often seen as a harbinger of price turbulence.

"The exchange supply of Bitcoin was boosted significantly just prior to Grayscale's win over the SEC. It looks quite clear that the powers that be knew of the inevitable boost in crypto market capitalization as a result of this outcome," Santiment tweeted, echoing onchain analyst Ali Martinez's comment.

Addresses-based onchain metrics are subject to labeling issues. Hence, drawing definite conclusions from the same is challenging.

The supply available on centralized exchanges had increased before Tuesday's pivotal court ruling. (Santiment, Ali Martinez) (Santiment, Ali Martinez)

Mean inflows and outflows surge

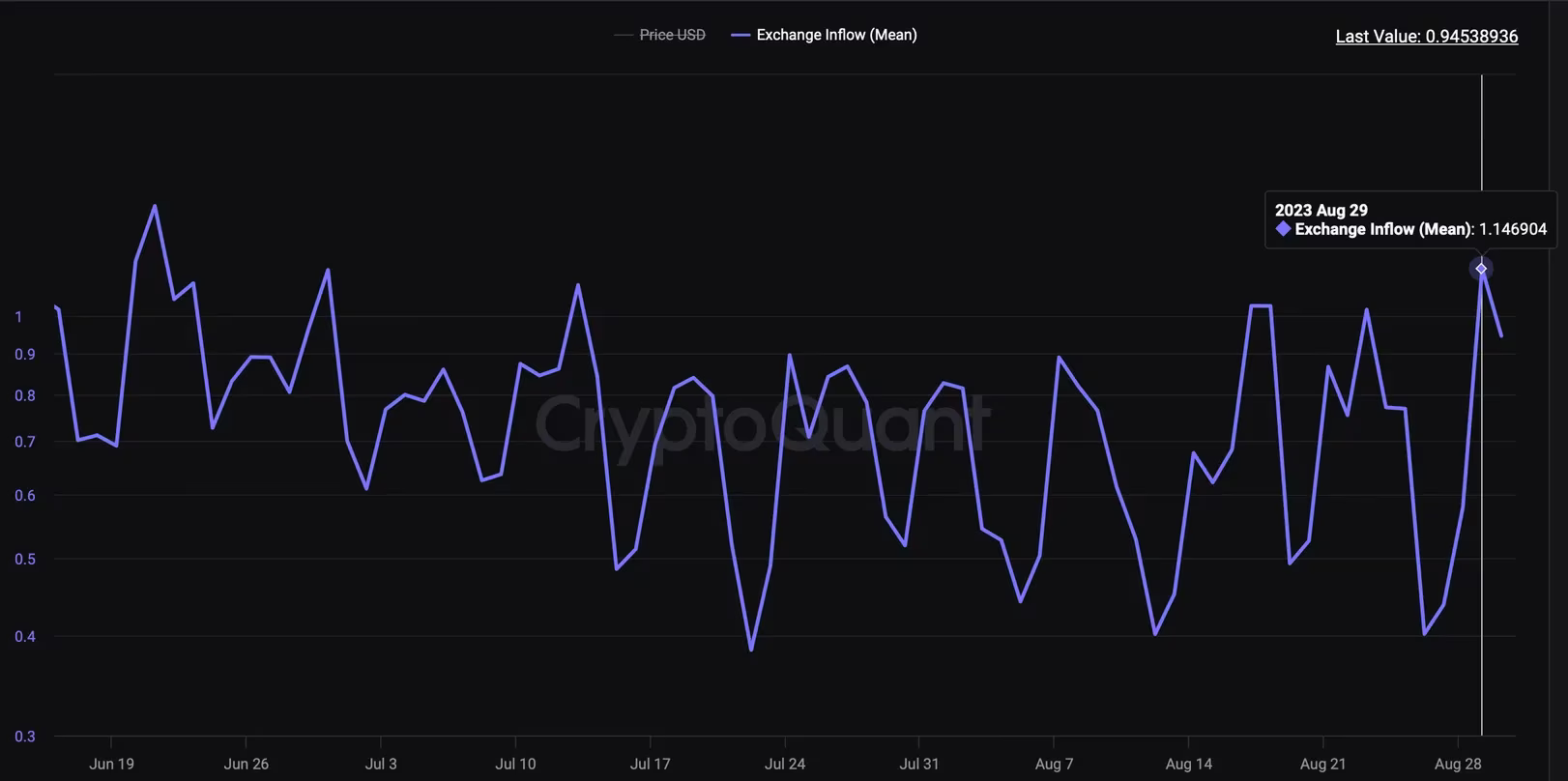

Data tracked by South Korea-based CryptoQuant shows the mean inflow or amount of BTC transferred to exchanges per transaction rose to 1.146, the highest since June 21, as prices rallied to $28,000.

Mean inflow indicates number of coins transferred to exchanges per transaction. (CryptoQuant) (CryptoQuant)

An uptick in the mean inflow indicates investors are sending a large number of coins in a transaction, a hint of potential selling pressure.

However, that's not necessarily the case this time, as mean outflows also jumped to two-month highs and the net balance held on exchanges, especially those offering spot trading, declined.

"Reserves held on U.S.-based spot exchanges continue to decrease while reserves on offshore exchanges, offering derivatives trading continue to increase. It's a sign derivatives and offshore exchanges drive the current price action," CryptoQuant said in a Telegram message.

All writers’ opinions are their own and do not constitute financial advice in any way whatsoever. Nothing published by CoinDesk constitutes an investment recommendation, nor should any data or Content published by CoinDesk be relied upon for any investment activities. CoinDesk strongly recommends that you perform your own independent research and/or speak with a qualified investment professional before making any financial decisions.

Recommended Content

Editors’ Picks

IRS says crypto staking should be taxed in response to lawsuit

The IRS stated that rewards from cryptocurrency staking are taxable upon receipt, according to a Bloomberg report on Monday, which stated the agency rejected a legal argument that sought to delay taxation until such rewards are sold or exchanged.

Solana dominates Bitcoin, Ethereum in price performance and trading volume: Glassnode

Solana is up 6% on Monday following a Glassnode report indicating that SOL has seen more capital increase than Bitcoin and Ethereum. Despite the large gains suggesting a relatively heated market, SOL could still stretch its growth before establishing a top for the cycle.

Ethereum Price Forecast: ETH risks a decline to $3,000 as investors realize increased profits and losses

Ethereum is up 4% on Monday despite increased selling pressure across long-term and short-term holders in the past two days. If whales fail to maintain their recent buy-the-dip attitude, ETH risks a decline below $3,000.

Crypto Today: BTC hits new Trump-era low as Chainlink, HBAR and AAVE lead market recovery

The global cryptocurrency market cap shrank by $500 billion after the Federal Reserve's hawkish statements on December 17. Amid the market crash, Bitcoin price declined 7.2% last week, recording its first weekly timeframe loss since Donald Trump’s re-election.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.