Crypto exchange Gemini suffers $485m rush of outflows amid contagion fears

Gemini suspended its yield-earning program, shaking users’ confidence in the exchange.

Gemini, a crypto exchange and custodian founded by the Winklevoss brothers, has suffered a rush of withdrawals as crypto firms wrestle with the reverberations of the FTX-Alameda bankruptcy and subsequent contagion within the digital asset industry.

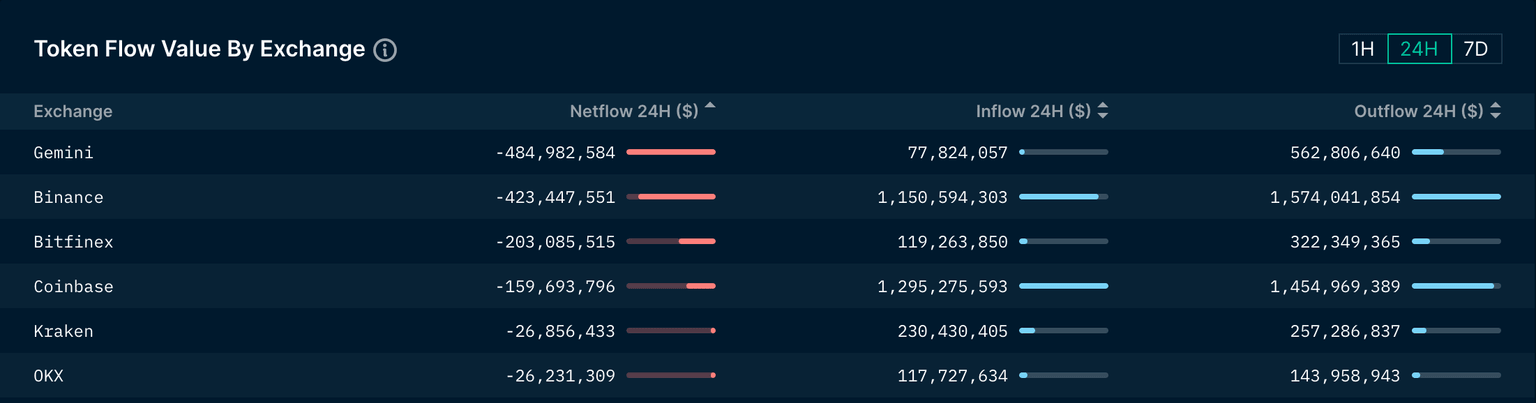

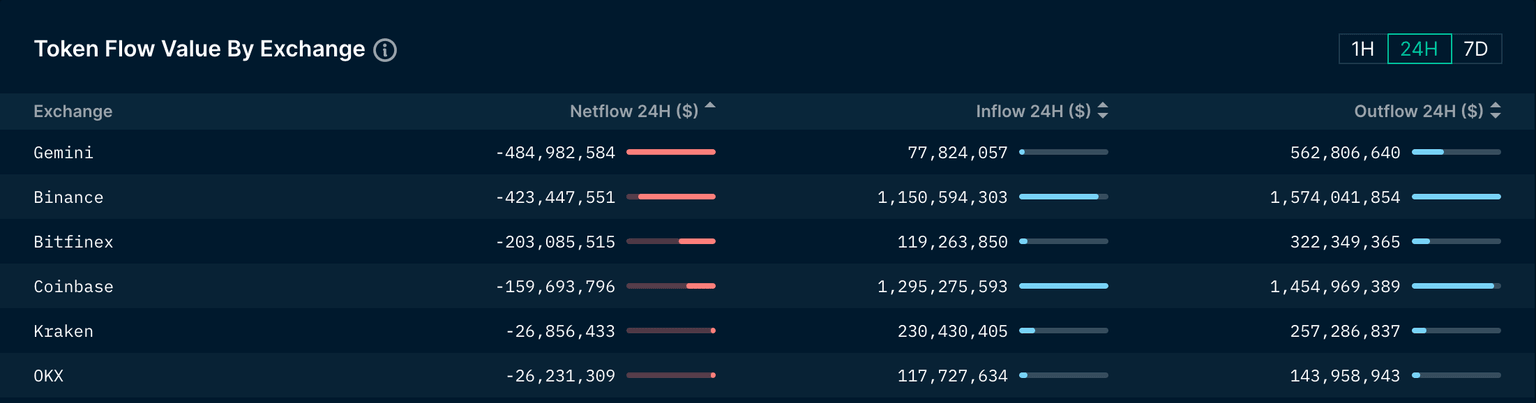

Data by blockchain intelligence platform Nansen shows that Gemini saw $485 million in net outflows in the past 24 hours, the largest among crypto exchanges. Outflows totaled $563 million, and were offset by only $78 million in inflows. In the past seven days, Gemini experienced a total of $682 million net outflows – the difference of $866 billion of inflows and $1.55 billion of inflows provided by Nansen – suggesting that most of the withdrawals have occurred on Wednesday.

Gemini endured the largest net outflows among crypto exchanges in the last 24 hours. (Nansen)

Digital asset balances on crypto wallets identified as Gemini dropped to $1.7 billion from about $2.2 billion a day ago, according to blockchain data platform Arkham Intelligence. Arkham and Nansen do not cover data from the Bitcoin blockchain and may not include all Gemini’s wallets.

Crypto balance held in Gemini's known wallets dropped to $1.7 billion from $2.2 billion in a day. (Arkham Intelligence)

The rush of withdrawals came as Gemini paused withdrawals earlier Wednesday from its yield-generating Earn program. The lending unit of crypto investment bank Genesis Global Trading, which powered the program for Gemini, announced that it was suspending customer redemptions citing “extreme market dislocation” and “loss of industry confidence caused by the FTX implosion."

The exchange also suffered an outage today, which was shortly resolved but exacerbated the fear about its stability.

Gemini had not return CoinDesk’s request for comment at the time of publication. Earlier today, the firm said in a tweet that all assets deposited by customers are available to withdraw at any time.

Gemini exchange fully back online; all customer funds held on the Gemini exchange are held 1:1 and available for withdrawal at any time.

— Gemini (@Gemini) November 16, 2022

Contagion fear looms

Pressure has mounted on crypto exchanges and lending firms dealing with the implosion of top exchange FTX and its corporate sibling, trading firm Alameda Research.

Cautious investors have scrambled to move digital assets from centralized exchanges amid “growing concerns about the solvency of other centralized exchanges,” crypto research firm Delphi Digital wrote in a report this week.

Binance, Coinbase, KuCoin all experienced large deposit drawdowns recently, according to Nansen data. Some smaller platforms, such as AAX, Liquid and lender Salt, have halted withdrawals in the past few days.

Multiple exchanges attempted to mitigate widespread fear by sharing or promising to publish their crypto holdings. High-profile industry figures are advocating for presenting proof of reserves and performing independent audits of crypto holdings on a regular basis.

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.